Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

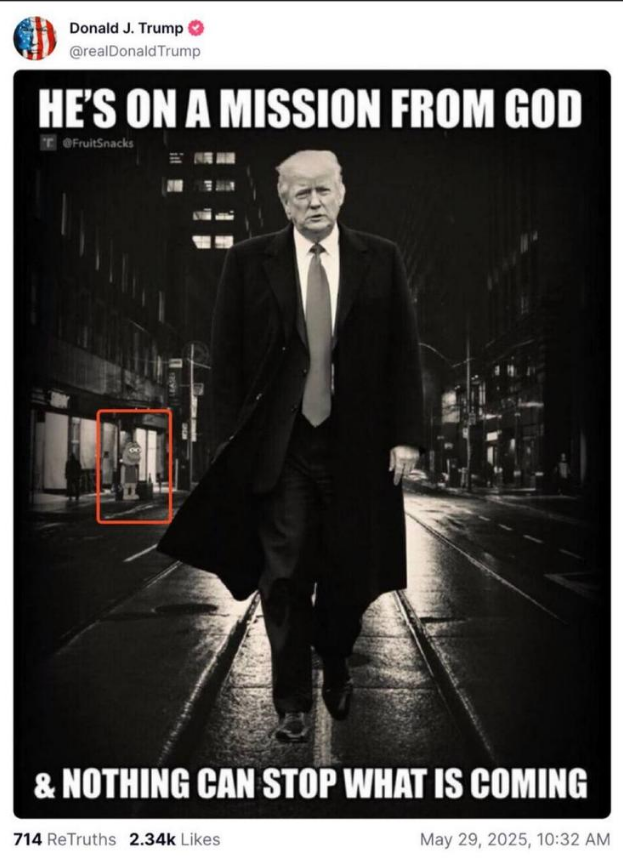

US President Donald Trump’s transient publish on Fact Social on Might 29 sparked a fast burst of pleasure amongst crypto merchants. Based mostly on reviews, some customers noticed a hidden reference to the Pepe meme coin (PEPE).

Associated Studying

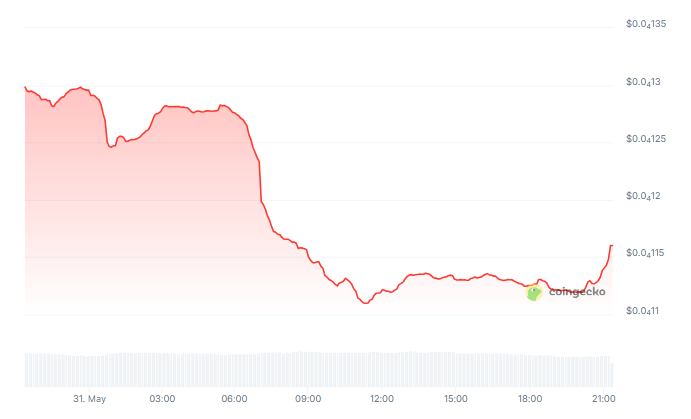

Within the subsequent few hours, PEPE shot up by 5% however then fell again by 15%. Merchants are actually watching to see if this social push can do what Elon Musk as soon as did for Dogecoin.

Pepe Value Strikes

In line with market information, PEPE’s value hit its higher resistance after the Trump publish. A brief surge introduced a 5% acquire. Then profit-taking and wider market stress drove an 18% correction.

The flip in momentum exhibits how briskly issues can change in meme-coin land. A small tweet or publish can ship costs hovering, however it solely takes a little bit of promoting to push them down once more.

🚨 Wait, what Trump simply dropped a $PEPE pic on Fact Social 🚨

Is this a secret crypto endorsement or simply trolling the web?

Both approach the $PEPE rocket may simply have a brand new co-pilot.

What’s subsequent a $PEPE rally or a Twitter soften down Keep tuned👀 pic.twitter.com/cu8RF7D55b

— Josh Mair (@WizzOfCrypto) Might 29, 2025

On Drama & Hypothesis

Trump’s message saying he’s “on a mission from God” makes him sound like he has a particular goal, not only a political objective. The darkish avenue scene and the phrases “nothing can stop what is coming” trace that one thing large is coming, even when he doesn’t clarify it. This sort of discuss can fireplace up his most loyal supporters – particularly PEPE aficionados – as a result of it feels dramatic and pressing.

Chart Patterns In Focus

Based mostly on reviews from chart watchers, PEPE seems to be forming a cup-and-handle sample that started about 5 months in the past. If the coin breaks above the deal with, some say it may attain $0.000026—double its present degree.

Proper now, the MACD line sits beneath the sign line after a latest dying cross, hinting at a near-term downtrend. The RSI has dipped towards 52 and will cross beneath it quickly, which may preserve sellers in management.

The 0.618 Fibonacci retracement degree sits at $0.00001 and will act as a bounce level. If that degree provides approach, merchants will take a look at $0.000008 as the subsequent help.

Tariff Ruling Provides Stress

Based mostly on US Courtroom of Worldwide Commerce filings, the courtroom reversed Trump’s tariff suspensions proper across the similar time that PEPE spiked. That transfer appears to have dampened the market’s risk-on temper.

For a lot of merchants, broader commerce information is usually a greater issue than any single tweet. If merchants fear about tariffs and slower progress, they usually dump riskier belongings like meme cash. That blend of social hype and market fear helped push PEPE down after its transient rally.

Wanting Forward For Merchants

Based mostly on this mixture of social buzz and chart alerts, it’ll take greater than a touch in a publish to maintain PEPE climbing. If the coin can break above its present resistance by mid-June, $0.000026 appears to be the primary goal.

However a falling MACD and RSI level towards extra promoting stress first. Merchants ought to watch the 0.618 degree at $0.00001 for indicators of a bounce. If that degree breaks, they’ll possible goal for $0.000008 subsequent.

Associated Studying

Featured picture from Inverse, chart from TradingView