Coinbase, one of many largest names in crypto, is coping with a critical mess. A latest cyber assault focused the corporate’s inside programs via a mixture of deception and insider manipulation. The Coinbase hack wasn’t simply one other phishing try. It concerned insiders, stolen information, and a possible $400 million fallout. Now, the fallout may value the change wherever from $180 million to $400 million, and that’s earlier than we even get into reputational injury.

The Assault Began With a Single Electronic mail

All of it started on Could 11, when Coinbase acquired an e mail from somebody claiming that they had stolen buyer information. However this wasn’t your traditional phishing rip-off. In accordance with the corporate, the attackers paid off a handful of contractors and workers to get entry to inside instruments and data. From there, they used that entry to impersonate Coinbase employees and trick customers into handing over their crypto.

BREAKING NEWS : COINBASE HACK – difficulty is KYC. The extra we KYC the extra in danger the person is. pic.twitter.com/SN2eQKjQWI

— Jason Ai. Williams (@GoingParabolic) Could 15, 2025

Solely a small portion of customers, lower than 1 p.c, have been impacted. However contemplating Coinbase has tens of millions of consumers, even that small group may add as much as an enormous monetary hit.

A $20 Million Ransom Request? Declined.

As soon as the attackers had what they wished, they got here again with a requirement. They requested Coinbase to pay $20 million to maintain the stolen information from being launched. Coinbase didn’t flinch. The corporate refused to pay and went public with the incident as a substitute.

The CEO of Coinbase has rejected a $20M ransom demand

He then positioned a $20M reward to search out the cyber-criminals behind it pic.twitter.com/LeVp3sTxk7

— Dexerto (@Dexerto) Could 15, 2025

They’ve promised to reimburse affected clients and have already taken disciplinary motion internally. Any workers who helped leak buyer data have been let go. And to take issues a step additional, Coinbase has arrange a $20 million reward fund for anybody who will help deliver the attackers to justice.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

How A lot Might This Value?

In a submitting to U.S. regulators, Coinbase estimated the injury may vary between $180 million and $400 million. That quantity consists of the price of fixing the breach, reimbursing customers, and any authorized fallout which may observe. It may go up or down relying on what occurs subsequent, particularly if any funds are recovered or extra losses are uncovered.

Buyers didn’t take the information flippantly. Coinbase inventory dropped simply over 4 p.c after the story went public.

This Isn’t Only a Coinbase Drawback

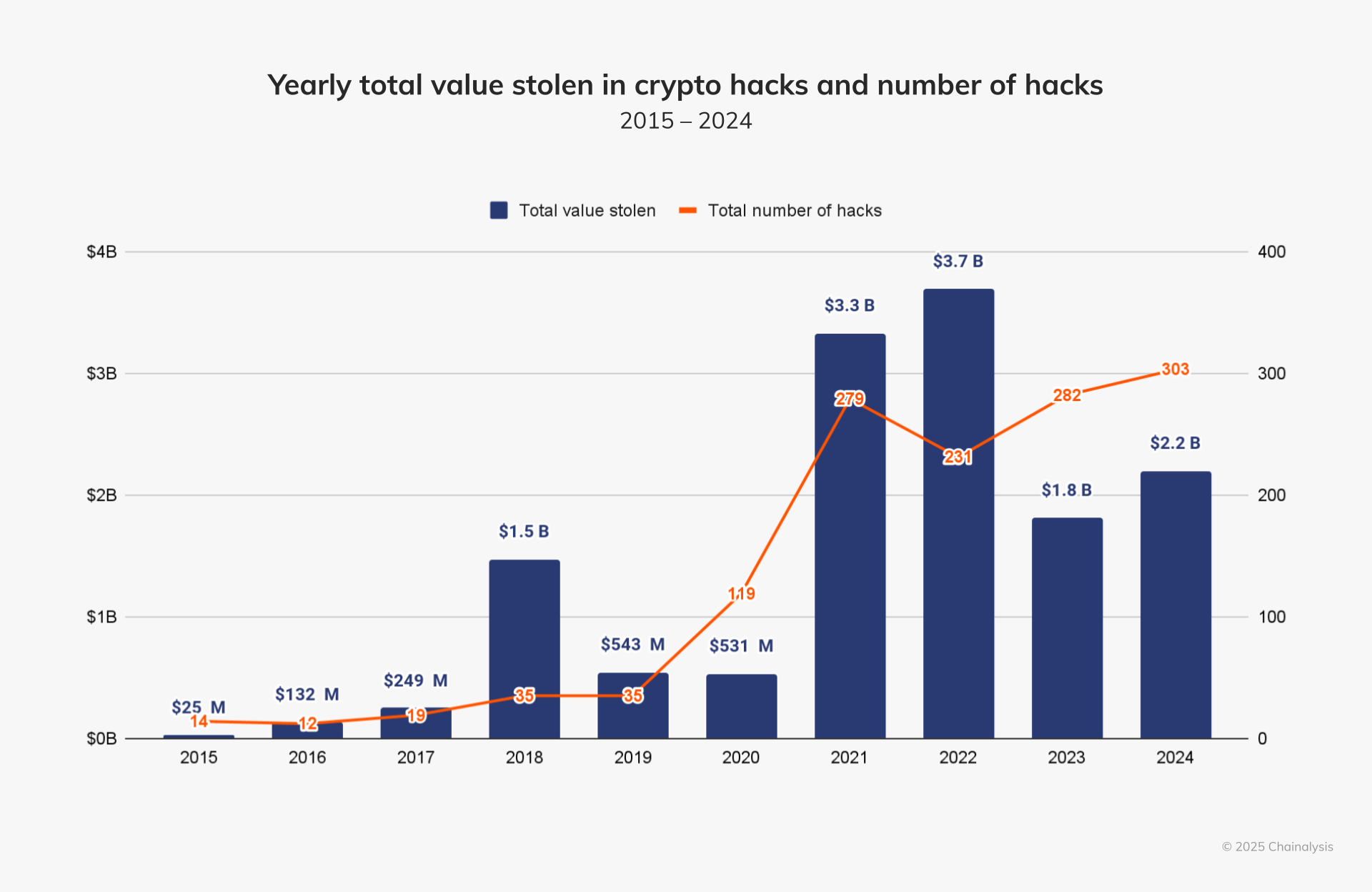

The crypto house has had a tough time with safety these days. In accordance with information from Chainalysis, hackers made off with greater than $2 billion in stolen funds in 2024 alone. And because the business grows, so do the targets. It’s no shock that attackers are getting extra inventive and going after greater fish.

This isn’t the primary time a serious platform has confronted an insider menace or phishing scheme. However Coinbase’s scenario reveals how complicated and dear these assaults have gotten, even for well-established corporations.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Coinbase Customers Ought to Know

Coinbase is urging customers to remain alert. The corporate is reminding everybody that it’s going to by no means ask for passwords, two-factor codes, or requests to ship crypto someplace else. If one thing feels off, customers are suggested to lock their accounts and report it instantly.

Coinbase Hack: A Harsh Lesson for the Business

With the Coinbase hack, we’re seeing how even the largest crypto platforms may be susceptible from the within out. This can be a clear signal that crypto platforms, regardless of how large, want to remain sharp. And for customers, it’s another excuse to be further cautious. In an area the place belief may be fragile, one breach like this will ripple far past the folks immediately concerned.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Coinbase is dealing with losses between $180 million and $400 million after a focused insider-driven cyber assault compromised its inside programs.

- Attackers allegedly bribed contractors and workers to achieve inside entry, then impersonated Coinbase employees to trick customers into handing over crypto.

- Coinbase refused to pay a $20 million ransom and has as a substitute gone public, promising to reimburse affected customers and examine the breach.

- The corporate has fired insiders concerned within the rip-off and launched a $20 million bounty fund to trace down these accountable for the assault.

- The hack highlights rising cybersecurity threats throughout the crypto business, the place even top-tier platforms are susceptible to insider manipulation.

The submit Coinbase Hacked: Up to $400M at Risk After Insider Scam appeared first on 99Bitcoins.