XRP gained 42% up to now week, after rallying near 1% on Friday. The altcoin hit a brand new all-time excessive, with the 24-hour commerce quantity leaving Ethereum (ETH) to chunk the mud on Thursday. The token may lengthen its streak within the coming days following President-elect Donald Trump’s inauguration.

XRP may lengthen rally alongside Bitcoin

XRP rallied over 40% up to now week. Bitcoin (BTC), the most important cryptocurrency recovered from its flashcrash underneath $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the highest crypto.

Trump’s upcoming inauguration is among the main catalysts, alongside optimism on crypto regulation, pro-crypto coverage and a brand new strategy by monetary regulatory companies within the U.S.

XRP may achieve additional, getting into worth discovery subsequent week.

XRP trades at $3.26 on the time of publication.

On-chain indicators help positive aspects

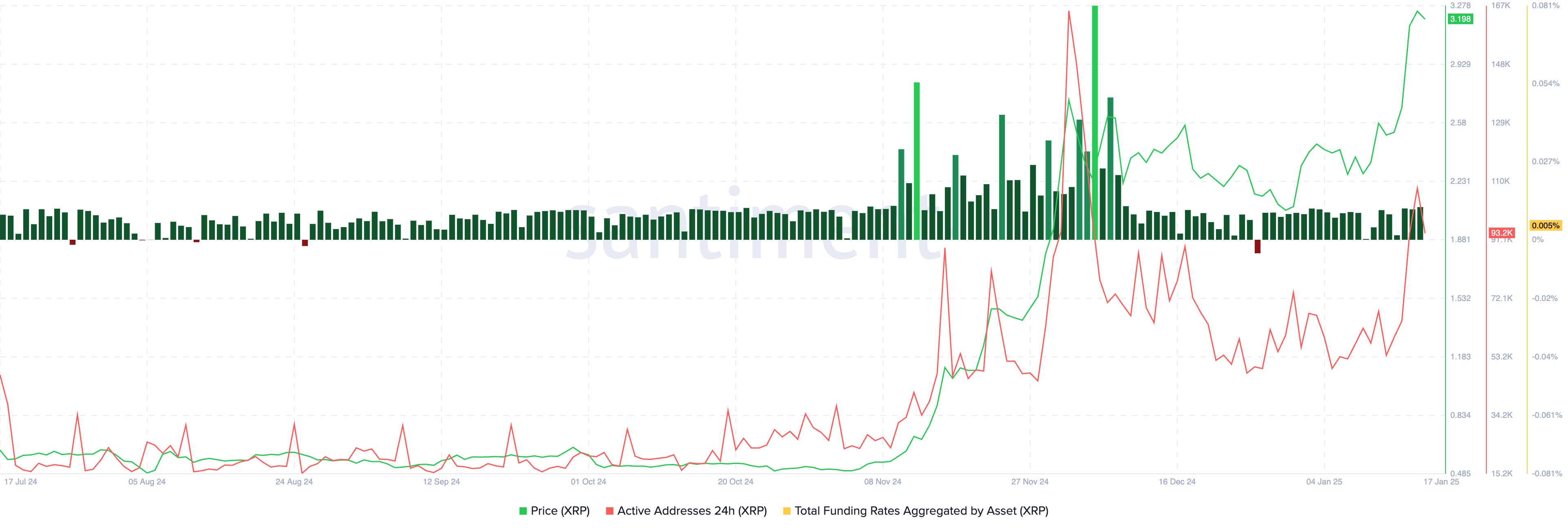

XRP’s on-chain indicators help a bullish thesis for the altcoin. The entire funding fee metric is constructive, larger than one all through January 2025. The rely of energetic addresses recorded a big spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to additional positive aspects in XRP within the coming week.

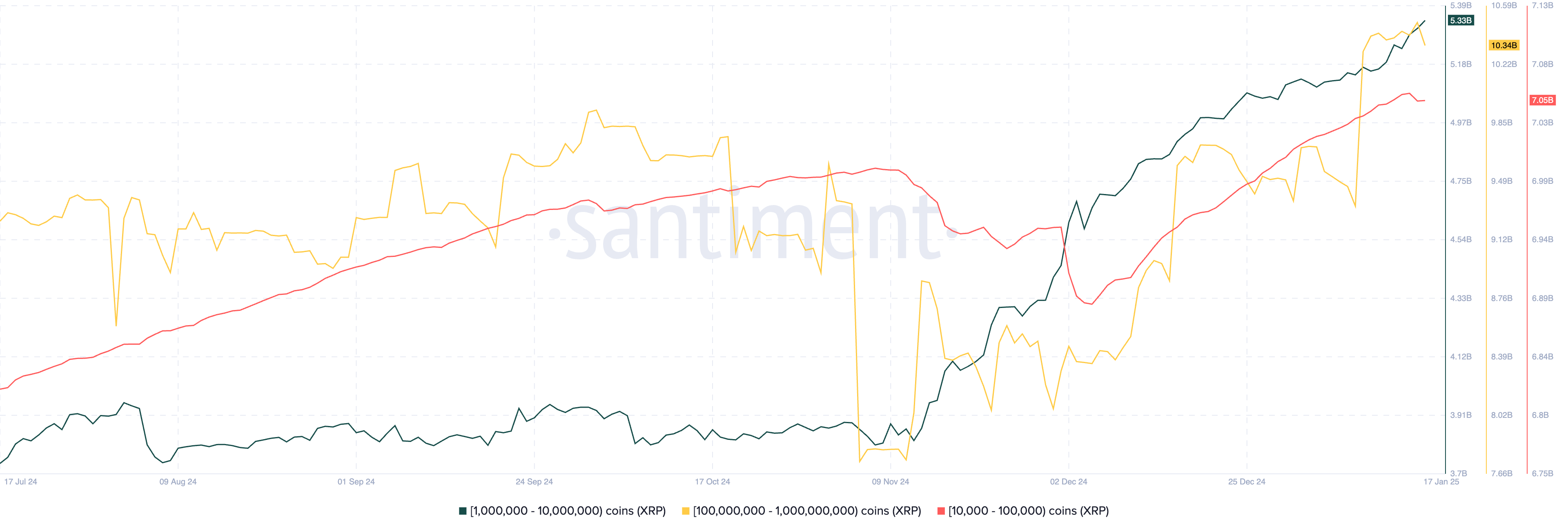

The availability distribution metric on Santiment reveals a rise in XRP token provide held by wallets that personal 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three lessons of holders have accrued the altcoin, at the same time as the worth climbs. That is indicative of a possible XRP worth improve sooner or later.

Market movers and Ripple lawsuit

Monday’s inauguration is the most important market mover in crypto. However RippleNet’s rising adoption amongst establishments, the developments in RLUSD stablecoin and the SEC’s lawsuit in opposition to Ripple are the three key market movers influencing the altcoin’s worth.

Even because the U.S. monetary regulator filed an enchantment in opposition to Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Choose Analisa Torres that categorised secondary gross sales of XRP as non-securities is being challenged and the SEC is searching for to have these retail gross sales categorised as unregistered securities gross sales.

Ryan Lee, chief analyst at Bitget Analysis, informed crypto.information in an unique interview:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

It stays to be seen whether or not the Trump administration will help pro-crypto regulation and whether or not it influences the result of lawsuits in opposition to companies like Ripple Labs.

Technical evaluation and XRP worth forecast

XRP is hovering near its all-time excessive at $3.40. On the time of writing, XRP traded at $3.2385. A 22% worth rally may push XRP into worth discovery, on the 141.4% Fibonacci retracement stage of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD help a bullish thesis for XRP. MACD flashes consecutive inexperienced histogram bars. Merchants have to maintain their eyes peeled as RSI alerts that the token is presently overbought or overvalued, because it reads 83.

Within the occasion of a correction, XRP may discover help on the 50% Fibonacci retracement stage at $2.6977.

James Toledano, COO at Unity Pockets, informed crypto.information in an unique interview:

“Given that XRP was stuck at around $0.50 for literally 3 years, its recent breakout momentum reflects new levels of investor optimism around regulatory clarity and the potential approval of an XRP ETF in the following months. If the XRP ETF gets approved, it will have the potential to open the floodgates of capital inflow, meaning it could reach new heights in 2025.”

Toledano warns XRP holders to be cautious as altcoins take volatility to the subsequent stage within the present market cycle.

He stated:

“Altcoin ETFs have real potential to draw capital, particularly if supported by innovation-friendly insurance policies with the brand new incoming U.S. administration. However, their success could also be much less constant in comparison with Bitcoin ETFs because of the seemingly episodic nature of curiosity in altcoins.

Simply check out fluctuations in Bitcoin’s worth this week. The elements are multifaceted; lets say it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended collectively. To play satan’s advocate, we people are sample seekers however generally there are hidden drivers and the trigger and results aren’t all the time linked.”

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.