Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

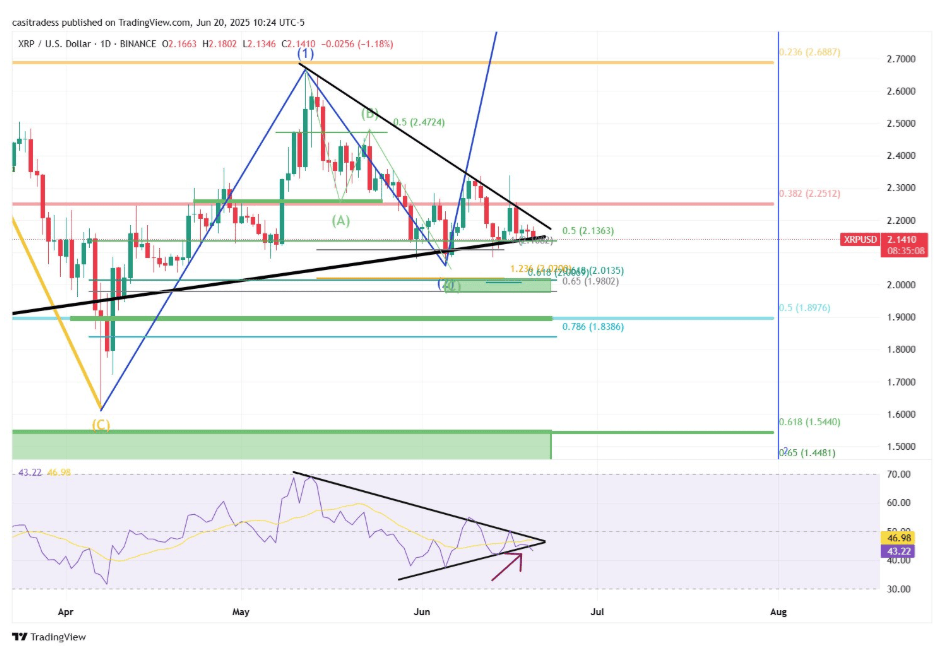

After weeks of decrease highs and better lows, XRP’s each day candlestick value chart is now giving a sign that might dictate the subsequent main transfer. Though the token remains to be holding above key horizontal ranges close to $2.13, technical information suggests momentum is beginning to slip. A technical evaluation of XRP’s each day RSI indicator provides a clue into what comes subsequent, and it’s not essentially bullish within the quick time period.

XRP RSI Breakdown: Loss Of Energy In Momentum

In accordance to an evaluation posted by crypto chartist CasiTrades on the social media platform X, XRP’s Relative Energy Index (RSI) has simply damaged beneath a well-respected trendline that had been monitoring increased lows since early April. The breakdown of this RSI construction, which is proven on the decrease half of the chart under, is a robust shift within the short-term momentum dynamics for XRP.

Associated Studying

It reveals that regardless of the XRP value holding comparatively flat above the 0.5 Fibonacci degree at $2.13, inner market power has clearly weakened.

The RSI had been forming a tightening wedge sample for weeks, identical to the worth motion’s compression on the apex of a symmetrical triangle on the each day timeframe. Any such RSI trendline break usually alerts a coming volatility enlargement, and because the analyst warns, the discharge might include a pointy sweep to main assist earlier than XRP reverses.

It’s a typical incidence for main value reversals to be preceded by a push into decrease helps. Within the case of XRP, crypto analyst CasiTrades highlighted some value targets to look at for reversals in case there’s a breakdown in XRP value.

Assist Ranges At Danger: XRP Looking out For Rebound Stage

XRP’s value motion is now coming into an vital take a look at part, one that might take its value decrease earlier than rebounding for the subsequent main rally. Evaluation from CasiTrades reveals a couple of demand zones the place patrons have stepped in. These demand zones are located at $2.01, which aligns with the 1.236 Fibonacci extension, the $1.90 value degree, and $1.55, which corresponds with the 0.618 retracement degree from one of many latest rallies.

These ranges are crammed with sufficient liquidity, and till XRP breaks and holds above $3, these helps will all the time be in play. If XRP hits one among these assist ranges cleanly and displays a pointy V-shaped restoration, that may sign the market discovered its pivot.

Associated Studying

Nevertheless, if XRP approaches these ranges and stalls or bounces prematurely, which will result in a closing shakeout transfer, forming a deeper low earlier than the actual reversal begins. Both manner, the RSI breakdown has now tilted short-term danger towards the draw back, a minimum of till value confirms a robust reclaim above $2.50 and $3.

On the time of writing, XRP is buying and selling at $2.11, down by 2% up to now 24 hours.

Featured picture from Picjumbo, chart from TradingView