Bitcoin is surging in 2025, igniting hypothesis a couple of historic Bitcoin supercycle. After a risky begin to the 12 months, renewed momentum, recovering sentiment, and bullish metrics have analysts asking: Are we on the cusp of a 2017 Bitcoin bull run repeat? This Bitcoin value evaluation explores cycle comparisons, investor conduct, and long-term holder tendencies to evaluate the chance of an explosive part on this cryptocurrency market cycle.

How the 2025 Bitcoin Cycle Compares to Previous Bull Runs

The most recent Bitcoin value surge has reset expectations. In accordance with the BTC Progress Since Cycle Low chart, Bitcoin’s trajectory aligns intently with the 2016–2017 and 2020–2021 cycles, regardless of macro challenges and drawdowns.

Traditionally, Bitcoin market cycles peak round 1,100 days from their lows. At roughly 900 days into the present cycle, there could also be a number of hundred days left for potential explosive Bitcoin value development. However do investor behaviors and market mechanics assist a Bitcoin supercycle 2025?

Bitcoin Investor Habits: Echoes of the 2017 Bull Run

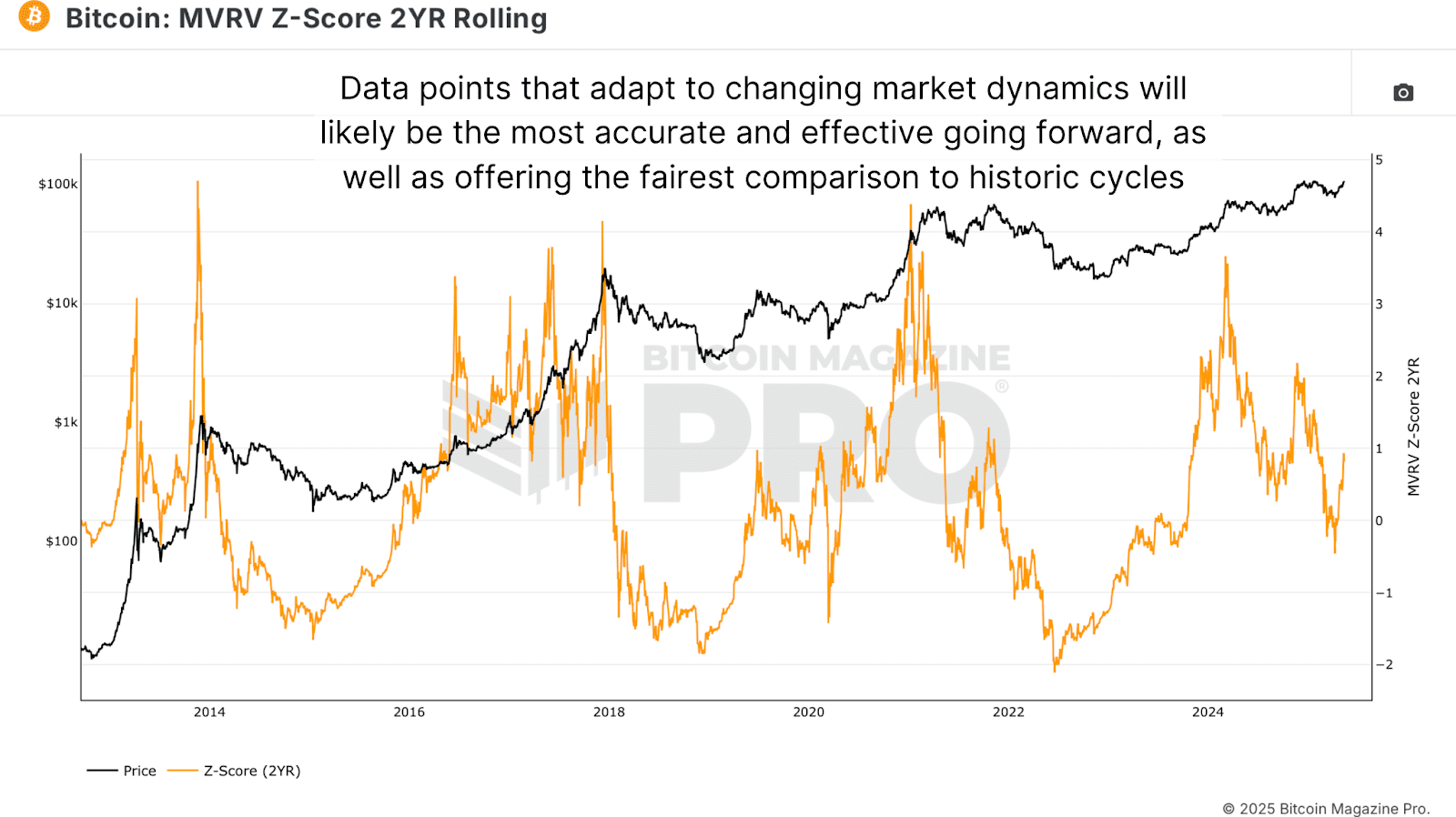

To gauge cryptocurrency investor psychology, the 2-Yr Rolling MVRV-Z Rating gives crucial insights. This superior metric accounts for misplaced cash, illiquid provide, rising ETF and institutional holdings, and shifting long-term Bitcoin holder behaviors.

Final 12 months, when Bitcoin value hit ~$73,000, the MVRV-Z Rating reached 3.39—a excessive however not unprecedented stage. Retracements adopted, mirroring mid-cycle consolidations seen in 2017. Notably, the 2017 cycle featured a number of high-score peaks earlier than its closing parabolic Bitcoin rally.

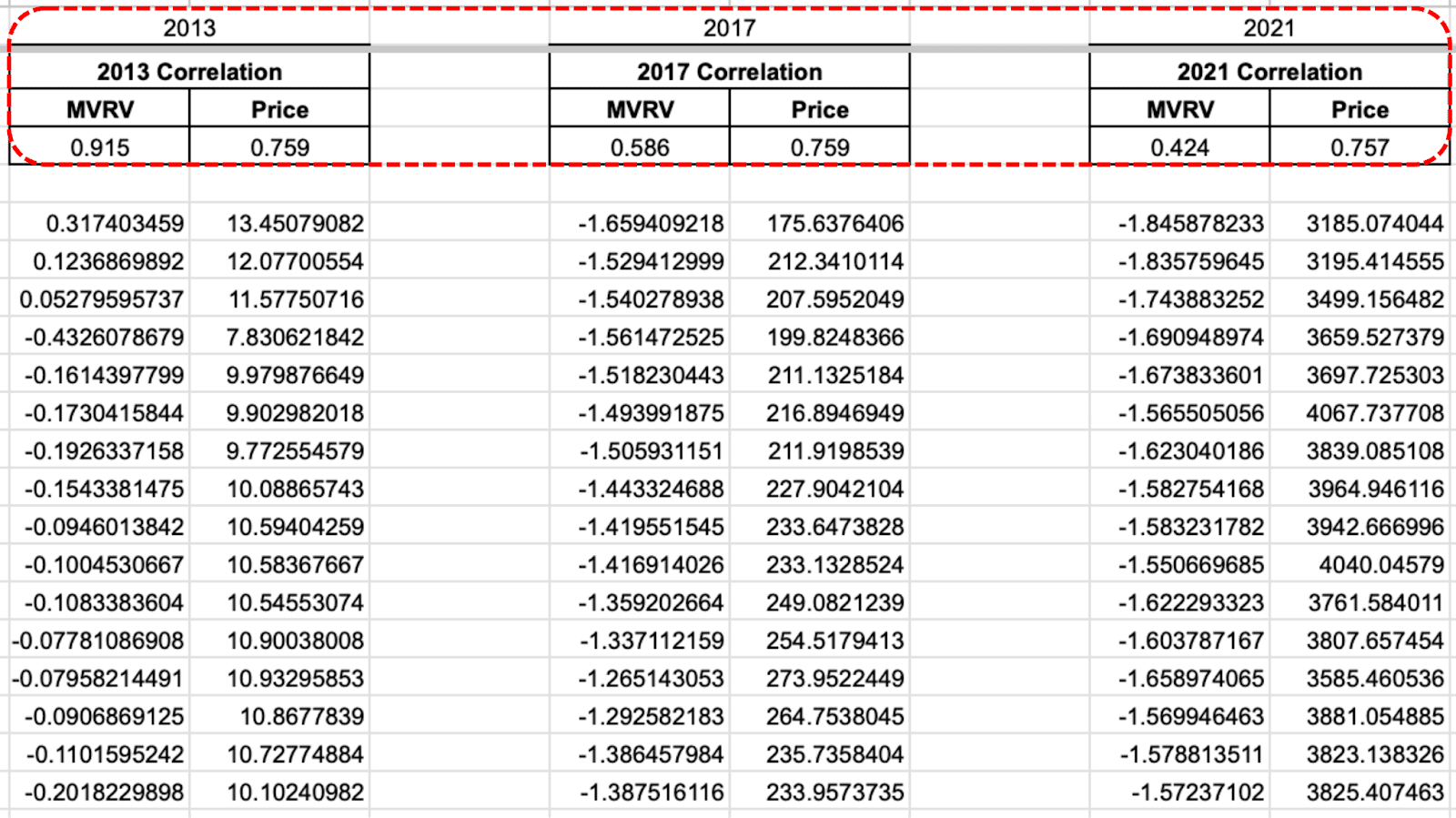

Utilizing the Bitcoin Journal Professional API, a cross-cycle Bitcoin evaluation reveals a hanging 91.5% behavioral correlation with the 2013 double-peak cycle. With two main tops already—one pre-halving ($74k) and one post-halving ($100k+)—a 3rd all-time excessive may mark Bitcoin’s first-ever triple-peak bull cycle, a possible hallmark of a Bitcoin supercycle.

The 2017 cycle exhibits a 58.6% behavioral correlation, whereas 2021’s investor conduct is much less comparable, although its Bitcoin value motion correlates at ~75%.

Lengthy-Time period Bitcoin Holders Sign Sturdy Confidence

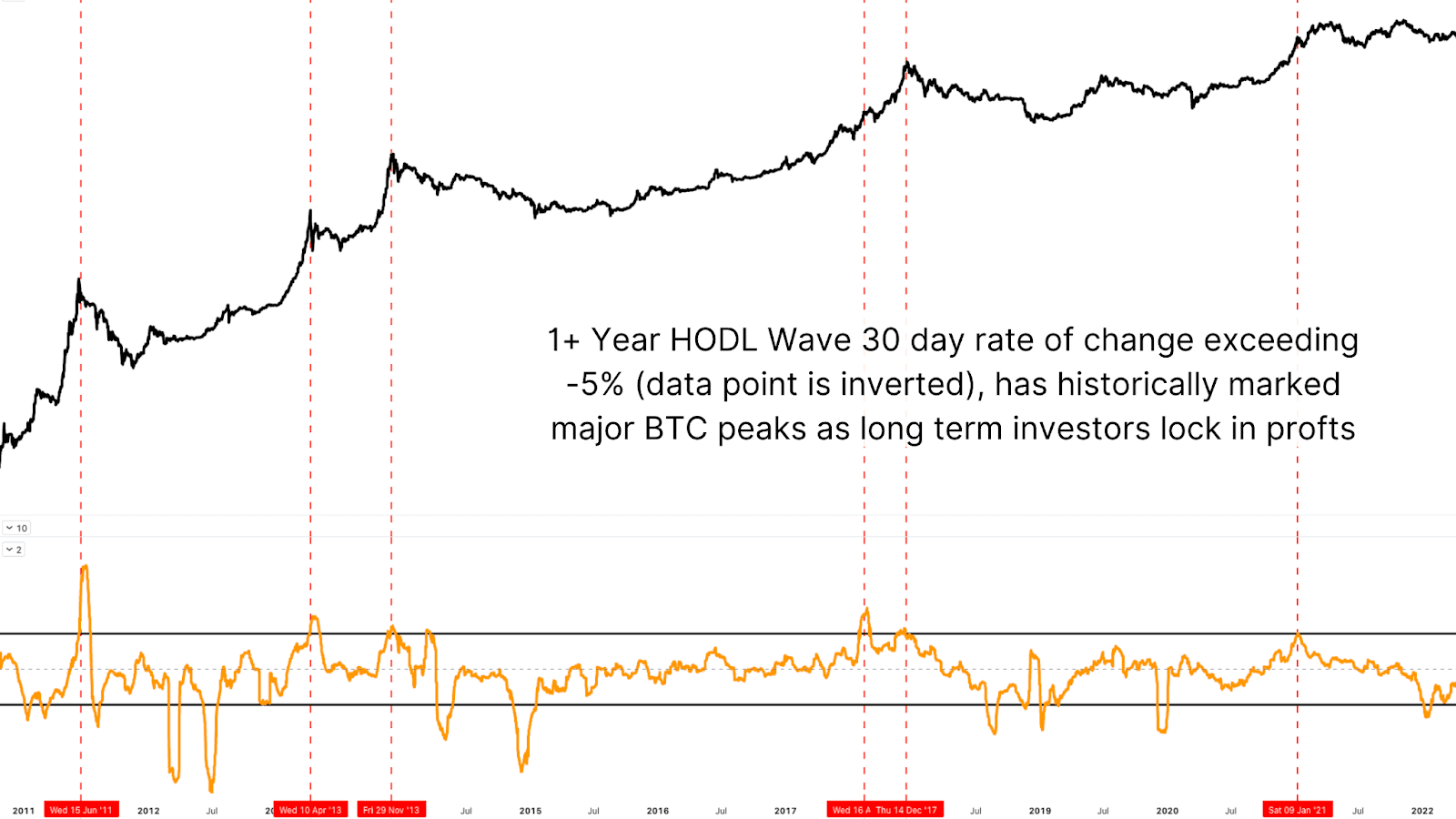

The 1+ Yr HODL Wave exhibits the share of BTC unmoved for a 12 months or extra continues to rise, whilst costs climb—a uncommon development in bull markets that displays sturdy long-term holder conviction.

Traditionally, sharp rises within the HODL wave’s charge of change sign main bottoms, whereas sharp declines mark tops. At the moment, the metric is at a impartial inflection level, removed from peak distribution, indicating long-term Bitcoin traders count on considerably larger costs.

Bitcoin Supercycle or Extra Consolidation?

Might Bitcoin replicate 2017’s euphoric parabolic rally? It’s doable, however this cycle might carve a singular path, mixing historic patterns with trendy cryptocurrency market dynamics.

We could also be approaching a 3rd main peak inside this cycle—a primary in Bitcoin’s historical past. Whether or not this triggers a full Bitcoin supercycle melt-up stays unsure, however key metrics counsel BTC is way from topping. Provide is tight, long-term holders stay steadfast, and demand is rising, pushed by stablecoin development, institutional Bitcoin funding, and ETF flows.

Conclusion: Is a $150k Bitcoin Rally in Sight?

Drawing direct parallels to 2017 or 2013 is tempting, however Bitcoin is not a fringe asset. As a maturing, institutionalized market, its conduct evolves, but the potential for explosive Bitcoin development persists.

Historic Bitcoin cycle correlations stay excessive, investor conduct is wholesome, and technical indicators sign room to run. With no main indicators of capitulation, profit-taking, or macro exhaustion, the stage is ready for sustained Bitcoin value growth. Whether or not this delivers a $150k rally or past, the 2025 Bitcoin bull run might be one for the historical past books.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.