Pi Network, backed by tens of millions and hyped as the subsequent large factor, now finds itself in turbulent waters.

A plunging value and Binance’s refusal to incorporate it in an inventory marketing campaign have left its future hanging by a thread.

Preserve your promise @binance $Pi pic.twitter.com/pAf8S8IQuC

— Pi Network Information International 𝛑 (@PiNewsGlobal) March 21, 2025

Pi Network 价格: Investor Sentiment Wanes

The exclusion from Binance’s itemizing plans has impacted Pi Network’s attraction to buyers. The Chaikin Cash Movement (CMF) indicator, which measures the stream of capital into and out of the venture, has hit its lowest level since Pi Network’s inception. This means an all-time excessive in outflows.

Such a marked decline in sentiment underscores Pi Network’s problem in retaining its person base and monetary backing. With confidence faltering, there’s a threat of additional cash withdrawals, which creates further downward stress on Pi’s value.

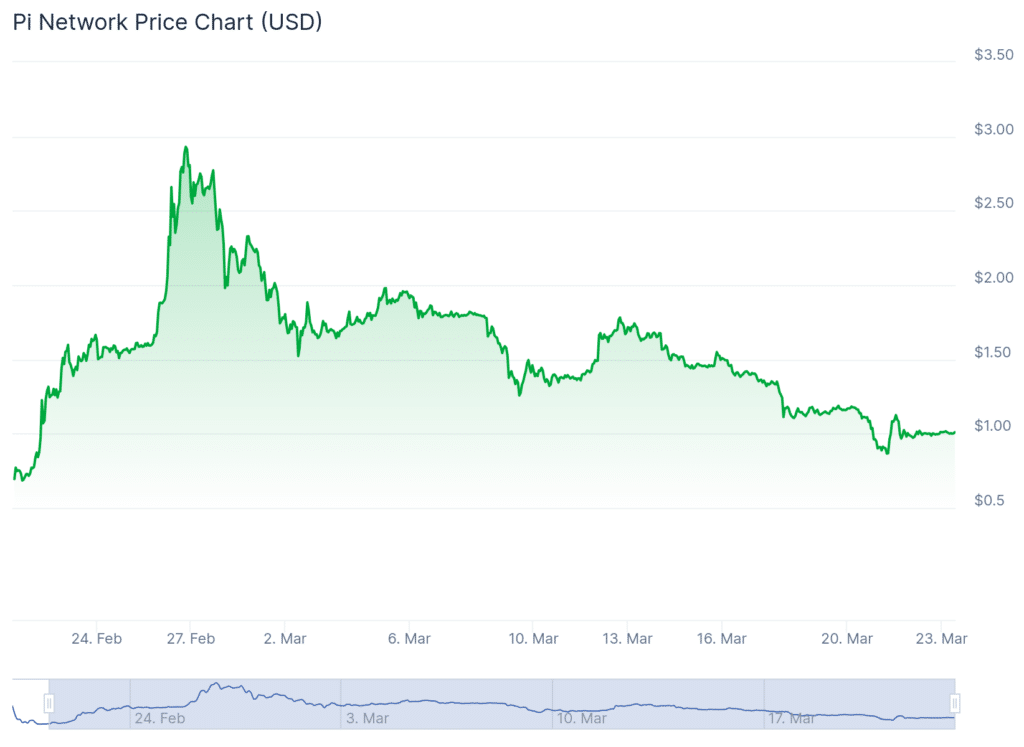

On the time of writing, Pi Network is buying and selling at roughly $1. This determine marks a 44% drop over the previous ten days. Regardless of makes an attempt to carry the road at this value level, the continuing outflows and broader market circumstances counsel robust occasions forward.

If promoting stress persists, Pi may breach the $0.92 assist stage. A breakdown there may end in additional declines, probably to $0.76. On the flip, reclaiming $1.19 as assist may spark restoration efforts.

Macro Momentum and Market Indicators for Pi Crypto

Apparently, some indicators reveal indicators of hope for Pi Crypto. The Relative Power Index (RSI) for Pi Network bounced after dipping into oversold territory earlier within the week. This typically suggests a possible value reversal, although it stays unclear if Pi Network can capitalize on the chance.

Pi Network’s struggles are magnified by the rise of Remittix (RTX), a presale token gaining traction for its sensible use in cross-border funds and crypto-to-fiat options. In contrast to its extra speculative counterparts, Remittix has delivered outcomes, elevating over $13 million and promoting 66% of its tokens. Its concentrate on monetary inclusion and quick transactions positions it as a viable rival.

Can Pi Network Stage a Comeback?

Pi Network’s promise of mobile-friendly mining is what despatched the coin into the stratosphere this yr, however belief is fading. Repeated mainnet delays, restricted token capabilities, and struggles with main exchanges like Binance aren’t a very good look. Press “X” to doubt.

To regain momentum, the venture wants transparency, a practical mainnet, and tier-1 alternate listings. With out these strikes, buyers could lean towards tasks like Remittix, which supply clearer plans and confirmed utility.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Pi Network 价格, backed by tens of millions and hyped as the subsequent large factor, now finds itself in turbulent waters.

- The exclusion from Binance’s itemizing plans has impacted Pi Network’s attraction to buyers.

- With out cleary outlined victories, buyers could lean towards tasks like Remittix, which supply clearer plans and confirmed utility.

The publish Pi Network Price Analysis 2025 – Understanding the Decline and What’s Next appeared first on 99Bitcoins.