Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The Bitcoin worth spiked to $87,400 on April 21, its highest degree since March 29. The intraday rally added greater than $3,000 to the asset in lower than 24 hours, erasing a considerable portion of April’s drawdown. Whereas the only‑day appreciation of about 4% isn’t unprecedented for the notoriously unstable asset, the backdrop that accompanied Monday’s advance has market members treating the transfer with additional significance.

Why Is Bitcoin Up Right now?

The most rapid macro‑financial thread was the promote‑off within the US greenback after Nationwide Financial Council Director Kevin Hassett advised reporters on Friday that US President Donald Trump intends to switch Federal Reserve Chair Jerome Powell. The greenback index (DXY) slipped to 98.182 on Monday, whereas capital rotated concurrently into conventional secure‑haven gold. Spot gold climbed to a brand new excessive at $3,385 per ounce, extending its 2025 achieve to twenty-eight%. In distinction, S&P 500 and Nasdaq futures traded about 0.5% decrease.

Associated Studying

Observers seized on the divergence between Bitcoin and danger‑asset benchmarks. Monetary writer Mel Mattison wrote on X that he’s “seeing more evidence tonight of BTC breaking its strong risk‑on/QQQ correlation,” recalling his January thesis that “this is the year BTC breaks that correlation and starts trading more in sympathy with gold.” Apollo founder Thomas Fahrer reached the same conclusion: “Bitcoin is pumping while stock futures are trading down. It’s almost like the market is treating it like it’s an alternative financial system or something.”

The Kobeissi Letter described the alignment between the 2 arduous‑asset narratives as notable as a result of “Gold has hit its 55th all‑time high in 12 months and Bitcoin is officially joining the run, now above $87,000.” In a observe‑up publish, the macro e-newsletter argued that each property are “telling us that a weaker US Dollar and more uncertainty are on the way,” crediting a part of gold’s power to President Trump’s publication of a “non‑tariff cheating” listing from Sunday that targets forex manipulation, export subsidies and different types of perceived financial aggression.

Associated Studying

The renewal of commerce‑coverage anxiousness capped a 3‑day Easter weekend that had failed, within the phrases of Kobeissi, to ship “the trade deals the market priced‑in last week.” Trump’s ninety‑day “reciprocal tariff” pause nonetheless has seventy‑9 days remaining, and market sentiment seems more and more sceptical {that a} sweeping accord will materialise in that window.

Nonetheless, FOX Enterprise correspondent Charles Gasparino reported on Sunday {that a} Wall Road government “with ties to the Trump White House” believes Treasury Secretary Scott Bessent is “close to announcing a significant trade deal, likely to be with Japan,” whereas cautioning that negotiations stay fluid.

Bitcoin Value Breaks Out

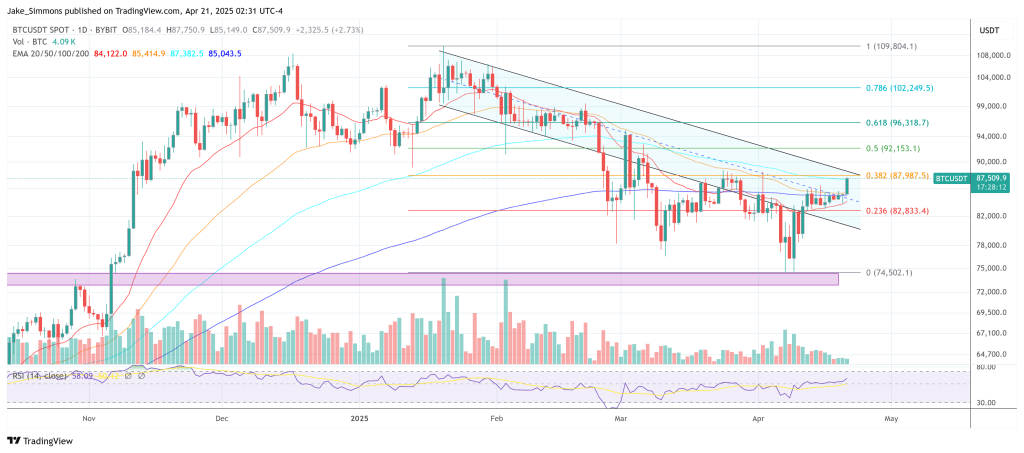

In opposition to the macro backdrop, chart technicians pointed to an vital structural break on the each day Bitcoin chart. Dealer Scott Melker noticed that the spot price is now “breaking through descending resistance from the all‑time high” and should clear $88,804 to invalidate the sequence of decrease highs and decrease lows.

The account @ChartingGuy highlighted $94,000—the 0.618 Fibonacci retracement of the complete drawdown—because the “minimum target on this rally,” including that market behaviour at that degree will decide whether or not the present impulse proves a mere reduction bounce or the start of a extra sustained advance.

In the meantime, crypto analyst IncomeSharks warned: “Nice to see the downtrend breakout but the timing is important. Sunday is not a day to celebrate a low volume pump while stock markets are closed. If you want to see a bullish moves lets see stocks open red tomorrow and keep this candle green. Then we can have fun.”

At press time, BTC traded at $87,509.

Featured picture created with DALL.E, chart from TradingView.com