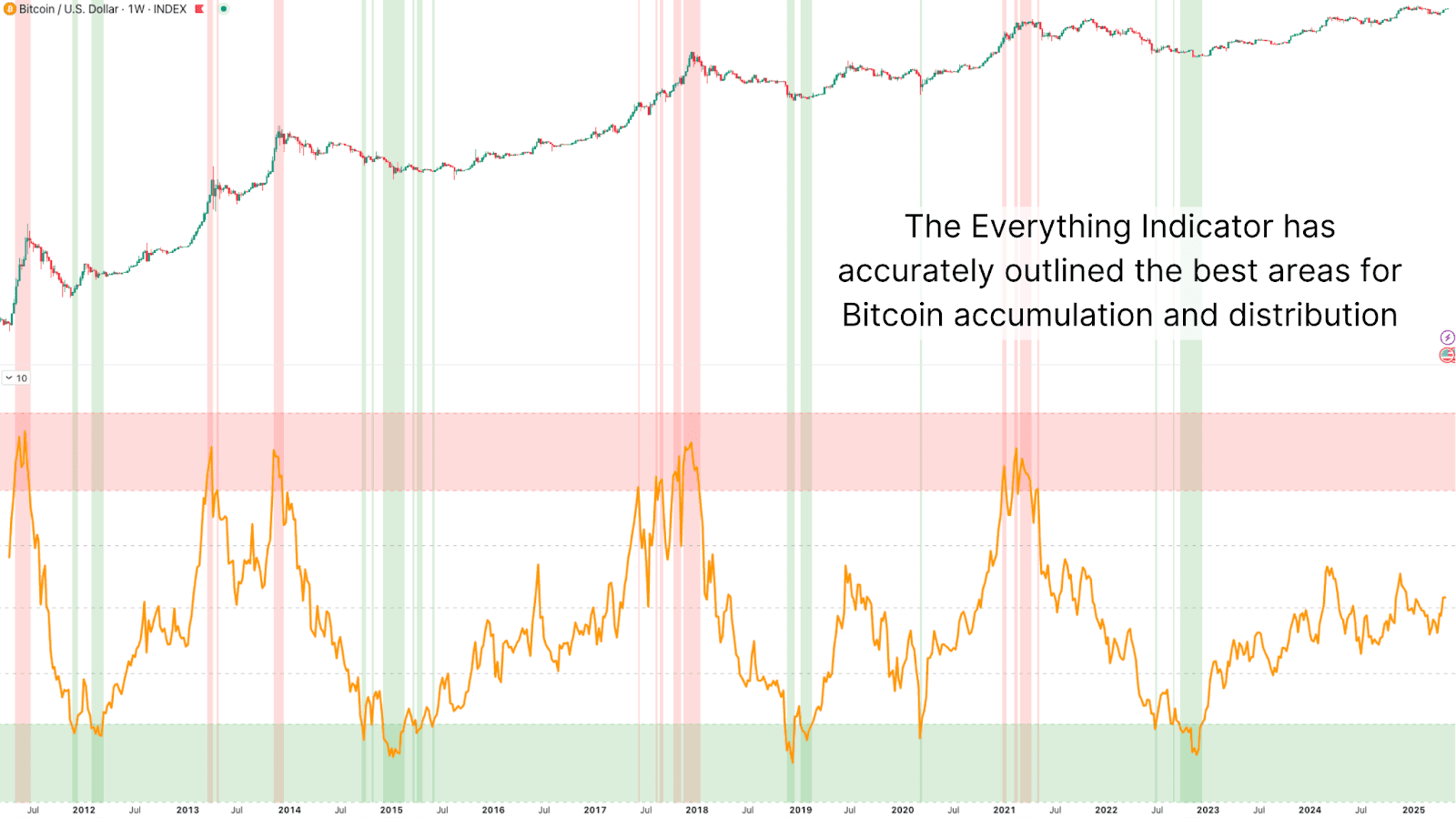

The Bitcoin Everything Indicator was designed to offer a complete view of all main forces impacting BTC value motion, on-chain, macro, technical, and elementary. Since its creation, it has confirmed remarkably correct at marking each cycle tops and bottoms. However in the present day, we take it a step additional.

On this article, we’ll discover how this already-powerful device will be upgraded with a easy modification to present extra frequent, actionable insights, with out compromising its core integrity. In the event you’re searching for a high-signal strategy to method the Bitcoin market extra actively, this is likely to be the metric you’ve been ready for.

What Is the Bitcoin Everything Indicator?

Initially constructed as a composite device, the Bitcoin Everything Indicator is constructed from a number of uncorrelated indicators:

Collectively, these knowledge factors are equal-weighted, not overfitted, creating an mixture rating that tracks broad BTC market dynamics. Importantly, it doesn’t depend on any single mannequin or indicator. As a substitute, it captures the confluence of a number of domains that collectively form Bitcoin value actions. Backtesting reveals that the indicator constantly highlights macro turning factors, together with cycle tops and capitulation bottoms, throughout all main Bitcoin cycles.

Rare However Robust Alerts

Whereas correct, the unique Everything Indicator was inherently long-term. Alerts would solely seem each few years, marking the key inflection factors of every bull and bear market. For traders trying to purchase generational lows or scale out at macro tops, it was invaluable.

However for these aiming to be extra energetic, strategically DCA-ing, rotating capital, and even managing danger with mid-cycle exits, it provided little day-to-day steerage. The answer? Enhance sign decision with out sacrificing the macro integrity of the mannequin.

Including A Transferring Common

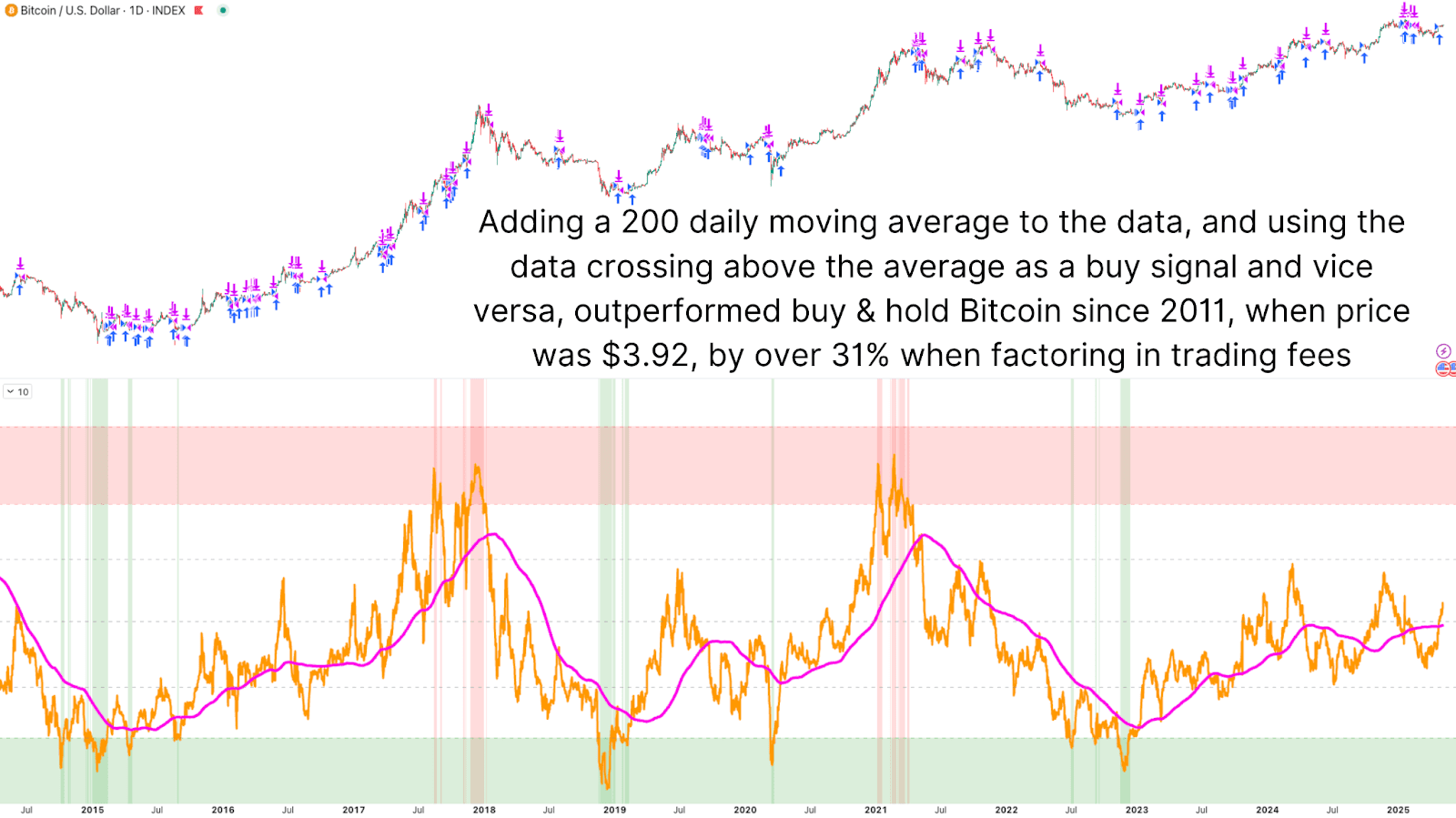

The enchancment is elegantly easy: apply a shifting common to the Everything Indicator rating and search for crossovers. Simply as we do with price-based methods, we are able to deal with the indicator like a sign line and search for directional modifications.

By default, a 200-period easy shifting common was utilized. When the Everything Indicator crosses above this MA, it suggests that almost all parts, liquidity, community well being, sentiment, and technicals, are trending upward collectively. These crossovers sign bullish pattern initiation, providing earlier entries than ready for cycle lows alone. Conversely, a cross under the shifting common can function a de-risking or distribution sign, particularly when occurring at or close to beforehand recognized overheated zones.

Even with conservative buying and selling assumptions (elevated charges and slippage), this technique’s efficiency was placing. Backtests from Bitcoin’s early years, when BTC traded underneath $4, confirmed this crossover technique returning over 3.1 million p.c, dramatically outperforming easy buy-and-hold.

Elevated Sign Frequency

To accommodate extra energetic traders, we are able to additional shorten the shifting common, down to twenty intervals, for instance. This gives tons of of entry and exit indicators per cycle whereas retaining the unique logic of the indicator.

Even when utilizing the shorter-term sign, returns remained sturdy, and outperformance relative to holding BTC remained intact. This reveals the device’s flexibility. It will possibly now serve each long-term traders searching for macro affirmation and energetic merchants who wish to reply extra dynamically to market modifications.

Decreasing the shifting common interval has key advantages, together with producing earlier indicators at market lows, extra frequent accumulation steerage, common exit prompts throughout overheated circumstances, and elevated alternatives to keep away from extended drawdowns.

Conclusion

The Bitcoin Everything Indicator might now provide the very best of each worlds: a high-integrity, all-encompassing view of market well being, and the pliability to supply frequent actionable indicators by a easy shifting common overlay. Even with real-world buying and selling friction, with charges and slippage, this technique has outperformed holding BTC over a number of timeframes, together with from way back to 2011.

So in case you’re already utilizing Bitcoin Journal Professional’s suite of indicators, now is likely to be the time to take this one step additional. Add overlays. Alter shifting averages. Layer in bands and filters. The extra you adapt these instruments to your individual technique, the extra {powerful} and intuitive they will turn into!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.