Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

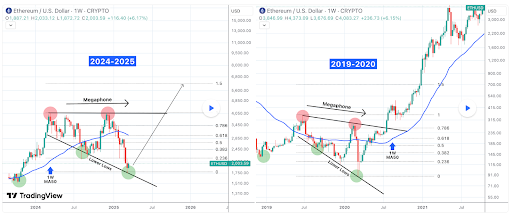

Crypto analyst TradingShot has revealed that the Ethereum worth has fashioned a megaphone backside which has not been seen since 2020. The analyst revealed what occurred the final time ETH fashioned this backside, which offers a bullish outlook for the altcoin.

Ethereum Price Forms Megaphone Bottom

In a TradingView put up, TradingShot said that the Ethereum worth has fashioned a megaphone backside like in March 2020. He famous that ETH is at present on the primary week of a rebound after recording three consecutive pink weeks when it couldn’t break above the 1-week MA50. The analyst additional remarked that ETH is taking over a decrease lows trendline, which is technically the underside of a 1-year megaphone for the reason that March 11, 2024 excessive.

Associated Studying

TradingShot claimed that the market isn’t any stranger to long-term megaphone consolidation durations like that. He said that the Ethereum worth ultimately broke upward the final time it fashioned this megaphone between June 2019 and March 2020, which occurred after the brutal COVID crash bearish leg that touched backside.

He famous that the March 2020 interval is sort of just like the present bearish Ethereum worth motion since late December. The analyst then highlighted how completely aligned the Fibonacci retracement ranges are. Based mostly on this improvement, he predicted that the Ethereum worth may at the least check the 1.5 Fibonacci extension at $6,000 earlier than this cycle tops on the finish of the yr.

Crypto analyst Crypto Patel additionally raised the opportunity of the Ethereum worth rallying to as excessive as $8,000. He prompt that this parabolic transfer may occur in part E of ETH’s bull run. He indicated that ETH may face important resistance at round $4,050 to this worth stage.

Bullish Fundamentals For ETH

Regardless of its underperformance, the Ethereum worth has bullish fundamentals, which may spark a reversal to the upside and trigger it to achieve new highs. Crypto analyst Various Bull revealed that the alternate reserves of ETH are considerably declining. He remarked that this is able to result in a restricted provide which makes it solely a matter of time earlier than ETH goes parabolic. In keeping with this, the analyst affirmed that the altcoin continues to be within the early phases of its bull run.

Associated Studying

Crypto analyst Ali Martinez has additionally revealed that whales are actively accumulating ETH, which is bullish for the Ethereum worth. In an X put up, he said that 360,000 ETH have been withdrawn from crypto exchanges within the final 48 hours, a improvement that would spark a provide shock.

Additionally it is price mentioning that the Ethereum worth may quickly witness a provide shock by means of the ETH ETFs. Asset managers like Bitwise have filed with the US SEC to incorporate staking of their funds. If accredited, this might take extra ETH out of circulation as some institutional buyers decide to stake their ETH to obtain yields.

On the time of writing, the Ethereum worth is buying and selling at round $1,969, down virtually 2% within the final 24 hours, in accordance with information from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com