Bitcoin worth has moved considerably over the previous month, gaining a whopping 40%. A transparent indication of bull power! Traders, in addition to holders, are hopeful once more. So far, this 12 months has been a thrill, an emotional rollercoaster that shook many individuals. Immediately

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

Price

Quantity in 24h

<!–

?

–>

Price 7d

has begun its retrace. How low will it go earlier than it bounces again up?

Bitcoin long-term holders added 630K BTC since March rising from 13.66M to 14.29M BTC

Should know one thing. pic.twitter.com/58njcvR4e7

— Gordon (@AltcoinGordon) May 15, 2025

As Gordon’s tweet reveals, long-term holders had been promoting between October 2024 and January 2025. The promoting began when the worth ranged between $60,000 and $70,000 and grew in November because it went as much as $100,000. They gathered once more in February ($97,000) and April ($75,000). Now, the quantity they maintain is again to the September – October excessive. Was it a sensible transfer, although? I’m not so certain.

DISCOVER: Greatest Meme Coin ICOs to Put money into May 2025

Bitcoin Price Analysis Insights for May 2025

(BTCUSD)

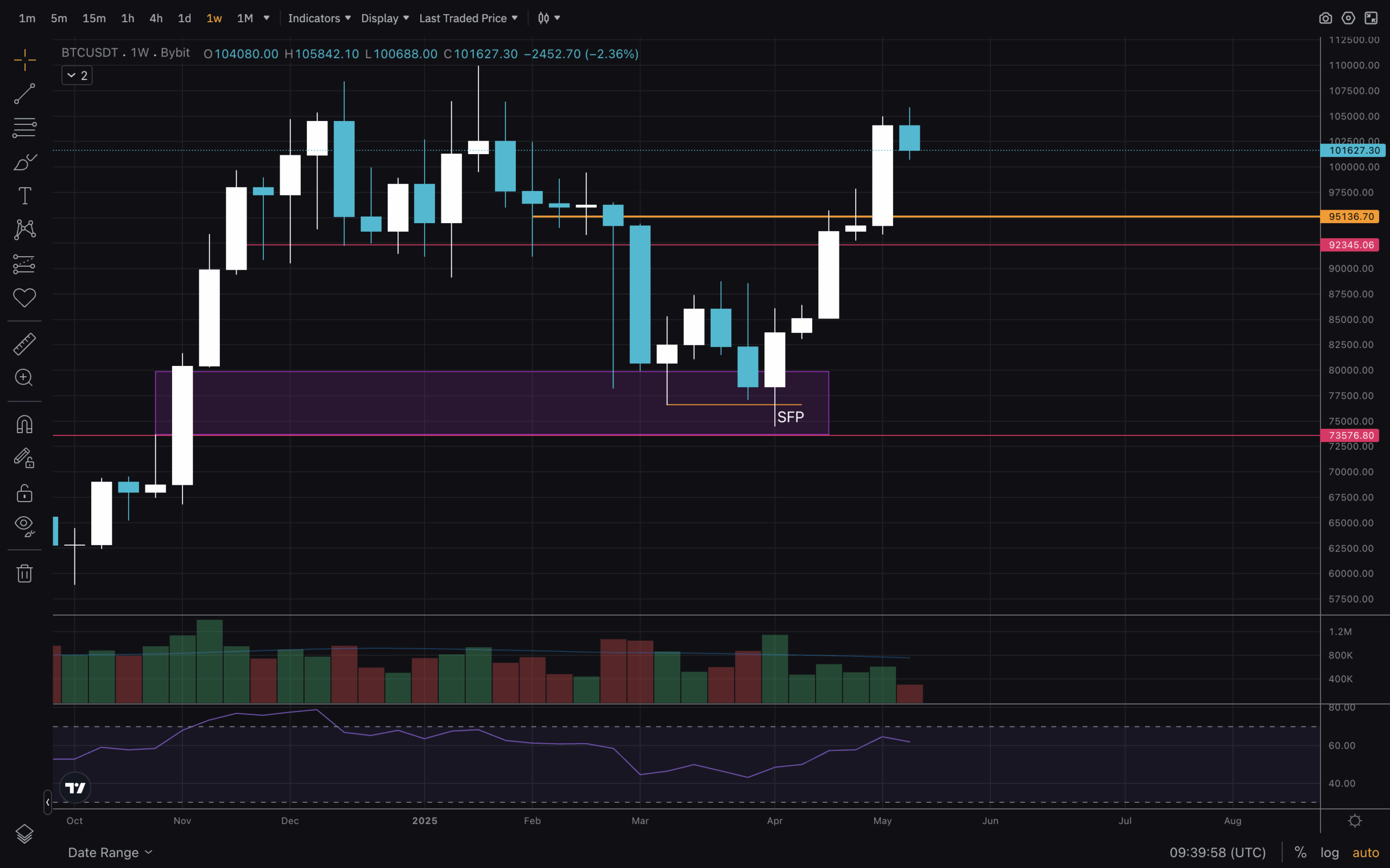

The chart offers us loads of info, beginning with the 1W timeframe. $73k is 2024’s excessive—a degree we wished to see as assist. It bought a entrance run, which was to be anticipated. The purple zone explored in final month’s article was an FVG hole and an space of curiosity the place the market discovered new liquidity. And we witnessed an SFP.

(BTCUSD)

Including the MAs on the weekly chart, we see an ideal retest and shut above MA50, adopted by this month lengthy pump. The construction stays bullish and has not been damaged! Ideally, we’d see worth take a look at the $92,000-$95,000 zone. And if it goes down additional, we don’t wish to see it shut under $80,000. If that occurs – market construction is damaged.

DISCOVER: Prime Solana Meme Cash to Purchase in May 2025

(BTCUSD)

Next, we’ll analyse the Day by day timeframe. The RSI divergence mentioned within the earlier article performed out completely, and this massive transfer up with little or no resistance within the $90k space was sudden. A terrific signal of power, although! Now, because the downtrend has been damaged, the worth will probably look to kind a decrease excessive.

(BTCUSD)

A doable lengthy entry can be the MA200 on the 4H timeframe, which at the moment sits between the $92-$95k talked about above. RSI additionally wants to chill down and reset. The 1D MAs are additionally above $90k, so that might be my degree to observe. It’s an ideal psychological degree as properly.

DISCOVER: Prime 20 Crypto to Purchase in May 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Bitcoin Price Analysis for May 2025: We Are So Back!

- Key ranges to retest are $90,000 – $95,000

- 1D Development is up once more, in search of a decrease excessive to kind

- Price grew 40% in a month – bullish!

The put up We Are So Back – ATH Next? Bitcoin Price Analysis for May 2025 appeared first on 99Bitcoins.