On-chain knowledge exhibits Dogecoin and XRP have lately been seeing the sharpest decreases in Supply in Profit out of the foremost cryptocurrencies.

Dogecoin & XRP Have Seen A Notable Drop In Profitcapacity Throughout Final 30 Days

In a brand new put up on X, the on-chain analytics agency Glassnode has mentioned concerning the newest development within the Supply in Profit for the foremost belongings within the cryptocurrency sector.

The “Supply in Profit” right here is an indicator that retains observe of the proportion of the whole circulating provide of a given digital asset that’s being held at some web unrealized revenue.

The metric works by going by means of the transaction historical past of every coin on the community to see what worth it was final moved at. If this earlier switch worth of any token was lower than the present spot worth, then that specific coin is assumed to be sitting on a revenue proper now.

The Supply in Profit provides up all cash of this kind and determines what a part of the provision that they make up for. An alternate indicator generally known as the Supply in Loss takes under consideration for the provision of the other sort. The worth of the Supply in Loss may merely be calculated by subtracting the Supply in Profit from 100, as the whole provide should add as much as a 100%.

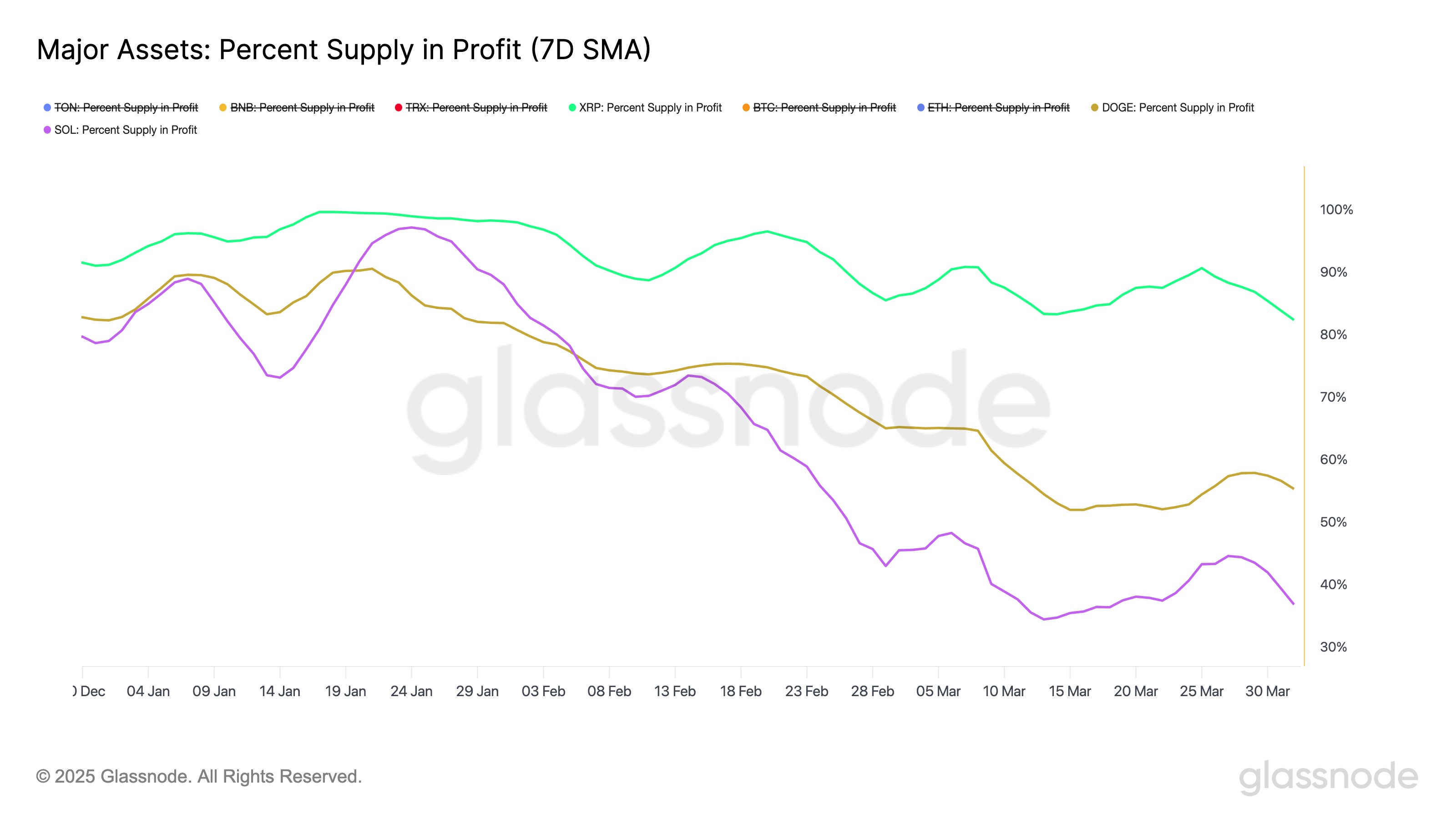

Now, right here is the chart shared by the analytics agency that exhibits the development within the 7-day easy shifting common (SMA) of the Supply in Profit for eight cryptocurrencies over the previous few months:

As is seen within the above graph, Toncoin (TON) and BNB (BNB) have seen the Supply in Profit undergo a big improve lately. Over the past 30 days, TON has seen an extra 23.8% of the provision get into the inexperienced, taking the whole to a whopping 94.1%. Equally, BNB has seen an increase of 17.4%, placing the metric at 86.3%.

On the opposite finish of the spectrum are Dogecoin (DOGE), XRP (XRP), and Solana (SOL), with every registering a notable lower within the indicator. Beneath is a chart that filters out the opposite belongings to concentrate on the curves for these cash.

With the lower, XRP has seen one other 5.2% of its provide fall right into a loss to take the whole Supply in Profit to 81.5%. Dogecoin has seen an nearly double digit lower within the metric, however a majority of its cash are nonetheless above water because the indicator sits at 53.6%.

Solana hasn’t been so fortunate, nevertheless, as regardless of a decline of simply 4.4%, solely 35.2% of the the cryptocurrency’s provide is presently holding a acquire. From one perspective, although, this growth could not truly be so dangerous for SOL. Typically, profit-sellers are what impede bullish strikes, however when there aren’t many buyers left in acquire anymore, the value tends to backside out.

With Solana and even Dogecoin sitting on a comparatively low stage of revenue provide, it’s attainable that their costs could possibly be close to a rebound.

DOGE Value

On the time of writing, Dogecoin is floating round $0.173, down greater than 11% during the last week.