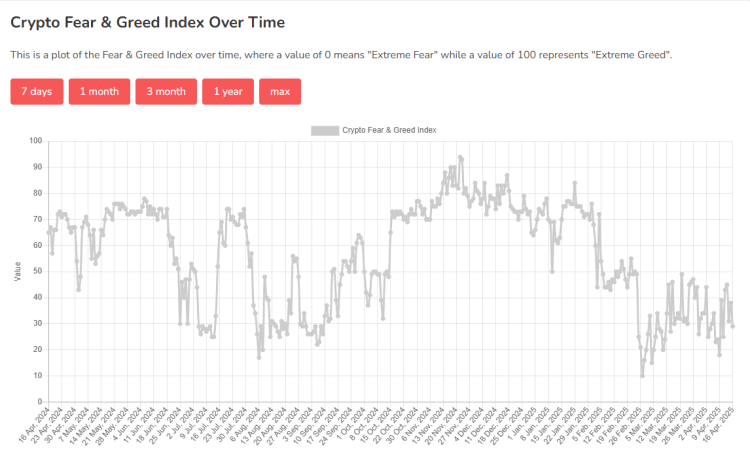

Knowledge exhibits the Bitcoin sentiment is at present not removed from the acute worry area, one thing that may very well be constructive for the asset’s restoration.

Bitcoin Fear & Greed Index Is Deep Into The Fear Zone

The “Fear & Greed Index” is an indicator made by Various that tells us concerning the common sentiment current among the many merchants within the Bitcoin and wider cryptocurrency markets.

The index makes use of the info of those 5 elements with the intention to decide the market sentiment: buying and selling quantity, volatility, market cap dominance, social media sentiment and Google Developments.

To signify the mentality, the indicator makes use of a numeric scale operating from zero to hundred. All values underneath the 47 mark correspond to a sentiment of worry, whereas these above 53 to that of greed.

Now, right here is how the sentiment is like within the sector proper now, in keeping with the Fear & Greed Index:

As is seen within the above graph, the Bitcoin Fear & Greed Index has a price of 29 for the time being, which suggests the traders as a complete share a sentiment of worry, a very sturdy one at that. The truth is, the indicator’s worth is at present so deep that it’s fairly near a particular area often called the acute worry (25 and underneath).

Simply earlier, the sentiment had seen an enchancment on account of the information associated to the 90-day pause on the tariffs and the worth surge that had adopted. However it could seem that the impediment that BTC has encountered in its restoration has worsened market temper as soon as extra.

To date, BTC’s pullback has been small, but the sentiment has already returned practically to excessive worry ranges. This may very well be a sign that the sooner renewed confidence was nonetheless fairly weak.

This reality could not really be a nasty signal for Bitcoin, nonetheless, if historical past is to go by. Prior to now, the asset’s worth has tended to maneuver within the route that’s the alternative of the gang’s expectations. The chance of such a opposite transfer happening has additionally solely grown the extra positive the traders have develop into.

The intense worry occurs to be the place a fearful mentality is the strongest, so bottoms have traditionally occurred when the Fear & Greed Index has been contained in the zone. There may be additionally an identical area on the greed facet as effectively, often called the acute greed. Naturally, it’s the place tops could be more likely to type.

With the market sentiment at present being close to the acute worry area, the present restoration rally may very well be good to go, not less than from a contrarian perspective.

BTC Value

On the time of writing, Bitcoin is buying and selling round $84,100, up over 2% up to now week.