Through the ongoing market uptrend, Bitcoin continues to steer the bullish wave because the main crypto asset data vital positive factors, pushing it to cost ranges above $95,000. Whereas BTC’s worth could have seen notable constructive actions above $95,000, this key stage now stands between an impending decline.

A Pullback Incoming For Bitcoin?

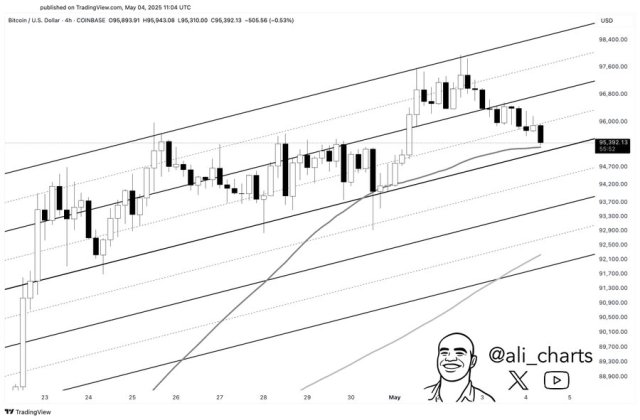

As Bitcoin prices towards the upside path, Ali Martinez, a technical and on-chain skilled, has revealed the significance of the $95,000 worth stage. The flagship asset is at present up towards a important check at a pivotal worth level that may determine whether or not there’s sufficient gasoline left for the present climb to final.

Martinez’s latest evaluation means that this stage may act as the inspiration for extra upward actions or a possible pullback in worth. It is very important word that Bitcoin’s worth is at present testing the $95,000 mark, demonstrating the potential for an uptrend resulting from bullish sentiment available in the market.

Nonetheless, if BTC fails to carry above this stage, the subsequent potential pullback would possibly trigger its worth to drop to $92,000. Within the meantime, consideration is being drawn to the $95,000 zone, which has traditionally acted as each a launchpad and a barrier for BTC.

Community Curiosity Dwindles Regardless of Holding Above The Level Uptrend

Whereas this $95,000 milestone is believed to ignite widespread on-chain engagement, transaction quantity, and lively addresses stay at low ranges, even amid market enthusiasm. Alphractal, a complicated on-chain knowledge and funding platform, cited a waning curiosity within the Bitcoin blockchain. Nonetheless, it’s price noting that the excessive value of Bitcoin doesn’t at all times translate into extra members utilizing the blockchain.

The discount in on-chain exercise signifies that the renewed traders’ enthusiasm may not but be mirrored in precise community utilization. At the moment, on-chain dynamism is going on elsewhere, whereas Bitcoin is being seen extra like a monetary asset, suggesting a notable shift in dynamics.

Alphractal has attributed the waning blockchain exercise to traditionally low volatility. This is as a result of merchants are much less motivated to behave when there’s little worth motion, which leads to fewer on-chain transactions.

Contemplating the event, Alphractal famous that the present uptrend appears to be pushed by exterior components. Institutional curiosity and capital inflows by Spot Bitcoin Alternate-Commerce Funds (ETFs) have not too long ago impacted Bitcoin’s present worth greater than precise blockchain deployment.

One more reason for this disconnection is synthetic crypto change volumes, as some platforms could also be inflated, giving the impression of elevated exercise when precise community utilization stays low. Restricted sensible demand just isn’t overlooked. Throughout this era, costs are maintained primarily by monetary devices and derivatives hypothesis slightly than by widespread blockchain adoption.

Bitcoin blockchain’s fading curiosity can also be as a result of market coming into right into a consolidation section. Alphractal said that traders are ready for lucid indicators or macro developments, resulting in a discount in coin actions.

Whilst BTC’s worth strikes upward, adoption and on-chain transactions have been shifted to layer 2 options just like the Lightning Community slightly than the Bitcoin Blockchain. Alphractal highlighted a speculative use of different main networks. Sometimes, high-traffic areas comparable to Decentralized Finance (DeFi), staking, and meme coin exercise are being drawn to networks like Ethereum, Solana, and Base.

Featured picture from Unsplash, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.