Este artículo también está disponible en español.

Latest worth decline motion has seen Dogecoin rebounding at a current multi-month low after the whole market began final week on a liquidation stretch. Nonetheless, technical evaluation from analyst Dealer Tardigrade means that Dogecoin could have already established its cycle backside earlier than the following worth surge.

Dogecoin Checks Key Weekly Support After 40% Drop

The cryptocurrency market confronted a major downturn final week, with widespread losses hitting varied digital belongings. Dogecoin was no exception to the sell-off, experiencing a sharp decline of practically 40% earlier than discovering assist round $0.22. This drop marked the bottom worth Dogecoin has reached for the reason that starting of 2025, and the final time it traded at this degree was in early November 2024.

Associated Studying

Regardless of the severity of the drop, technical evaluation from crypto analyst Dealer Tardigrade means that Dogecoin’s current 2025 low could also be extra vital than it seems at first look. In a social media submit on platform X, the analyst shared a weekly timeframe chart highlighting that $0.22 is a part of a key trendline that performed an important function in Dogecoin’s worth actions all through 2024.

Now, with the value falling again to this degree and bouncing off it, Dealer Tardigrade famous that the trendline has seemingly flipped into a robust assist zone.

As of now, Dogecoin has rebounded to $0.2561, reflecting a optimistic response of roughly 16% from its current low. Notably, on-chain information from IntoTheBlock exhibits patrons stepped in simply round this assist degree. Nonetheless, Dogecoin’s means to carry above this assist degree within the coming weeks will decide if the cryptocurrency has really reached a backside for the remainder of this cycle.

Picture From X: Dealer Tardigrade

Historic Pullbacks Level To $2 Worth Goal

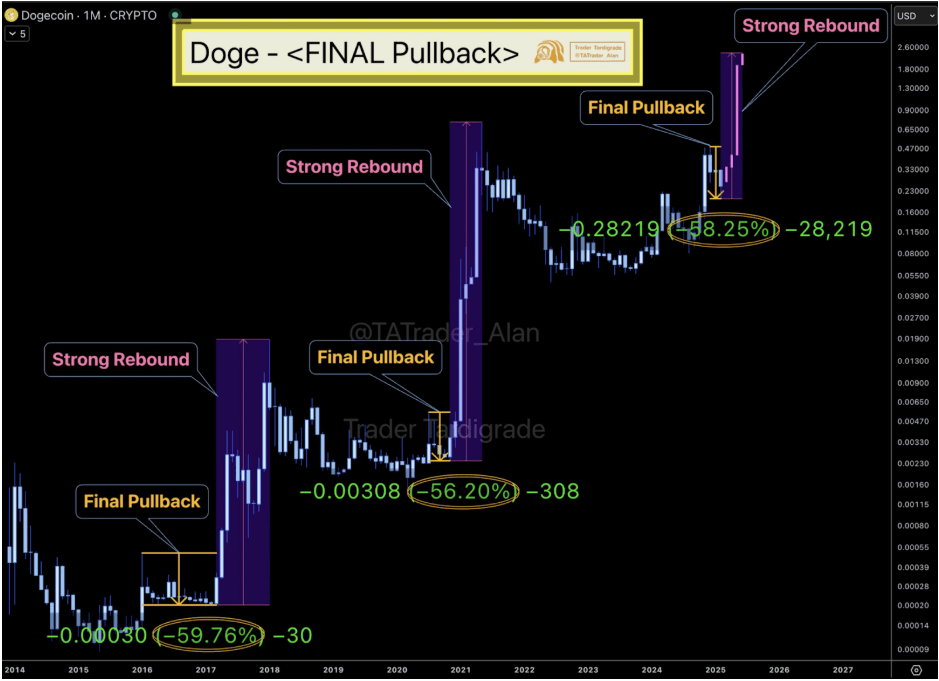

In one other evaluation, Dealer Tardigrade highlighted a recurring sample through which the Dogecoin worth tends to expertise vital pullbacks of greater than 50% after a robust multi-month rally. Nonetheless, these pullbacks have at all times been accompanied by one other sturdy rebound rally, and Dogecoin finally reached a brand new peak.

His evaluation famous three main pullbacks: the primary noticed a decline of 59.76%, the second dropped by 56.2%, and the newest pullback registered a 58.25% drop. Primarily based on this historic habits, Tardigrade famous that the current correction may be accompanied by one other sturdy rebound.

The final such a rebound occurred, Dogecoin went on a 23,000% enhance to achieve its present all-time excessive of $0.73. From right here, Dealer Tardigrade predicted an analogous playout to achieve a worth goal of $2.

Picture From X: Dealer Tardigrade

Associated Studying

The $2 worth goal has been a recurring prediction amongst crypto analysts for Dogecoin. One comparable prediction got here from crypto analyst Dima Potts, who predicted that Dogecoin is poised to focus on all-time highs between $1.50 and $2.10. For now, step one for a bullish Dogecoin can be to interrupt above $0.3.

Featured picture from Mudrex, chart from TradingView