Ethereum worth pulled again prior to now three days as merchants alter their positions for June, its traditionally worst month.

Ethereum (ETH) has declined for 3 consecutive days, hitting a low of $2,500. That’s a 9.8% drop from its month-to-month excessive. Regardless of the pullback, it has outperformed most altcoins, a lot of which have fallen greater than 15% from their highs this month.

ETH retreated forward of June, which is normally its worst month, due to the beginning of summer season. CoinGlass information reveals that the typical month-to-month efficiency in June since 2016 is minus 7.4%. Its median month-to-month return in June is minus 8.68%.

June can be Bitcoin’s (BTC) second-worst-performing month after September, with a mean return of minus 0.35%.

Seasonality doesn’t all the time work out. For instance, ETH dropped by 18% in March, bucking a four-year pattern of positive factors. It additionally dropped by 31% in February, after recording constructive positive factors within the final six consecutive years.

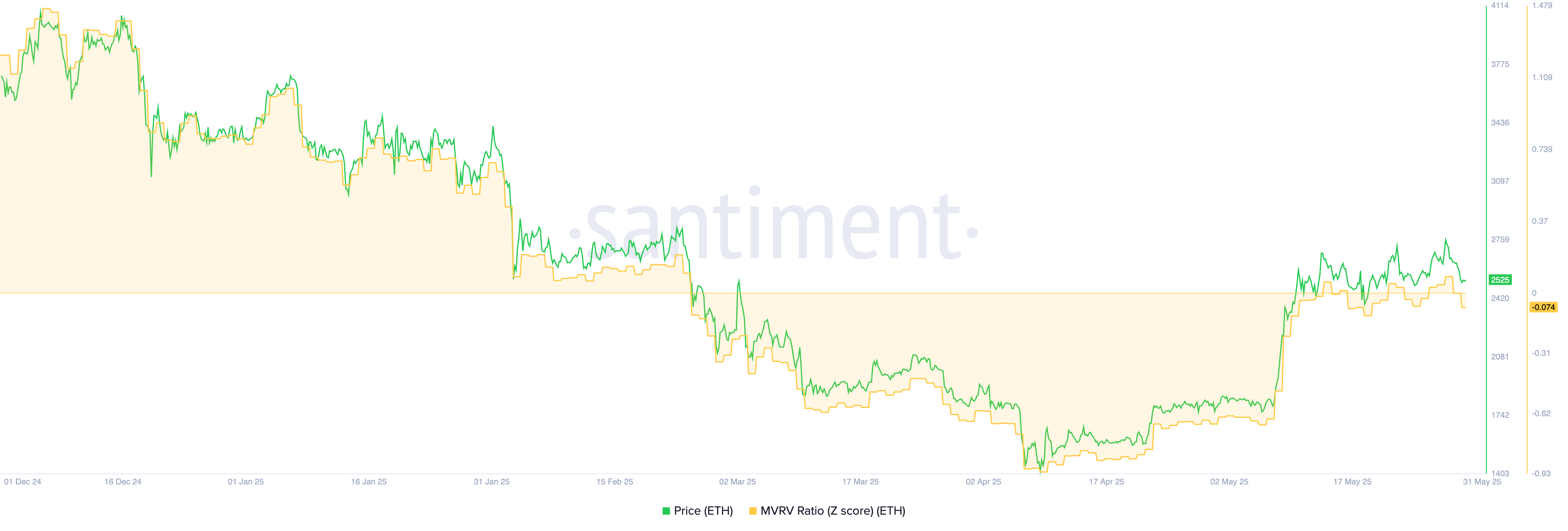

Ethereum has some sturdy fundamentals as June kicks off. First, there are indicators that the coin is affordable, because the closely-watched MVRV ratio has moved to minus 0.074. The MVRV ratio compares the market worth and the realized worth, with a studying of lower than 1 signaling that an asset is undervalued.

There are additionally indicators that Ethereum whales are shopping for the dip. They maintain 103.5 million ETH cash, up from this week’s low of 103.45 million. Whale purchases is a extremely bullish signal.

Wall Road buyers have additionally continued to purchase ETH this month. Spot Ethereum ETFs have had inflows within the final 10 straight days, bringing the cumulative inflows to over $3 billion.

Ethereum worth technical evaluation

The day by day chart under reveals that Ethereum’s worth bottomed at $1,385 on April 9 after which bounced again to the present $2,530. It has moved above the 50-day transferring common and is slowly forming a bullish flag sample.

This sample contains of a vertical line and a consolidation.

Ethereum can be forming a cup-and-handle sample, a well-liked continuation signal. The cup has a depth of about 50%, giving it a worth goal of $4,185.