Este artículo también está disponible en español.

The Ethereum value is exhibiting indicators of a breakout, as an analyst has recognized the formation of an inverse head and shoulder sample on its 6-month long-term value chart. This bullish formation has fueled predictions that Ethereum may rally to $12,000 quickly, marking a new all-time excessive for the second-largest cryptocurrency by market capitalization.

Ethereum Price Targets $12 With New Chart Pattern

In a Tuesday X (previously Twitter) submit, crypto analyst Tony Severino launched an Ethereum value chart illustrating an inverse head and shoulder, a technical evaluation indicator signaling a potential development reversal. This distinctive chart sample has 4 key elements: a left shoulder, head, proper shoulder, and neckline.

Associated Studying

Usually, when the sample is totally shaped, and a cryptocurrency breaks by means of the neckline, it signifies a possible shift from a downtrend to an uptrend. In Ethereum’s case, its value has been on a big downward trajectory, declining by over 8% up to now week.

Regardless of dropping from a value excessive of over $4,000 to under $3,500 lately, Severino stays optimistic about Ethereum’s potential for a development reversal, predicting a bullish value goal of $12,000 for the highest altcoin.

Analyzing the analyst’s value chart, the left shoulder of the inverse head and shoulder was shaped in 2021, whereas the pinnacle emerged throughout Ethereum’s value crash on the finish of 2022, marking the bottom level within the sample.

Moreover, the suitable shoulder of the inverse head and shoulder sample is full, with Ethereum lately testing the neckline — a key resistance degree by a horizontal trendline. On the time, Ethereum broke above $3,400, confirming the bullish development reversal usually related to this chart sample.

Wanting on the value chart, the gap between the pinnacle and the neckline measures roughly 265.84%, suggesting that Ethereum may rally between $10,000 and $12,000 if the sample performs out as anticipated. The upward-sloping channel of the inverse head and shoulder additional helps this bullish development outlook, with Severino’s Ethereum value goal probably aligning with the channel’s trajectory.

Ethereum Whale Accumulation Pattern Skyrockets

Whereas the Ethereum value is buying and selling at $3,493 after surging by 2.3% up to now 24 hours, an analyst referred to as ‘Mister Crypto’ revealed that whales have been on a significant shopping for spree.

Associated Studying

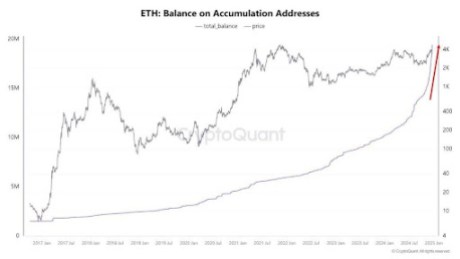

The analyst shared a chart illustrating Ethereum’s steadiness on accumulation addresses. He disclosed that Ethereum whales are buying ETH tokens exponentially, steadily growing their holdings since 2017. The sharp rise in accumulation means that traders are doubtlessly positioning themselves forward of a bullish value motion.

The pink arrow within the analyst’s chart additionally exhibits a significant spike within the ETH steadiness on accumulation addresses in current months. Most wallets related to this surging accumulation have seen minor outflows, signaling long-term holding habits by traders.

Featured picture created with Dall.E, chart from Tradingview.com