TON crypto spiked 40% after Telegram introduced the finalization of the $1.5 billion bond sale, backed by BlackRock, Citadel, and Mubadala. As tokenization picks up steam, will Toncoin and Tonchain dominate?

What differentiates crypto from securities is hype. True, market forces impression crypto, however when the “hype” catches on, costs are inclined to surge quickly. There are various examples, together with the rise of among the finest Solana meme cash, like BONK, which hit file highs within the final bull run.

Discover: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in Might 2025

TON Spikes 40%

Presently, TON, the native coin of the Tonchain ecosystem, may very well be primed for extra good points if the spike on Might 28 spills over to right now.

The almost 40% surge prior to now 24 hours may very well be sufficient for swing merchants to discover shopping for alternatives, load up on dips, and anticipate costs to climb greater.

(TONUSDT)

Nonetheless, for elementary merchants, the TON crypto surge is greater than only a breakout.

Telegram Finalizes $1.5 Billion Bond Sale

Yesterday, Telegram, the favored messaging app with over 1 billion customers worldwide, introduced a $1.5 billion bond sale, lifting TON costs.

The bond sale attracted A-list institutional buyers, together with BlackRock, Citadel, and UAE’s Mubadala, fueling the surge.

Telegram, intently tied to Tonchain and TON, did what many corporates do: refinance.

The Might 28 announcement of the finalization of the $1.5 billion bond sale sparked a frenzy, boosting TON and dominating headlines. The funds will refinance earlier debt and, crucially, assist future development.

The bond carries a 9% annual yield over 5 years. If Telegram goes public inside this era, it’s convertible into fairness at a reduction.

The potential of Telegram going public by 2030 probably attracted BlackRock and others.

Nonetheless, the bond was designed to attract long-term buyers who consider in Telegram’s prospects.

Furthermore, the 9% yield indicators the app’s strong monetary well being and potential to develop its ecosystem, which is bullish for TON.

Discover: 10+ Crypto Tokens That Can Hit 1000x in 2025

The BlackRock Endorsement

Regardless of authorized challenges surrounding Pavel Durov, the involvement of BlackRock, an asset supervisor with over $13 trillion in belongings, is a decisive vote of confidence in Telegram and an oblique validation of Tonchain, the place TON performs a vital position.

Moreover, the participation of Citadel and Mubadala, each main institutional powerhouses, provides credibility and capital to Telegram, accelerating TON adoption and Tonchain ecosystem growth.

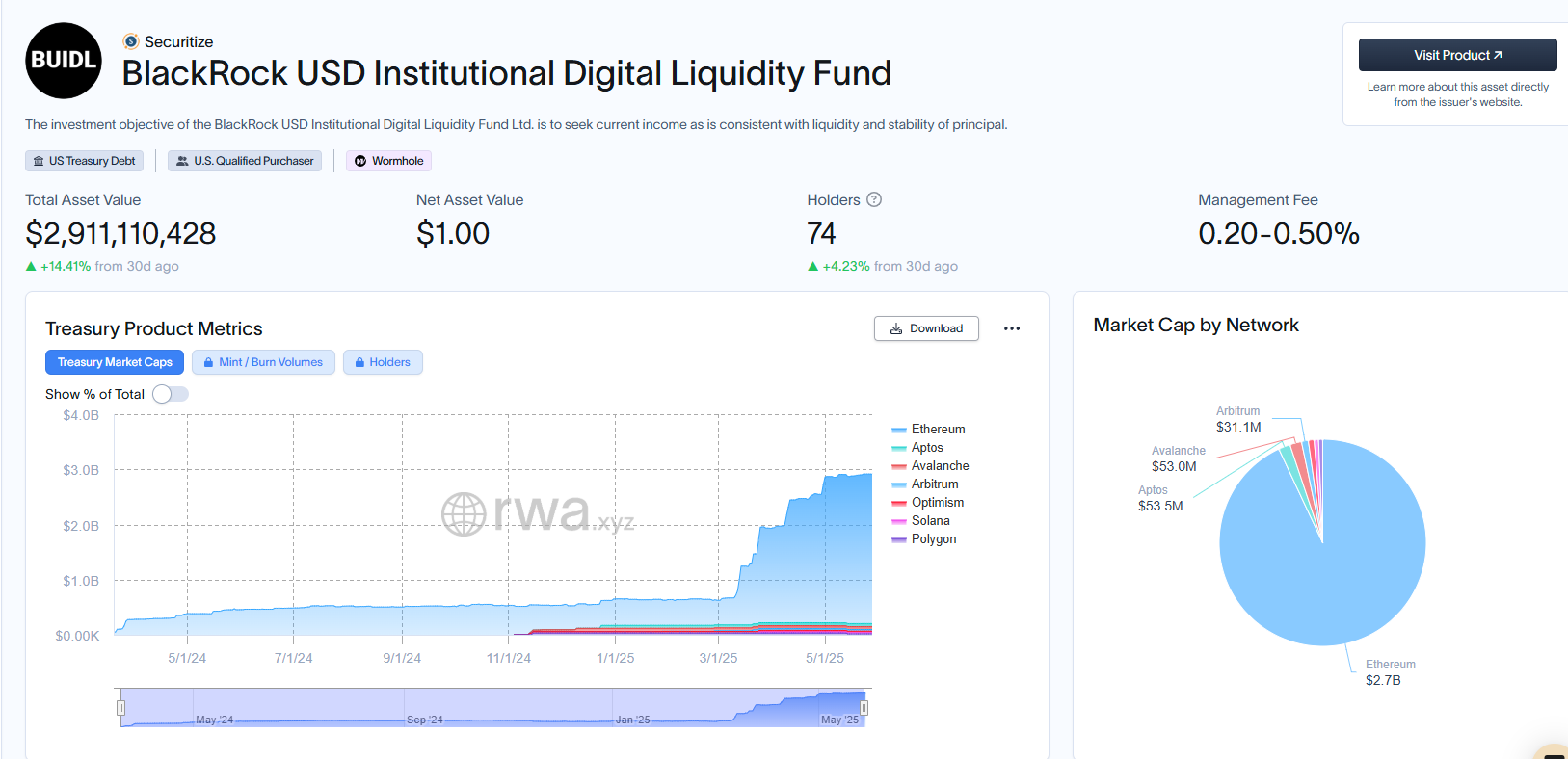

BlackRock is pro-crypto, issuing spot Bitcoin and Ethereum ETFs for U.S. establishments. Furthermore, their BUIDL fund has attracted over $2.9 billion from buyers searching for publicity to liquid U.S. Treasuries.

(Supply)

Larry Fink, the CEO of BlackRock, initiatives the tokenization market to succeed in $1 trillion by 2030. If this would be the case, analysts are satisfied that these prime 20 cash could explode in 2025.

Will Tokenization Achieve Traction on Tonchain?

The $1.5 billion bond sale aligns with the rising pattern of tokenization.

Not too long ago, Libre launched a $500 million Telegram Bond Fund (TBF) on Tonchain.

The RWA narrative simply bought an enormous push as @librecap & TON Basis are tokenizing $500M of Telegram bonds on TON Blockchain by way of the Telegram Bond Fund ($TBF)!

Key factors:

$500M in Telegram bonds on TON

Entry for institutional & accredited buyers

Powered by Libre… pic.twitter.com/nXOdSsatKN

— TON

(@ton_blockchain) April 30, 2025

Moreover, Tether and USDe have been built-in into Tonchain, making them accessible to over 1 billion Telegram customers.

The timing is vital, particularly because the U.S. prepares legal guidelines to fast-track the tokenization of U.S. Treasuries and, presumably, equities sooner or later.

This summer time, Telegram customers will acquire entry to the most effective AI know-how in the marketplace. @elonmusk and I’ve agreed to a 1-year partnership to convey xAI’s @grok to our billion+ customers and combine it throughout all Telegram apps

This additionally strengthens Telegram’s monetary… pic.twitter.com/ZPK550AyRV

— Pavel Durov (@durov) Might 28, 2025

Yesterday, Durov introduced a partnership between Telegram and Elon Musk’s xAI to convey Grok agent to Telegram.

DISCOVER: Finest New Cryptocurrencies to Invest in 2025 – High New Crypto Cash

TON Crypto Provides 40% After BlackRock Backs Telegram’s $1.5B Bond Sale

- TON crypto agency, could lengthen good points

- Telegram finalizes their $1.5 billion bond sale

- Bond sale backed by BlackRock, Citadel, and Mubadala

- Will Tonchain be a hub of tokenization within the coming months?

The put up TON Crypto Soars After BlackRock Backs Telegram In $1.5B Bond Sale: What’s Next? appeared first on 99Bitcoins.