A just lately launched leveraged XRP ETF (exchange-traded fund) continued including belongings final week even because the XRP value retreated.

The Teucrium 2x Lengthy Every day XRP ETF, whose ticker image is XXRP, has gathered over $106 million in belongings since its approval in April.

Most significantly, the fund has added belongings in all weeks since its inception, with final week being its finest. ETF.com knowledge exhibits that it added $30.4 million in belongings, a giant improve from the $14.1 million it added per week earlier.

The continuing inflows are an indication that there’s demand for XRP ETFs on Wall Road. Spot Ethereum ETFs have added simply $2.5 billion in belongings since September, whereas the 2X Solana ETF (SOLT) has solely $30 million. SOLT was launched two months earlier than the XXRP ETF.

This view mirrors the JPMorgan forecast for Solana and XRP ETFs. In its report, the financial institution predicted that the 2 funds would appeal to $15 billion in inflows within the first 12 months, with most of them going to XRP.

The following necessary catalyst to look at is in June when the SEC will rule on the Franklin Templeton XRP ETF.

It would probably delay the ETF approval once more, after which will probably be accepted with these of firms like Bitwise and VanEck forward of their Oct. 15 deadline.

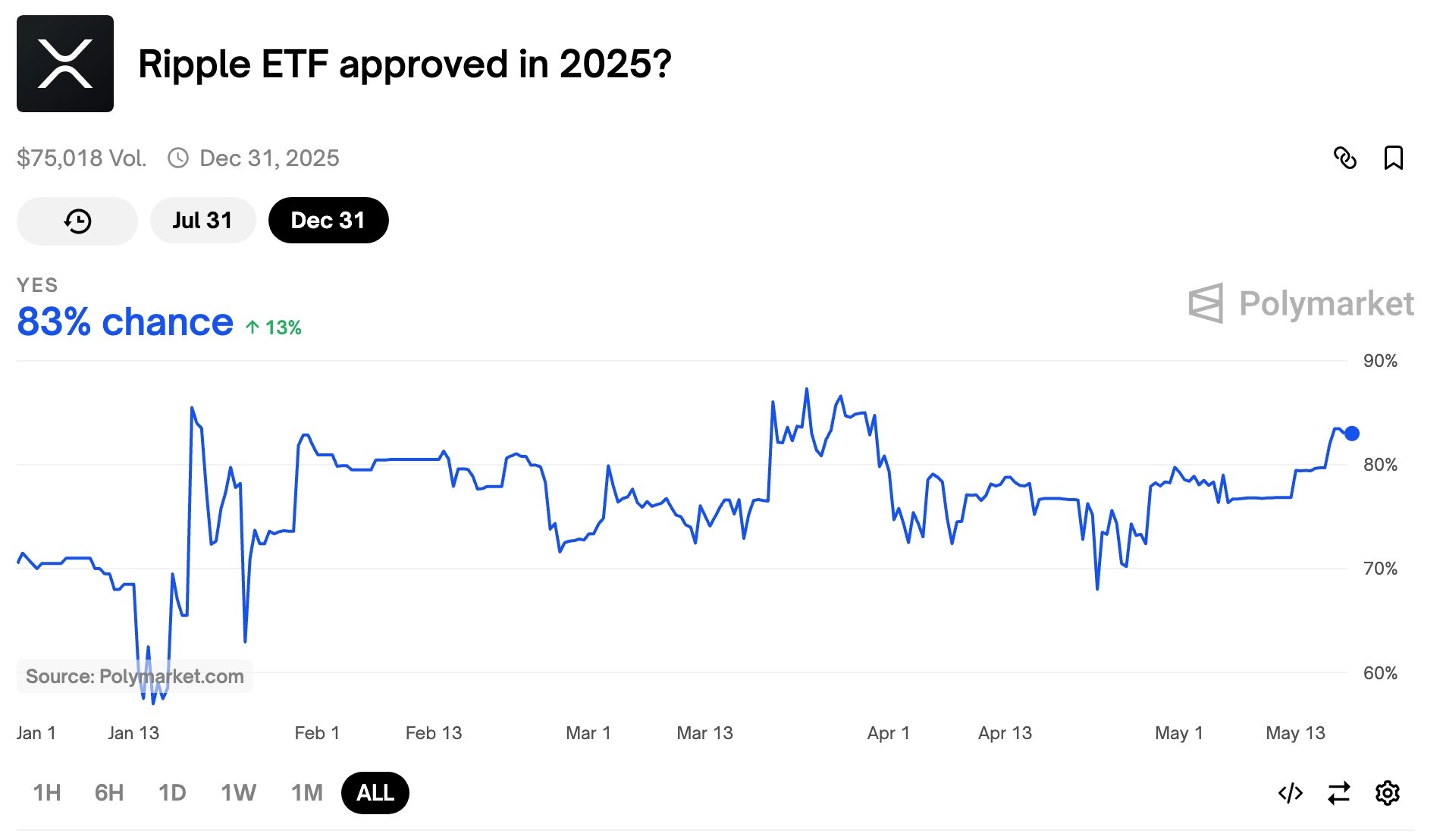

Polymarket merchants have positioned an 83% likelihood of XRP ETFs being accepted this 12 months.

The XXRP ETF is considerably completely different than the spot XRP ETFs. For one, it’s a costlier fund to personal due to its 1.89% expense ratio. Judging by the present ETH and BTC ETFs, their expense ratios will likely be lower than 0.50%.

The ETF can be leveraged, permitting traders to attain 2 instances the each day returns of XRP. For instance, it dropped by virtually 3% on Friday as Ripple (XRP) fell by 1.5%.

The long-term efficiency of a leveraged ETF can go both manner, relying on the underlying asset.

For instance, the leveraged ProShares UltraPro QQQ ETF has jumped by 270% within the final 5 years, whereas the Nasdaq 100 Index has risen by 130% in the identical interval.

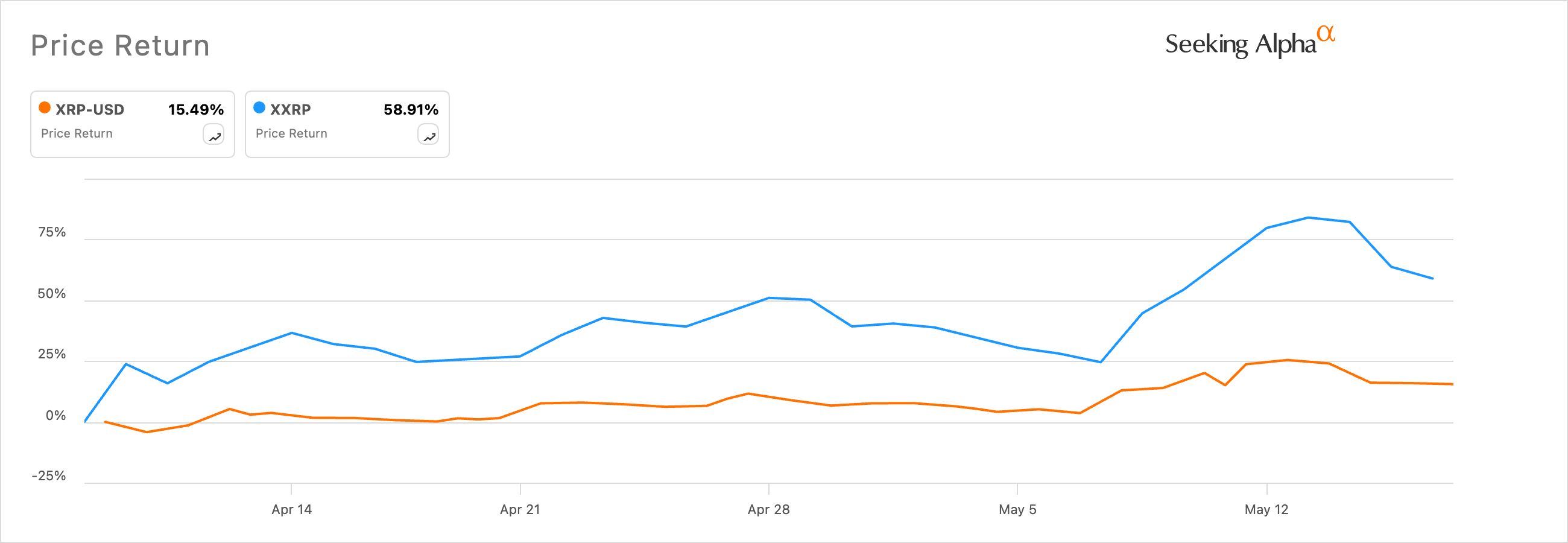

The XXRP has jumped by 58% since inception, whereas the XRP has risen by 15%.