Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin’s worth slipped to $105,235 at this time, dropping 1.5% over the previous 24 hours and falling 4.2% within the final week. Some market watchers see this dip as a pause earlier than a significant transfer. In accordance with their charts, Bitcoin could possibly be gearing up for one more steep achieve.

Associated Studying

Historic Patterns Level To Rebound

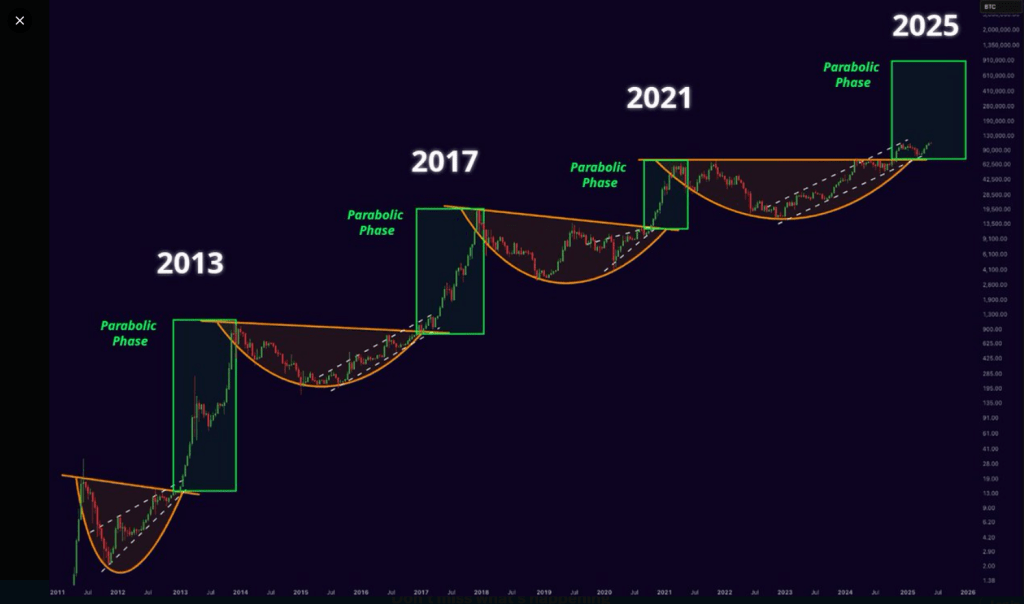

Primarily based on experiences from the analyst often called “Mister Crypto,” rounded-bottom formations and ascending triangles have marked each huge Bitcoin rally. In 2013, when Bitcoin was buying and selling underneath $10, it spent months in a clean, curved base earlier than breaking out and climbing previous $1,000.

The same sample confirmed up in 2017. After practically three years of sideways motion, the value lastly exploded towards $20,000. The final cycle in 2021 additionally adopted the identical playbook, with virtually 4 years of constructing a large base earlier than capturing as much as practically $70,000.

Bitcoin will go parabolic.

This time received’t be totally different! pic.twitter.com/0fEMMMclbD

— Mister Crypto (@misterrcrypto) Could 29, 2025

Mister Crypto’s chart means that the interval after 2021 has shaped one other base. If historical past performs out the identical manner, his forecast factors to a breakout in 2025 that might ship Bitcoin as excessive as $900,000—a 760% rise from at this time’s degree.

Analyst Charts Re-Accumulation

In accordance with charts shared by one other analyst, Bitcoin usually strikes in levels. First, there’s an preliminary “leg up” that alerts the shift from deep accumulation right into a rising bull pattern. Then, the value settles right into a sideways “re-accumulation” section earlier than the ultimate run.

From 2019 by way of 2021, Bitcoin adopted this path carefully. Analysts word that from late 2023 into mid-2025, Bitcoin appears to be in that very same re-accumulation section. If this unfolds as in previous cycles, the following huge upswing might push Bitcoin into the $270,000–$350,000 vary earlier than any parabolic spike comes into view.

Lengthy-Time period Holders Hold Including Cash

On-chain information reveals long-term holders (addresses that haven’t moved their cash in over 155 days) are nonetheless piling on. Between March 3 and Could 25, 2025, these holders elevated their total provide by practically 1.40 million BTC.

That pushed long-term holdings from 14,354,000 BTC to fifteen,739,400 BTC. In earlier bull markets—like these in 2013, 2017, and 2021—long-term holders usually bought in the course of the rallies to lock in revenue.

Associated Studying

At present, although, they appear content material to carry. If giant pockets of Bitcoin stay off exchanges, fewer cash can be found for brand spanking new patrons. That might tighten provide and make sharp strikes extra possible as soon as demand picks up.

Trying Forward In Unsure Market

Bitcoin has misplaced momentum just lately, however many analysts really feel these dips received’t final. At $105K area, the value sits beneath final week’s ranges.

Primarily based on experiences, some see that as wholesome consolidation earlier than an even bigger run. Others warn that world rates of interest, regulation, and macro elements might gradual issues down.

Featured picture from Pexels, chart from TradingView