Because the Bitcoin market steps into 2025, traders are keenly analyzing seasonal tendencies and historic information to foretell what February may maintain. With Bitcoin’s cyclical nature typically tied to its halving occasions, historic insights present a invaluable roadmap for navigating future efficiency. By inspecting historic information—together with Bitcoin’s common month-to-month returns and its post-halving February efficiency—we intention to offer a transparent image of what February 2025 may appear to be.

Understanding Bitcoin’s Seasonality

The primary chart, “Bitcoin Seasonality,” highlights common month-to-month returns from 2010 to the most recent month-to-month shut. The info underscores Bitcoin’s best-performing months and its cyclical tendencies. February has traditionally proven a median return of 13.62%, rating it as one of many stronger months for Bitcoin efficiency.

Notably, November stands out with the best common return at 43.74%, adopted by October at 19.46%. Conversely, September has traditionally been the weakest month with a median return of -1.83%. February’s strong common locations it within the higher tier of Bitcoin’s seasonality, providing traders hope for constructive returns in early 2025.

Historic Efficiency of February in Put up-Halving Years

A deeper dive into Bitcoin’s historic February returns reveals fascinating insights for years that comply with a halving occasion. Bitcoin’s halving mechanism—which happens roughly each 4 years—reduces block rewards by half, making a provide shock that has traditionally pushed worth will increase. February’s efficiency in these post-halving years has constantly been constructive:

- 2013 (Put up-2012 Halving): 62.71%

- 2017 (Put up-2016 Halving): 22.71%

- 2021 (Put up-2020 Halving): 36.80%

The typical return throughout these three years is a powerful 40.74%. Every of those Februarys displays the bullish momentum that usually follows halving occasions, pushed by lowered Bitcoin provide issuance and elevated market demand.

Associated: We’re Repeating The 2017 Bitcoin Bull Cycle

January 2025’s Efficiency Units the Stage

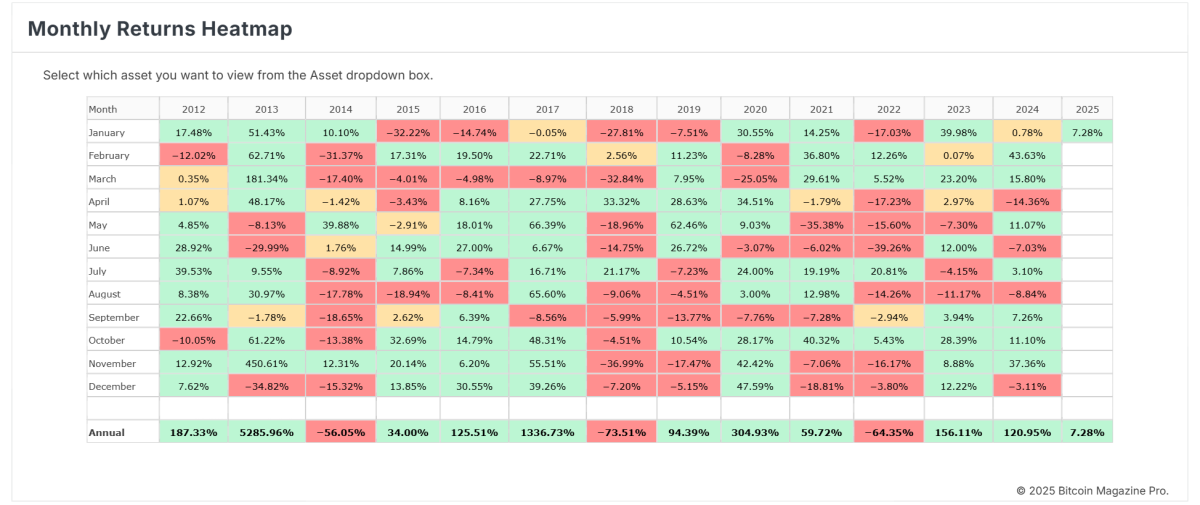

Whereas February 2025 is but to unfold, the yr started with a modest 7.28% return up to now in January, as proven within the “Monthly Returns Heatmap.” January’s constructive efficiency hints at a continuation of bullish sentiment within the early months of 2025, aligning with historic post-halving patterns. If February 2025 follows the trajectory of previous post-halving years, it may see returns within the vary of 22% to 63%, with a median expectation round 40%.

What Drives February’s Robust Put up-Halving Efficiency?

A number of components contribute to February’s historic energy in post-halving years:

- Provide Shock: The halving reduces new Bitcoin provide coming into circulation, growing shortage and driving worth appreciation.

- Market Momentum: Traders typically reply to the halving occasion with elevated enthusiasm, pushing costs increased within the months following the occasion.

- Institutional Curiosity: In latest cycles, institutional adoption has accelerated post-halving, including vital capital inflows to the market.

Key Takeaways for February 2025

Traders ought to strategy February 2025 with cautious optimism. Historic and seasonal information counsel the month has sturdy potential for constructive returns, significantly within the context of Bitcoin’s post-halving cycles. With a median return of 40.74% in previous post-halving Februarys, traders may count on related efficiency this yr, barring any vital macroeconomic or regulatory headwinds.

Conclusion

Bitcoin’s historical past supplies a invaluable lens via which to view its future efficiency. February 2025 is shaping as much as be one other constructive month, pushed by the identical post-halving dynamics which have traditionally fueled spectacular beneficial properties. Combining historic information efficiency with a constructive regulatory surroundings, the incoming pro-Bitcoin administration, and the information that The Monetary Accounting Requirements Board (FASB) has issued a brand new guideline (ASU 2023-08) basically altering how Bitcoin is accounted for (Why Tons of of Firms Will Purchase Bitcoin in 2025), 2025 is shaping as much as be a transformative yr for Bitcoin. As at all times, traders ought to mix these insights with broader market evaluation and stay ready for Bitcoin’s inherent volatility.

Associated: Why Tons of of Firms Will Purchase Bitcoin in 2025

By leveraging the teachings of historical past and the patterns of seasonality, Bitcoin traders could make knowledgeable choices because the market navigates this pivotal yr.

To discover reside information and keep knowledgeable on the most recent evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.