Within the prime 5 cryptos, Ethereum is lagging, underperforming in opposition to Bitcoin, Solana, and nearly all prime altcoins. In contrast to Solana, which has hit new all-time highs, ETH

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Worth

Quantity in 24h

<!–

?

–>

Worth 7d

continues to be fluctuating between the $3,000 and $3,500 vary, keeping off decided sellers eager on suppressing costs.

Nonetheless, it appears to be like like this state of “bearish” value motion is likely to be coming to an finish. Yesterday, regardless of the Federal Reserve holding charges regular, one analyst on X noticed that the coin broke above $3,200.

On the time of writing, the coin continues to be buying and selling above this threshold and appears agency, constructing momentum.

ETH Worth Evaluation: Is Ethereum Worth Prepared To Rip?

Nonetheless, ETH isn’t out of the woods but. Trying on the ETH value motion, it’s clear that sellers are nonetheless in management, and for consumers to take over, they have to shut above the descending channel. The speedy resistance is on the $3,500 degree.

If bulls achieve momentum, they could overcome $3,700 and even break above $4,100, 2024 excessive, in a refreshing purchase pattern continuation. Earlier than that, optimistic holders might solely watch the value motion, hoping that bulls would maintain above $3,200 within the quick to medium time period.

(ETHUSDT)

All the identical, confidence is excessive that Ethereum bulls would possibly shake off the weak spot and resume the uptrend seen within the second half of 2023, the place the coin spiked to as excessive as $4,100 in January 2024.

Whereas Ethereum faces stiff competitors from Solana and validators should take care of low income following the activation of Dencun in early 2024, there are indicators of elevated exercise.

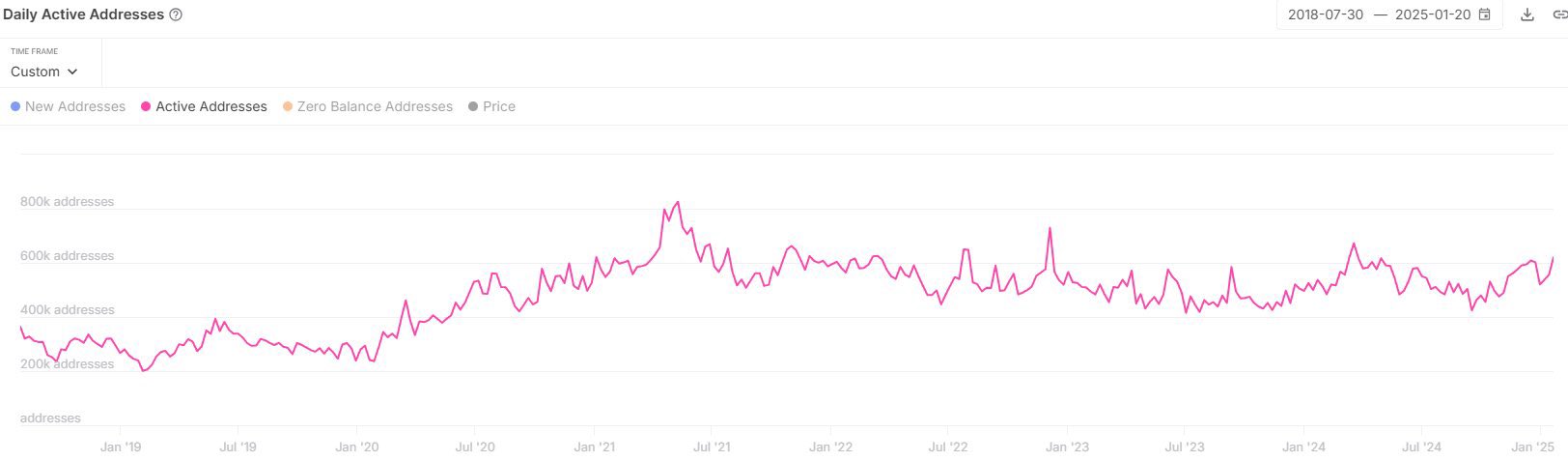

Citing on-chain knowledge, the analyst observes that the variety of energetic addresses on the mainnet rose by over 37%, reaching 670,000 final week. This is almost 50% greater than what was recorded in March 2024, at 400,000, when the group was optimistic concerning the coin reaching again to $5,000.

(Supply)

This surprising uptick would possibly trace that Ethereum is gearing up for a major bull run in 2025 that might drastically elevate valuations. Even so, merchants should stay cautious.

ETH Whales MIA However Vitalik Buterin Has a Plan For ETH Worth

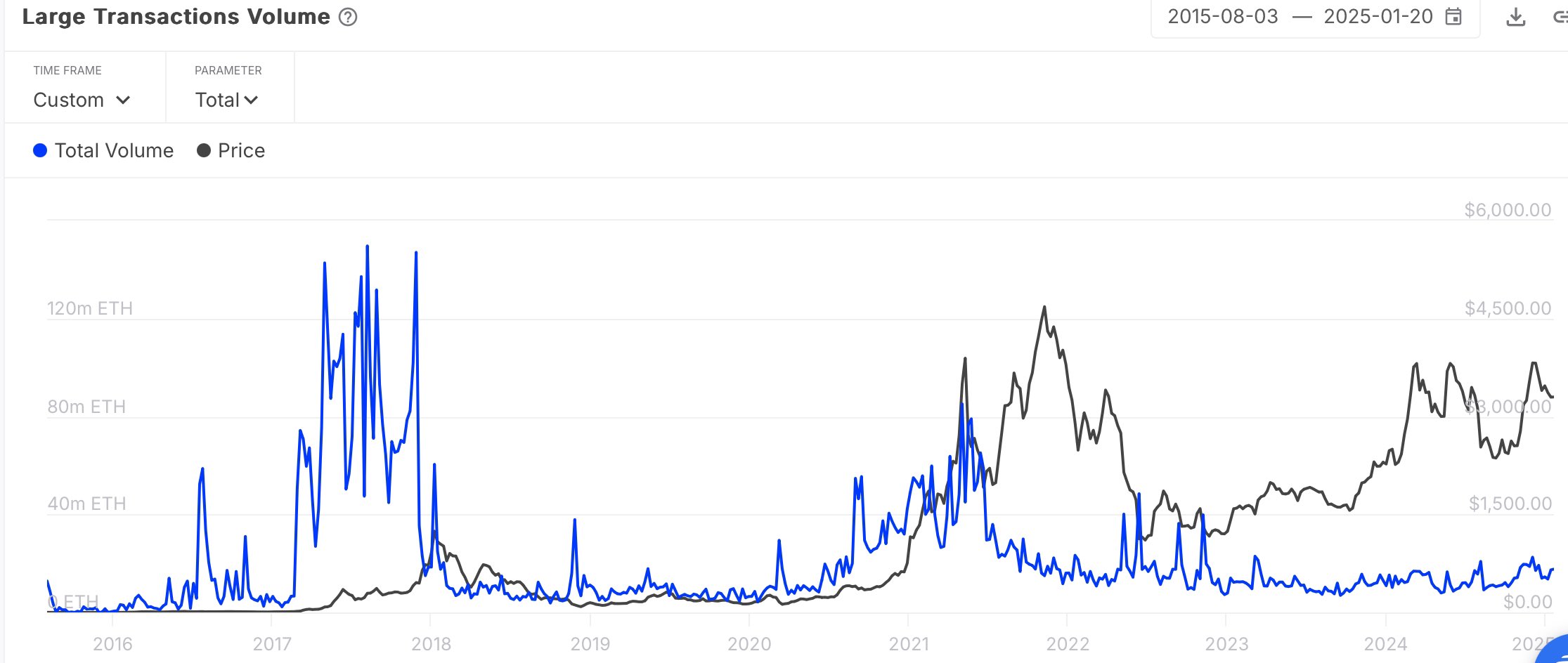

Though there are extra new customers, the variety of massive transactions stays subdued, notably when in comparison with the bull runs of 2021 and 2017.

A unique evaluation by a consumer on X notes that the absence of a whale frenzy suggests an absence of institutional demand. Nonetheless, this “silence” may be interpreted positively because the coin stays above $3,000, a psychological assist degree.

At spot charges, ETH could also be undervalued, which is a chance to build up.

(Supply)

It stays to be seen how ETH costs will evolve within the quick time period. The group is watching how Ethereum builders will deal with the stiff competitors, notably from Solana.

Thus far, Vitalik Buterin has emphasised the necessity for a multi-pronged method to boosting ETH value. In a submit, the co-founder identified the need of additional scaling the mainnet whereas additionally cementing ETH as a major asset throughout the ecosystem.

To extend ETH burning, he advised rising the variety of “blobs” and setting a minimal value for creating such knowledge containers.

Blobs are essential for layer-2 options and assist scale off-chain actions whereas lowering charges. By his estimation, if the variety of blobs will increase to 128, over 700,000 ETH might be burned yearly.

EXPLORE: $1M Catslap Crypto Burn Anticipated To Set off Main Upaspect For $SLAP Worth

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Ethereum Bulls Getting Started? Network Activity Up 23% in 24 Hours, ETH Breaks $3,200 appeared first on 99Bitcoins.