The launch of Bitcoin ETFs in January 2024 was heralded as a groundbreaking second for the market. Many anticipated these merchandise to open the floodgates for institutional capital and catapult Bitcoin costs to new heights. However now, a yr later, have Bitcoin ETFs delivered on their promise?

For a extra in-depth look into this subject, take a look at a latest YouTube video right here: Have Bitcoin ETFs Lived Up to Expectations?

A Robust Begin

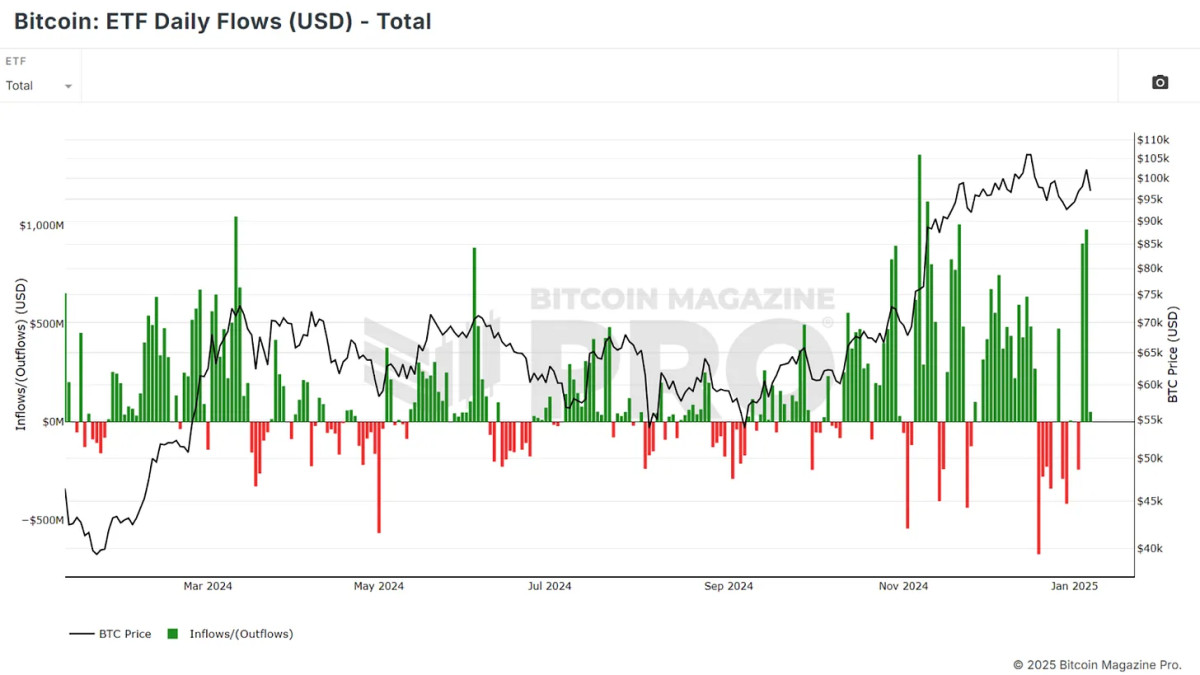

Since their launch, Bitcoin ETFs have accrued over 1 million BTC, equal to roughly $40 billion in property below administration. Even when accounting for outflows from competing merchandise just like the Grayscale Bitcoin Belief (GBTC), which noticed withdrawals of over 400,000 BTC, the online inflows stay vital at about 540,000 BTC.

View Reside Chart 🔍

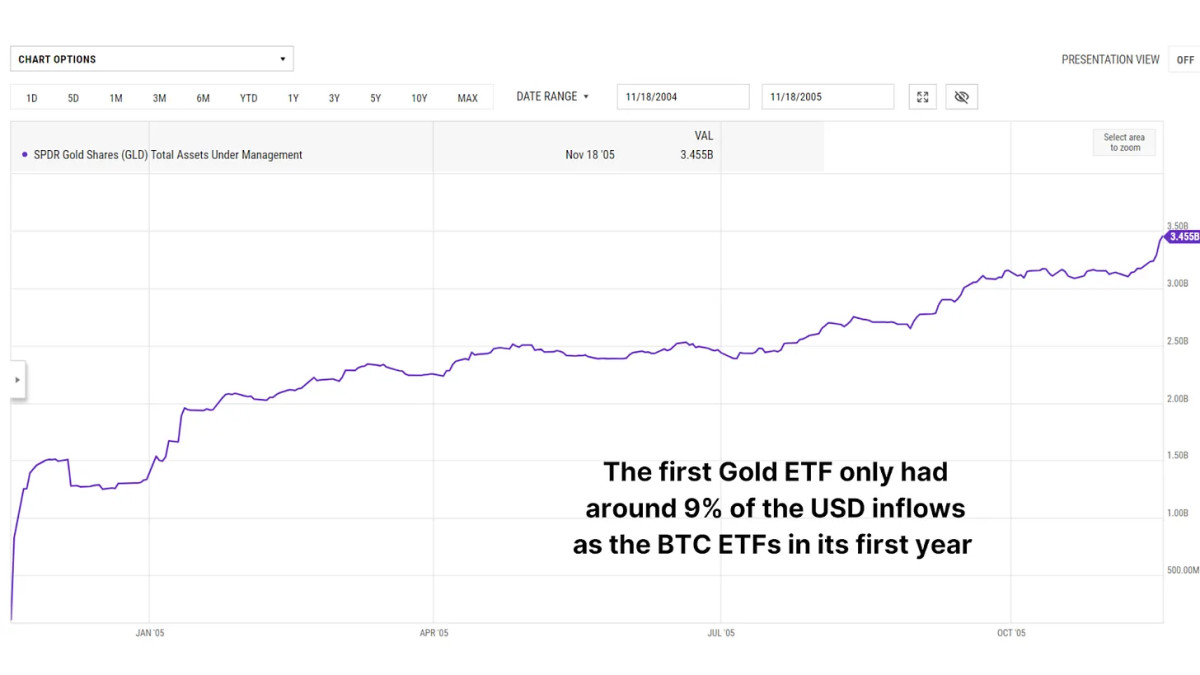

To place this into perspective, the dimensions of inflows far exceeds what we witnessed in the course of the launch of the primary gold ETFs in 2004. Gold ETFs garnered $3.45 billion of their first yr, a fraction of Bitcoin ETFs’ $37.5 billion in inflows over the identical interval. This highlights the extreme institutional curiosity in Bitcoin as a monetary asset.

Bitcoin’s Yr of Progress

Following the launch of Bitcoin ETFs, preliminary value actions have been underwhelming, with Bitcoin briefly declining by almost 20% in a “buy the rumor, sell the news” state of affairs. Nonetheless, this bearish pattern rapidly reversed. Over the previous yr, Bitcoin costs have risen by roughly 120%, reaching new heights. For comparability, the primary yr following the launch of gold ETFs noticed a modest 9% value improve for gold.

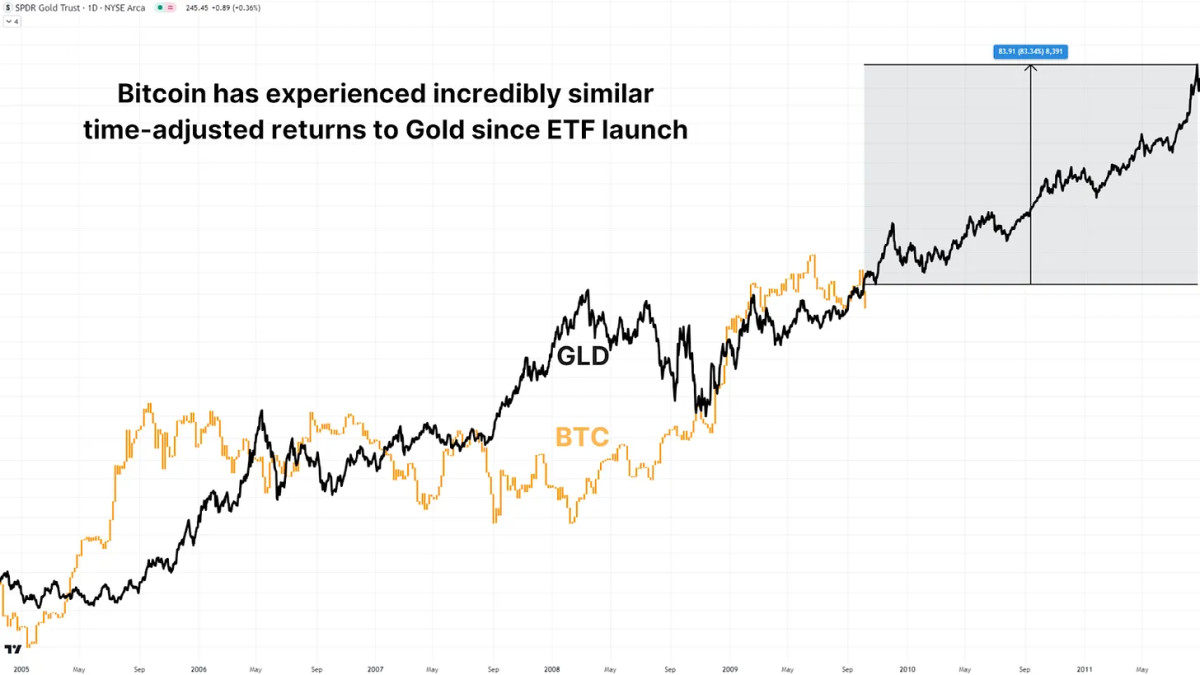

Following the Gold Fractal

When accounting for Bitcoin’s 24/7 buying and selling schedule, which leads to roughly 5.3 instances extra yearly buying and selling hours than gold, a placing similarity emerges. By overlaying Bitcoin’s first yr of ETF value motion with gold’s historic information (adjusted for buying and selling hours), we are able to see virtually the identical % returns. If Bitcoin continues to observe gold’s sample, we may see a further 83% value improve by mid-2025, probably pushing Bitcoin’s value to round $188,000.

Institutional Technique

One intriguing perception from Bitcoin ETFs has been the connection between fund inflows and value actions. A easy technique of shopping for Bitcoin on days with constructive ETF inflows and promoting on days with outflows has constantly outperformed a conventional buy-and-hold strategy. From January 2024 to right now, this technique has returned 130%, in comparison with ~100% for a buy-and-hold investor, an outperformance of almost 10%.

View Reside Chart 🔍

For extra info on this institutional influx technique, watch the next video:

Utilizing ETF Knowledge to Outperform Bitcoin [Must Watch]

Provide and Demand Dynamics

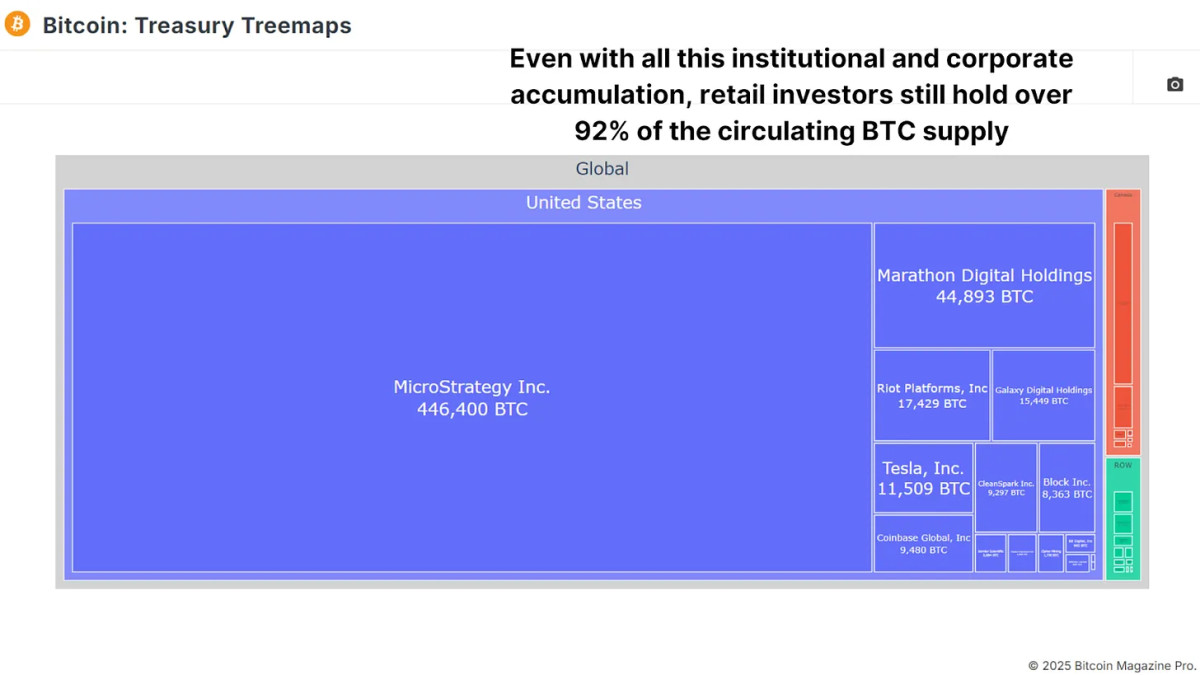

Whereas Bitcoin ETFs have accrued over 1 million BTC, this represents solely a small fraction of Bitcoin’s complete circulating provide of 19.8 million BTC. Firms like MicroStrategy have additionally contributed to institutional adoption, collectively holding tons of of 1000’s of BTC. But, nearly all of Bitcoin stays within the fingers of particular person buyers, guaranteeing that market dynamics are nonetheless pushed by decentralized provide and demand.

View Reside Chart 🔍

Conclusion

One yr in, Bitcoin ETFs have exceeded expectations. With billions in inflows, a big impression on value appreciation, and rising institutional adoption, they’ve solidified their function as a key driver of Bitcoin’s market narrative. Whereas some early skeptics have been disillusioned by the shortage of quick explosive value motion, the long-term outlook stays extremely bullish.

The comparisons to gold ETFs present a compelling roadmap for Bitcoin’s future. If the gold fractal holds true, we might be on the cusp of one other main rally. Coupled with favorable macroeconomic situations and rising institutional curiosity, Bitcoin’s future seems brighter than ever.

Discover reside information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.