Saifedean Ammous, CEO of Saifedean.com and writer of The Bitcoin Customary, delivered a data-driven keynote on the Bitcoin 2025 Convention, warning of inevitable U.S. greenback decline and positioning Bitcoin as the one rational hedge. “Default, devaluation, or default by devaluation are inevitable,” Ammous declared, including pointedly, “Tether can’t fix what a century of fiat democracy ruined.”

Utilizing projections and stream charts, Ammous argued that Tether’s Bitcoin technique may quickly outpace its U.S. greenback reserves. “Then Tether will break the peg upwards,” he stated, predicting a state of affairs the place 1 USDT may equal 1.02 USD and proceed revaluing because the greenback weakens. “Tether becomes a relatively stablecoin as the dollar declines.”

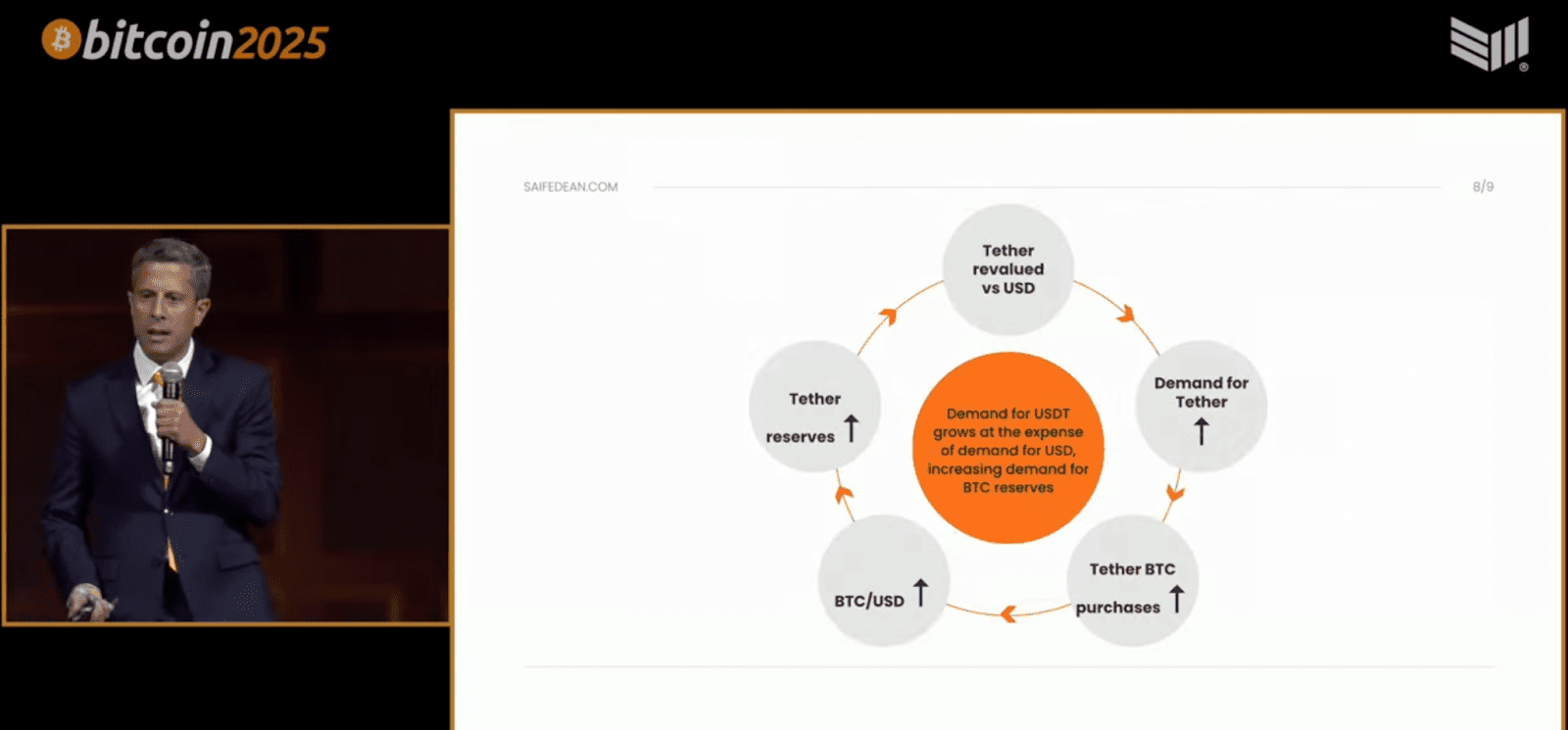

The discuss emphasised what Ammous described as a self-reinforcing loop: as USDT demand rises, so does Tether’s want for BTC reserves, which drives up Bitcoin costs—resulting in much more revaluation. “This is a significant impact on the market,” he stated. “Buying bitcoin is the smartest thing anybody could do.”

In a remaining sweeping assertion, Ammous forecasted the top of the USD period. “Eventually, USD reserves go to zero next to BTC reserves,” he stated. “USDT keeps getting revalued upward until it is redeemable in bitcoin. USDT → BTCT.” He referred to as Tether a “transition monetary system” and concluded, “Even the most bullish scenario for USD is much more bullish for BTC.”

To Ammous, the greenback is locked in a downward spiral whereas Bitcoin, with its “number go up technology,” continues rising. “The thing that goes up is going to overtake the thing that goes down,” he stated—summarizing his whole argument in a single sentence.