Dogecoin rallied almost 10% this week, resilient within the face of the U.S. President Donald Trump’s tariff warfare and macroeconomic developments. Most altcoins have suffered the unfavorable impression of Trump’s bulletins, DOGE continues to realize, again above $0.2058 for the primary time in almost two weeks.

Dogecoin rallies in double-digits, what to anticipate from DOGE value?

Dogecoin (DOGE) hit a close to two-week peak at $0.20585 on Wednesday, March 26. Previously seven days, DOGE rallied almost 10%, whilst altcoins struggled with restoration within the ongoing macroeconomic developments within the U.S.

The most important meme coin within the crypto market may proceed its climb, extending positive factors by almost 11%, and testing resistance on the decrease boundary of the imbalance zone between $0.24040 and $0.21465.

The higher boundary of the zone at $0.24040 is the subsequent key resistance for DOGE, almost 24% above the present value.

Two key momentum indicators, the RSI and MACD assist a bullish thesis for Dogecoin. RSI is 52, above the impartial stage. MACD flashes inexperienced histogram bars above the impartial line, which means there’s an underlying optimistic momentum in Dogecoin value pattern.

Dogecoin on-chain evaluation

On-chain evaluation of the most important meme coin exhibits that the variety of holders of DOGE is on the rise. If Dogecoin’s variety of holders maintain climbing or regular within the coming week, the meme coin may stay related amongst merchants.

The community realized revenue/loss metric exhibits that DOGE holders have realized earnings on a small scale. Sometimes, massive scale profit-taking will increase promoting strain on the meme coin and will negatively impression value.

The metric helps a bullish thesis for DOGE within the coming week. Dogecoin’s energetic tackle rely has been regular since mid-March, one other signal of the meme coin’s resilience.

DOGE derivatives evaluation and value forecast

The evaluation of Dogecoin derivatives positions throughout exchanges exhibits that open curiosity is recovering from its March 12 low. Open Curiosity is $1.98 billion, as Dogecoin trades at $0.19. Coinglass information exhibits a gradual climb in OI within the chart beneath.

The full liquidations information exhibits $4.29 million in lengthy positions have been liquidated on March 27. Sidelined consumers want to observe liquidations information and costs carefully earlier than including to their derivatives place.

The lengthy/quick ratio on high exchanges, Binance and OKX exceeds 1, which means derivatives merchants are betting on a rise in DOGE value.

When technical evaluation and derivatives information is mixed, it’s possible Dogecoin value may check resistance at $0.21465 subsequent week, if spot costs comply with the cue of derivatives merchants.

What to anticipate from DOGE

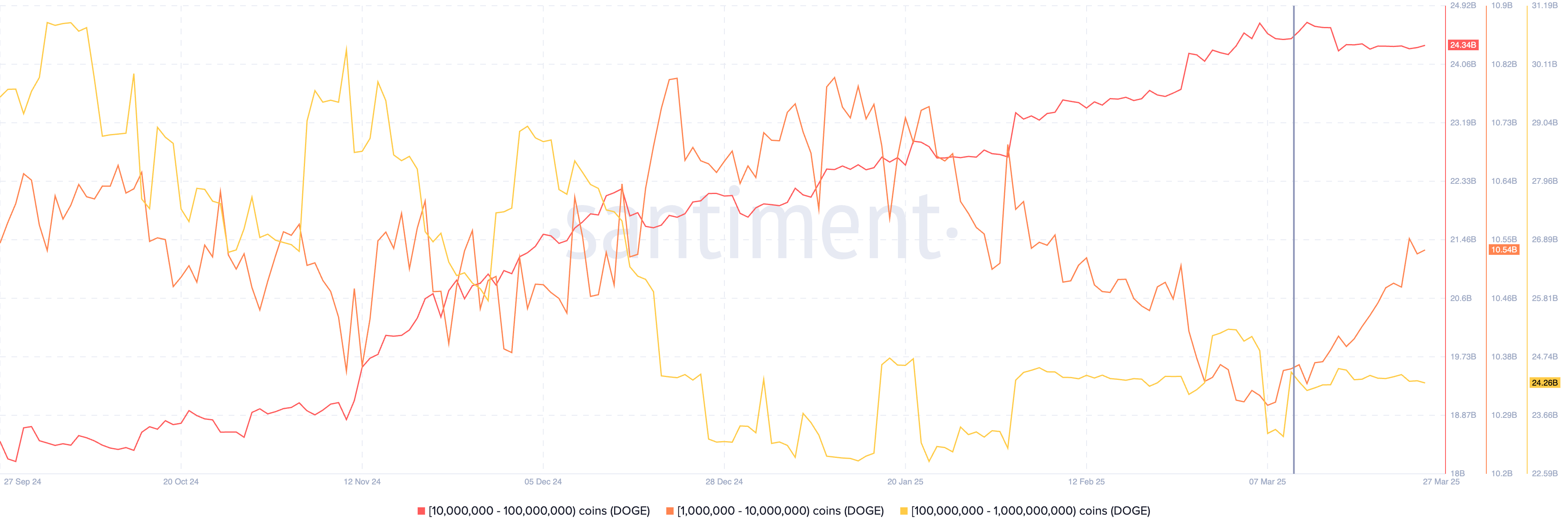

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio constantly between March 10 and 27, whereas the opposite two classes, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held almost regular in the identical timeframe.

The information from Santiment exhibits that DOGE’s merchants holding between 1 million and 10 million tokens are quickly accumulating, even because the token’s value rises. This helps demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are carefully watching developments in Bitwise’s Dogecoin ETF submitting with the SEC. The ETF submitting is an effort to legitimize the meme coin as an funding class for institutional buyers, as DOGE value holds regular amongst altcoins quickly eroding in worth.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, nevertheless the meme token recovered every time and constant positive factors may sign an finish to DOGE’s multi-month downward pattern.

Different key catalysts for Dogecoin are optimistic updates in crypto regulation, passage of the stablecoin invoice within the Congress, and demand for DOGE amongst whales and huge pockets buyers.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.