Bitcoin is at a crossroads as market contributors develop more and more divided on its subsequent transfer. Bulls stay eager for a breakout above the all-time excessive (ATH) close to $112,000, whereas bears argue {that a} deeper correction is imminent. The present indecision is mirrored within the value motion, with BTC struggling to achieve traction after its current pullback, and volatility climbing amid rising macroeconomic and geopolitical tensions.

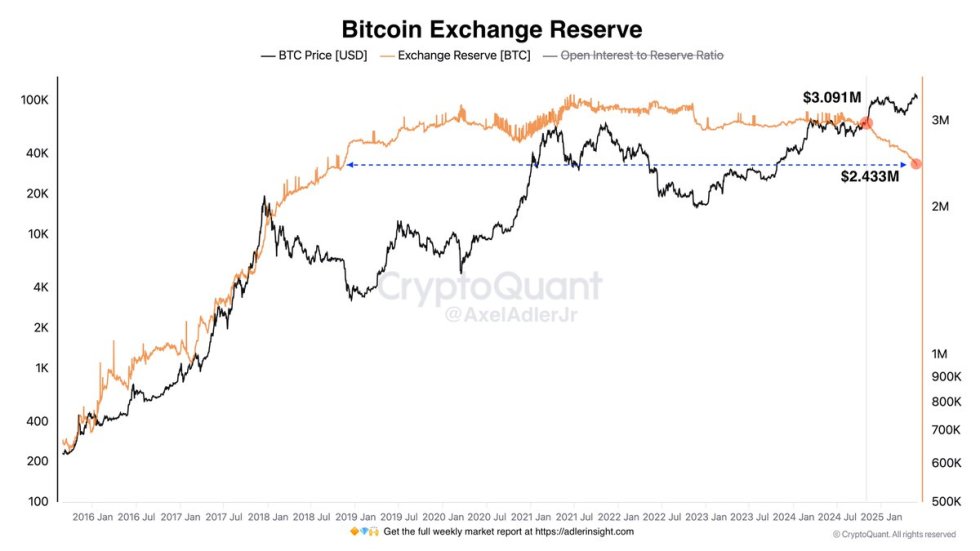

Analysts agree {that a} decisive transfer is coming, and all eyes are on on-chain information for clues. In line with CryptoQuant, since November 2024, centralized change (CEX) reserves have dropped by 668,000 BTC—a powerful long-term bullish sign suggesting continued accumulation and decreased promoting stress. Nevertheless, whereas the decline in reserves is notable, it’s removed from signaling exhaustion.

This divergence between bullish and bearish narratives units the stage for a essential second in Bitcoin’s cycle. Whether or not a provide squeeze triggers the subsequent leg up or rising world uncertainty results in additional retracement, the approaching days will possible outline BTC’s short-term trajectory.

Bitcoin Holds Essential Assist As Uncertainty Rattles Sentiment

Bitcoin is presently buying and selling at a key juncture, holding above essential demand ranges however failing to verify a decisive breakout above the $112,000 all-time excessive. The asset has proven resilience after a 7% pullback, however a scarcity of sturdy momentum has left the market in a state of uncertainty. Analysts stay divided, with some anticipating a renewed bullish impulse whereas others warn of a bigger correction amid rising volatility.

The macroeconomic backdrop provides to the unease. The aggressive and unpredictable bond market continues to form world danger dynamics, with surging US Treasury yields signaling systemic stress that would ripple by means of crypto markets. Merchants have gotten extra cautious, and sentiment has shifted right into a extra defensive posture.

Nonetheless, on-chain information affords a glimmer of long-term optimism. In line with prime analyst Axel Adler, centralized change (CEX) reserves have fallen by 668,000 BTC since November 2024. This notable decline indicators decreased promoting stress and elevated confidence amongst long-term holders. Nevertheless, it’s untimely to declare reserves depleted. As of now, there are nonetheless 2,432,989 BTC obtainable throughout exchanges.

At present market costs, it could take over a quarter-trillion {dollars}—roughly $253.4 billion—to soak up that liquidity fully. This large capital requirement means that whereas bullish indicators are rising, the market stays removed from a real provide squeeze. Till BTC reclaims $112,000 with conviction, buyers ought to put together for additional consolidation and even deeper retests.

BTC Value Evaluation: Resistance Nonetheless Looms

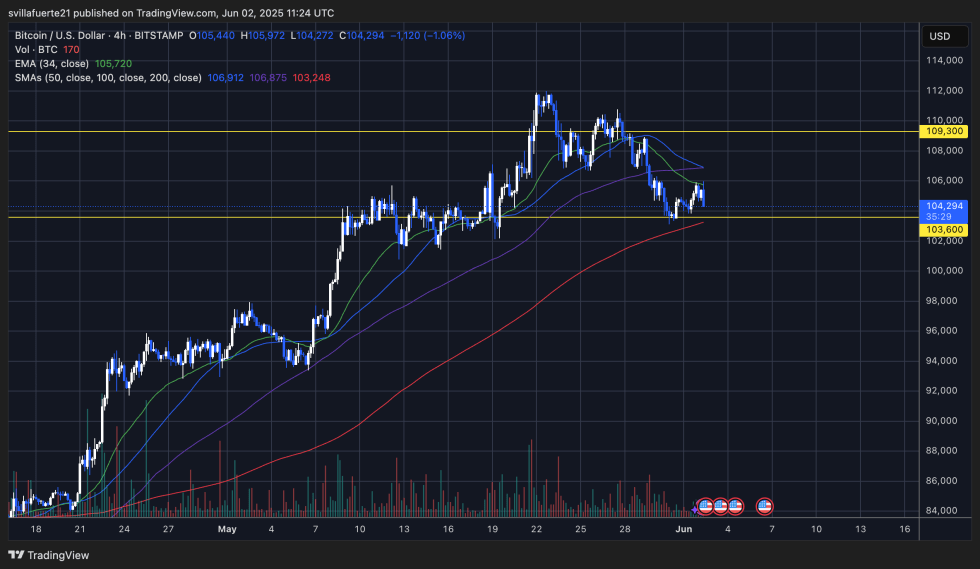

Bitcoin is holding above a key assist zone round $103,600 after bouncing off this stage earlier within the day. The 4-hour chart reveals BTC making an attempt a restoration, with short-term resistance now forming close to the 34-EMA ($105,720), which aligns intently with the 50 and 100 SMA cluster. A break above this confluence may open the door to retest the $109,300 resistance—a stage that capped the earlier rally and triggered the present correction.

Quantity stays modest, suggesting a scarcity of sturdy conviction from bulls or bears. Nevertheless, the 200 SMA continues to be sloping upward and sits beneath present value motion, offering structural assist close to $103,200.

If BTC fails to reclaim the $106K vary, additional consolidation is probably going, and a clear break beneath $103,600 may expose the market to deeper retracement towards $100K psychological ranges.

Bulls should clear $106K to regain short-term momentum, whereas bears will likely be eyeing a breakdown beneath $103.6K to achieve management. With macro volatility rising and on-chain information displaying sturdy accumulation from massive holders, the subsequent few periods may provide extra readability on BTC’s short-term course.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.