Este artículo también está disponible en español.

Some analysts raised their considerations that Bitcoin would possibly expertise a doable crash which will likely be pushed by the Chicago Mercantile Alternate (CME) hole resulting in an enormous drop in its worth.

Since Bitcoin must fill within the hole, crypto merchants predict it’d push the firstborn cryptocurrency close to the crucial CME hole, suggesting that its worth may go as little as $77,000 per coin.

Associated Studying

Bitcoin May Slide To $77,000

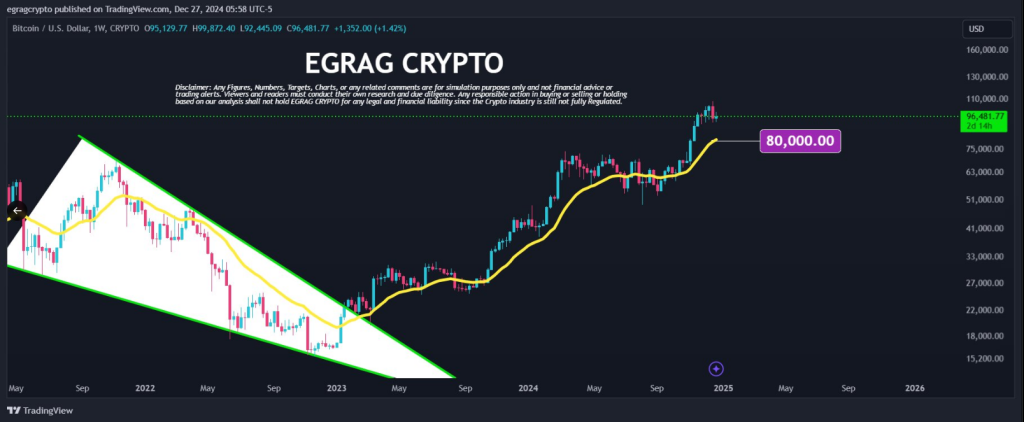

Crypto analyst Egrag Crypto urged that the large corrections that Bitcoin has been experiencing may trigger the coin to plunge to the $77,000 mark.

Egrag added that since October 2022, the flagship cryptocurrency has been subjected to about seven appreciable drops, including, “The average drop across these events is approximately 23.53%.”

#BTC Drop – Common Dump & CME (70K-74K): How & Why?

1⃣Common Drop:

Since October 2022, #BTC has skilled almost seven important drops. Listed here are the share declines:1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%📊 The typical drop throughout… pic.twitter.com/Vz6QiZlnzF

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

“From the current high of around 108,975, we’re looking at a potential drop to the lower end of the CME GAP (between 77K-80K). This represents a 25% decline, aligning well with the average drop observed during this cycle,” Egrag mentioned in a publish.

Egrag additionally famous that the present 21 Weekly EMA is round $80,000, suggesting that “another flash crash could be on the horizon.”

CME Gap At $80,000

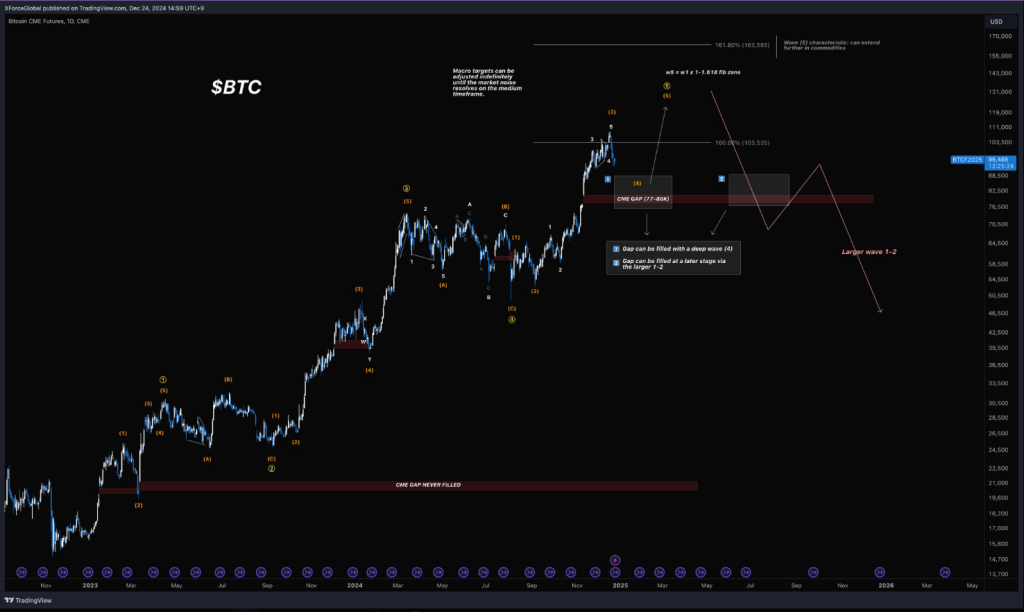

One other crypto analyst, XForceGlobal, reminded merchants that “there’s a 1D CME gap at $80,000.”

XForceGlobal mentioned that traditionally, 90% of day by day CME gaps bigger than have been finally crammed since 2018.

Only a pleasant reminder: there’s a 1D CME hole at $80,000.

Statistically, since 2018, with the rising curiosity in gaps, 90% of 1-Day timeframe gaps bigger than $1,000 have finally been crammed (ignore something under the 1D timeframe).

The difficult half with CME gaps is… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

Nonetheless, the crypto analyst famous that it’s laborious to foretell the timing and technique of filling CME gaps.

“The tricky part with CME gaps is that their timing and method of filling remain unpredictable,” XForceGlobal mentioned in a publish.

The crypto analyst sees doable eventualities to fill the CME gaps. In a single situation, XForceGlobal suggests it could possibly be filed by a deep wave or wave-4 correction, bringing Bitcoin all the way down to the $77,000 to $80,000 degree.

In one other situation, XForceGlobal mentioned it may be crammed “at a later stage via the assumed 1-2 correction after we finally finish off this bull run’s impulse,” a situation which could end result within the BTC to plummet to $46,000.

Associated Studying

A Market Dump In January?

Egrag believes that market makers would possibly use the upcoming inauguration of President-elect Donald Trump to set off promoting stress for Bitcoin, contributing to its imminent crash.

“Market makers are known for seizing opportunities during crises. Expect a market dump on Inauguration Day (January 20, 2025). This could be the perfect local top for a sell-off, likely leaving many newcomers in a panic,” the crypto analyst mentioned.

Egrag outlined two eventualities which may unfold from the present market situation, suggesting that in a single situation, Bitcoin may pump to $120,000 and later expertise a dump to the CME GAP earlier than “resuming the bull run in 2025.”

In one other doable situation, the crypto analyst mentioned that BTC may drop to the CME hole of $70,000 to $75,000 degree earlier than the resumption of the bull run.

Featured picture from Pexels, chart from TradingView