Este artículo también está disponible en español.

The Bitcoin value appears set to get pleasure from a bullish reversal in January subsequent yr, having maintained a tepid value motion to shut out this yr. This bullish outlook for the flagship crypto got here as crypto analyst Tony Severino revealed a possible Doji formation, which urged that BTC might get pleasure from this uptrend within the new yr.

Associated Studying

Doji Formation May Lead To New 12 months Bitcoin Worth Rally

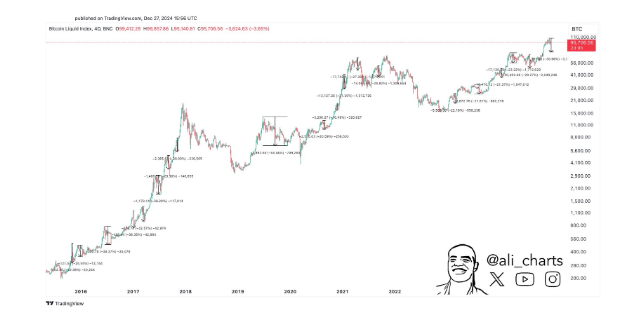

In an X put up, Severino urged {that a} Doji formation might result in a Bitcoin value rally within the first two months of the brand new yr. The analyst talked about that he suspects BTC will finish December with the Doji after which January reveals a robust continuation for the flagship crypto. His accompanying chart confirmed that this robust continuation might prolong into February.

The crypto analyst defined {that a} Doji represents a pause available in the market because of indecision from consumers and sellers. He added that the next candlestick reveals market individuals the choice the market has made by way of robust continuation or a reversal. On this case, Severino expects that the next candlestick will present a robust continuation for the Bitcoin value.

Severino famous {that a} related Doji at related subwaves every resulted in two extra months of upside earlier than a native high was in for the Bitcoin value. Due to this fact, the crypto might get pleasure from two months of upside between January and February 2025 if historical past repeats itself. From a basic perspective, Donald Trump’s inauguration is one issue that might spark this robust continuation.

The BTC value rallied above $100,000 after Trump’s victory within the November US presidential elections. As such, the flagship crypto might proceed this rally as Trump turns into the primary pro-crypto US president. Furthermore, the US president-elect might create a Strategic Bitcoin Reserve when he takes workplace, which would offer extra bullish momentum for BTC.

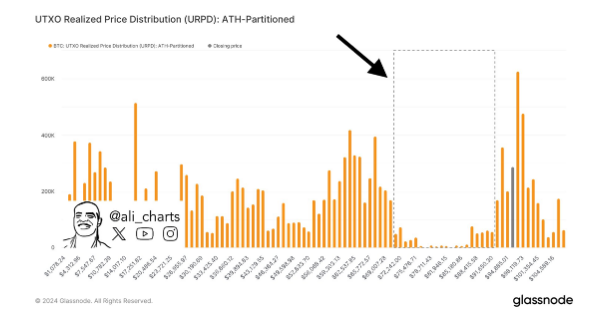

BTC Wants To Maintain Above $92,730

In an X put up, crypto analyst Ali Martinez remarked that the Bitcoin value must keep away from dipping beneath $92,730, as if that degree breaks, it is going to be in free-fall territory. The analyst’s accompanying chart confirmed that Bitcoin might drop to the $70,000 vary if it breaks this $92,730 value degree.

Associated Studying

Nonetheless, in one other X put up, Martinez urged that such a Bitcoin value drop may not essentially be dangerous. This got here as he acknowledged {that a} 20% to 30% value correction is essentially the most bullish factor that might occur to Bitcoin. In the meantime, Martinez acknowledged that the invalidation ranges for his bearish Bitcoin outlook are a sustained shut above $97,300 and a every day shut above $100,000.

On the time of writing, the Bitcoin value is buying and selling at round $94,400, down virtually 2% within the final 24 hours, in line with information from CoinMarketCap.

Featured picture from Reuters, chart from TradingView