Este artículo también está disponible en español.

In a technical replace posted on X, crypto analyst Extra Crypto Online (@Morecryptoonl) offered a one-hour DOGE/USD chart (Binance) illustrating a precarious sideways motion and a possible turning level for the meme coin. At press time, Dogecoin is caught across the $0.25 area, barely transferring after a considerable drop in early February, with little to substantiate a definitive backside in place.

Dogecoin Caught In Limbo

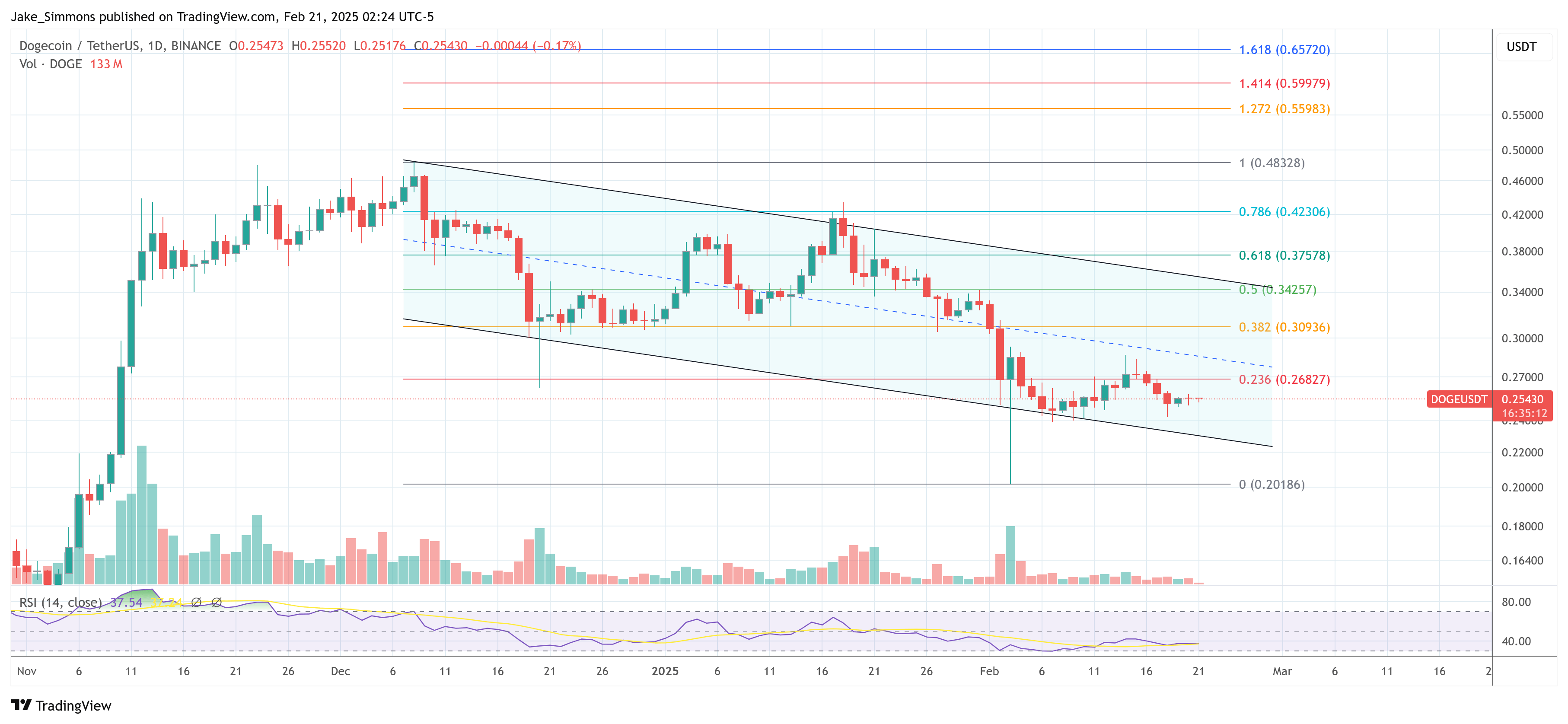

From the chart’s labeling, the analyst employs a mix of Elliott Wave counts and Fibonacci retracement ranges to map out Dogecoin’s doable subsequent steps. Notably, a broad corrective sequence labeled as (1), (4), C, A, B, W, X, Y highlights a number of overlapping waves—indicative of an prolonged correction moderately than a easy worth pullback.

Within the newest leg downward, the analyst’s markings present a serious swing low round $0.21–$0.22, which coincides with a possible wave (4) on the chart, though there may be an “alt 4?” label suggesting this may occasionally nonetheless be an alternate rely which drags the DOGE worth even deeper in a single final correction.

The Fibonacci retracements and extensions plotted within the $0.22–$0.24 area, with key ranges together with the 50% retracement at $0.2446, a 78.6% stage close to $0.2206, and a 100% extension round $0.2338, are key assist ranges. These overlapping zones present the place DOGE’s worth bounced and consolidated over the previous a number of periods.

Associated Studying

Regardless of the intricate wave construction, the analyst factors out there may be “no clear confirmation of a bottom.” The worth has been range-bound within the mid-$0.25 territory, missing the momentum often seen in strong development reversals.

Extra Crypto Online underscores two main ranges overhead that might affirm a bullish reversal: $0.293 – Breaking above this zone could supply the primary tangible indication that consumers are taking management and $0.341 – An in depth above $0.341 would function a stronger affirmation of development reversal and sure invalidate present lower-wave counts.

Associated Studying

Till these thresholds are breached, the analyst stays cautious, noting that whereas they “lean toward the low being in,” there may be nonetheless no definitive proof to assist it. An important commentary is the muted bounce off latest lows whereas the Bitcoin worth noticed a powerful transfer upwards on Thursday.

In accordance with the chart, every subsequent uptick has been shallow, failing to achieve significant traction and hinting that sellers stay energetic. This underscores the broader uncertainty. If consumers can’t push above $0.293 quickly, Dogecoin’s sideways drift may persist. A deeper dip under $0.22 may give rise to a extra prolonged corrective sample, labeled on the chart as (5) or C, difficult bullish hopes that the final swing low is the cycle backside.

Within the phrases of the analyst: “Despite some charts showing strong moves today, the DOGE price has remained stagnant, with no clear confirmation of a bottom. The price continues to move sideways, lacking decisive momentum. A break above $0.293 would be the first step in signaling a potential reversal, with stronger confirmation coming from a move beyond $0.341. While I lean toward the low being in, there’s still no definitive evidence. So far, the upside move from the last low has been too small to be meaningful.”

At press time, DOGE traded at $0.25.

Featured picture created with DALL.E, chart from TradingView.com