Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

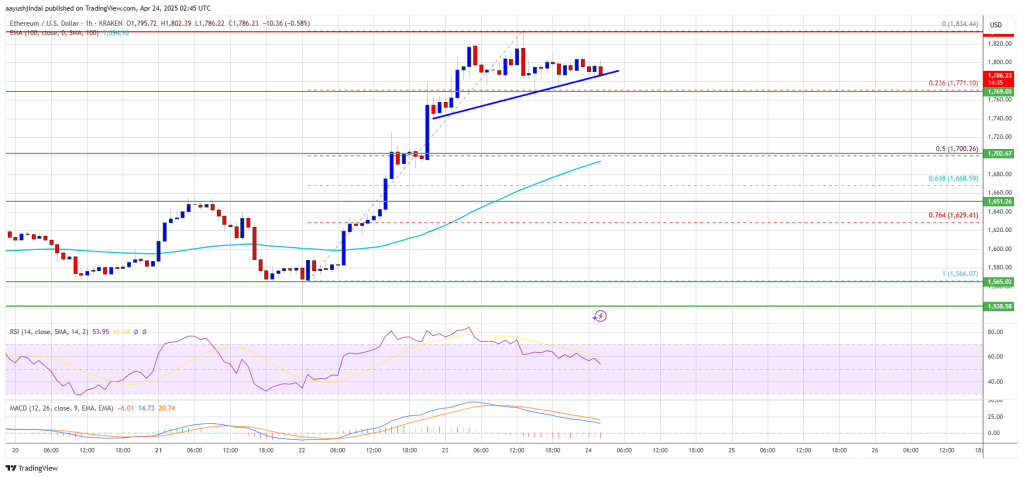

Ethereum value began a contemporary surge above the $1,750 resistance. ETH is now consolidating positive factors and may try to clear the $1,840 resistance.

- Ethereum began a contemporary rally above the $1,750 zone.

- The value is buying and selling above $1,720 and the 100-hourly Easy Shifting Common.

- There’s a connecting bullish pattern line forming with help at $1,780 on the hourly chart of ETH/USD (knowledge feed through Kraken).

- The pair might begin a contemporary improve if it clears the $1,820 resistance zone.

Ethereum Price Features Momentum

Ethereum value remained steady above the $1,650 stage and began a contemporary improve, like Bitcoin. ETH traded above the $1,700 and $1,720 ranges. The bulls even pumped the worth above the $1,750 stage.

The pair even spiked above the $1,800 zone. A excessive was shaped at $1,8343 and the worth not too long ago began a consolidation section. There was a drop towards the 23.6% Fib retracement stage of the upward transfer from the $1,565 swing low to the $1,834 excessive.

Ethereum value is now buying and selling above $1,720 and the 100-hourly Easy Shifting Common. There’s additionally a connecting bullish pattern line forming with help at $1,780 on the hourly chart of ETH/USD.

On the upside, the worth appears to be dealing with hurdles close to the $1,820 stage. The following key resistance is close to the $1,840 stage. The primary main resistance is close to the $1,880 stage. A transparent transfer above the $1,880 resistance may ship the worth towards the $1,920 resistance.

An upside break above the $1,920 resistance may name for extra positive factors within the coming classes. Within the acknowledged case, Ether might rise towards the $1,950 resistance zone and even $2,000 within the close to time period.

Are Dips Supported In ETH?

If Ethereum fails to clear the $1,820 resistance, it might begin a contemporary decline. Preliminary help on the draw back is close to the $1,780 stage. The primary main help sits close to the $1,740 zone.

A transparent transfer under the $1,740 help may push the worth towards the $1,700 help or the 50% Fib retracement stage of the upward transfer from the $1,565 swing low to the $1,834 excessive. Any extra losses may ship the worth towards the $1,665 help stage within the close to time period. The following key help sits at $1,620.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is dropping momentum within the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Main Help Stage – $1,740

Main Resistance Stage – $1,820