Bitcoin rallied previous its earlier all-time excessive within the USD and USDT markets on Wednesday and prolonged features on Thursday, climbing to a peak of $111,880. Bitcoin’s breakout didn’t usher euphoria amongst merchants and the response on derivatives merchants was muted, relative to earlier BTC worth rallies.

Ethereum (ETH) struggles to draw institutional inflows at the same time as ETH rallies alongside Bitcoin (BTC) in its worth discovery. Altcoins within the prime 50 cryptocurrencies ranked by market capitalization are within the inexperienced, rallying within the final 24 hours.

Bitcoin derivatives evaluation

Analysts at 10xResearch and Amberdata are in settlement on the truth that spot market power and never hypothesis, is driving features in BTC. Bitcoin’s rally past $111,000 didn’t kick in a euphoria amongst merchants and the lengthy/brief ratio throughout prime derivatives exchanges is above 1. Whereas this means that merchants are bullish on BTC and anticipate additional features, on earlier cases just like the 2017 and 2020 cycles, the ratio exceeded 2.

The 24-hour liquidation information reveals $175 million in shorts liquidations and over $47 million in lengthy positions had been liquidated. Bearish merchants are being punished for betting towards Bitcoin worth rally, however the important thing query is, how excessive will Bitcoin go?

Bitcoin futures open curiosity chart on Coinglass reveals a large spike in OI. Open derivatives contracts in Bitcoin crossed a complete of $78 billion in OI on Might 22. OI is climbing alongside Bitcoin worth, signaling power within the BTC uptrend. Merchants are assured of additional features in Bitcoin worth.

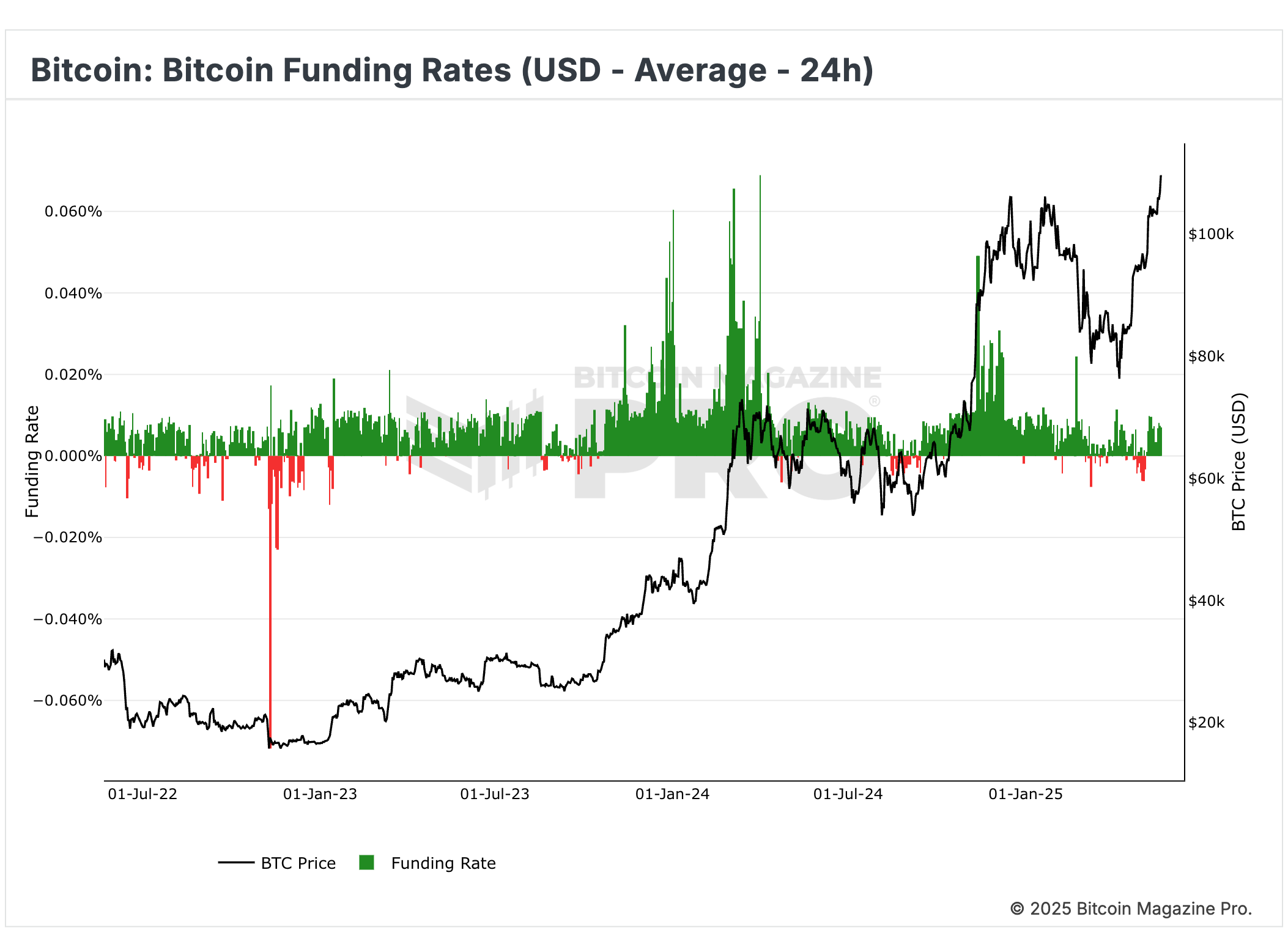

Funding charge has been constructive since Might 8, consistency within the inexperienced bars within the funding charge chart under reveals how derivatives merchants are positioning themselves for additional upside in Bitcoin. A constructive funding charge fuels a bullish narrative for an asset, within the case of Bitcoin this helps a thesis of features.

Ethereum technical and derivatives evaluation

Ethereum on-chain information reveals a slight improve in OI, lower than 7% within the final 24 hours. In the identical timeframe, the lengthy and brief liquidations in Ethereum had been almost the identical quantity, above $60 million.

The lengthy/brief ratio throughout prime derivatives exchanges is lower than 1, at the same time as choices quantity surged almost 60%. There isn’t a clear indication of a bullish or bearish bias amongst Ethereum’s derivatives merchants.

Ethereum derivatives information evaluation reveals the most important altcoin lags behind relative to Bitcoin, when it comes to curiosity and exercise from derivatives merchants.

The open curiosity chart on Coinglass reveals, at the same time as ETH breaks previous $2,600, the OI lags ranges beforehand seen in January and February 2025. A profitable implementation of the newest technical improve didn’t gasoline a bullish sentiment amongst merchants and catalyze features within the altcoin.

The ETH/USDT day by day worth chart reveals ETH is presently buying and selling 12% under its psychologically essential goal of $3,000. ETH has established help at $2,415, and additional features are seemingly as RSI slopes upwards and MACD flashes inexperienced histogram bars above the impartial line.

Ethereum’s goal is the $4,578 stage, as seen within the ETH/USDT worth chart. The altcoin’s earlier all-time excessive is the $4,878 stage.

Crypto dealer sentiment and why euphoria is lacking

The Worry and Greed Index Chart on CoinMarketCap reveals that at the same time as Bitcoin enters worth discovery, the degrees of “Greed” noticed in November 2024 had been the very best. Dealer sentiment just isn’t as euphoric as one would possibly anticipate, on the time of writing it reads 73.

Excessive greed is often correlated with cycle peaks or yearly tops. Above $110,000 Bitcoin remains to be lagging when it comes to bullish sentiment amongst merchants.

This can be a constructive signal because it helps the thesis that the cycle prime remains to be away and merchants are seemingly ready and waiting for the following pullback and rally in BTC.

How excessive can Bitcoin go?

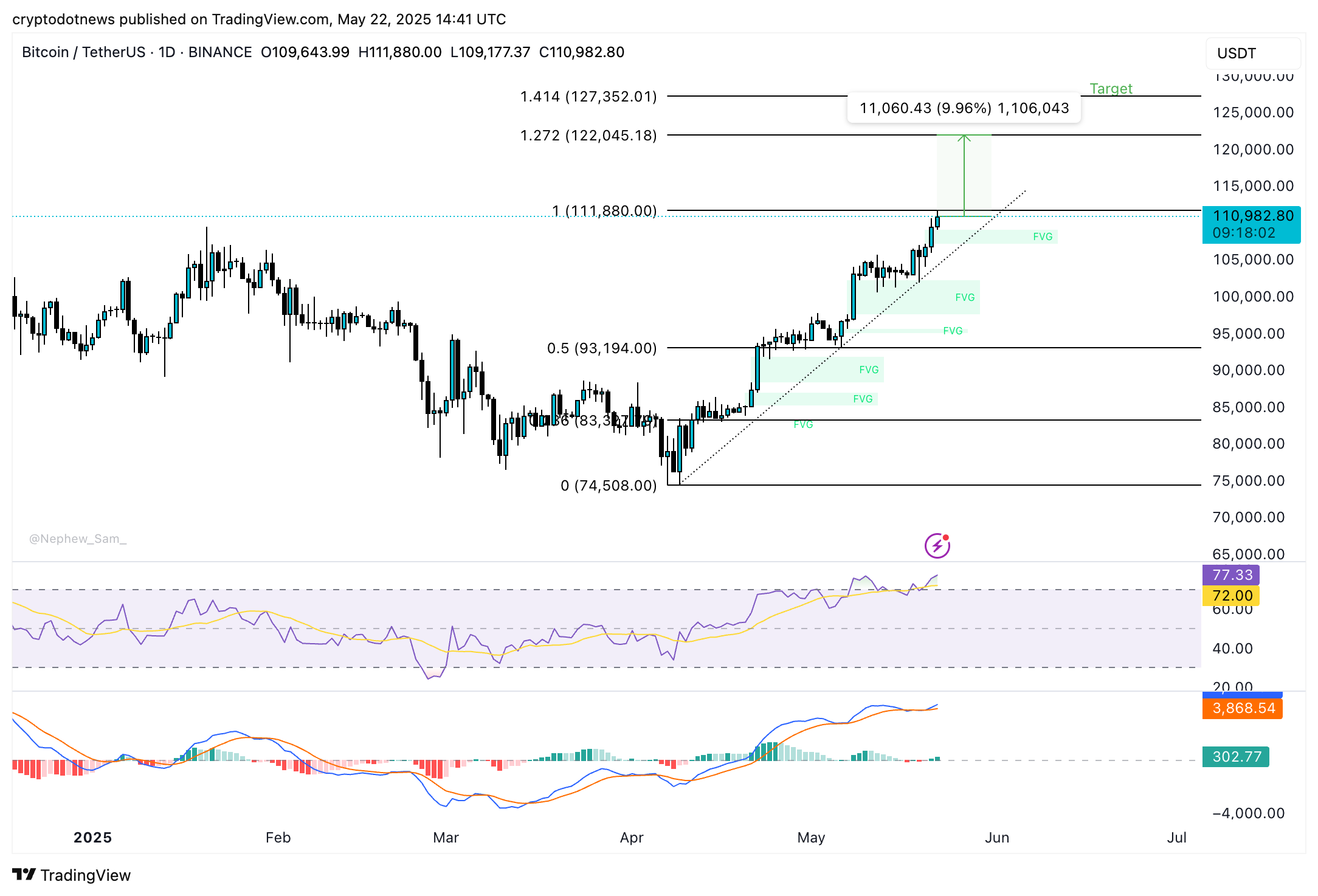

Bitcoin’s goal is the $122,000 stage that coincides with the 127.2% Fibonacci retracement of its 50% rally from April 7 low to Might 22 peak. BTC is presently lower than 10% away from its goal and technical indicators on the day by day worth chart help chance of additional features.

RSI is sloping upwards and crossed into the “overvalued” zone and MACD flashes consecutive inexperienced histogram bars. If Bitcoin exams resistance at $122,000 and breaks previous this stage, the following goal at $127,352 comes into play.

The $127,352 goal is the 141.4% Fibonacci retracement stage for Bitcoin in its ongoing upward pattern. Whereas analysts at Bernstein pushed their goal for Bitcoin to $200,000 in 2025, it’s seemingly that BTC crosses the $127,000 stage earlier than June 2025, primarily based on its features since April 2025.

Shubh Varma, the CEO of Hyblock Capital advised Crypto.information that from a technical perspective, he sees probably the most dependable help zone between $101,000 and $102,500. Exchanges like Binance and Bybit have seen “heavy open interest entries that trap shorts and attract fresh longs,” on this zone.

Bitcoin pushed above resistance between the $105,000 and $106,000 stage early on Thursday. It stays to be seen how lengthy Bitcoin holds above the FVGs on the day by day timeframe.

Bitfinex analysts advised Crypto.information in a written notice that the group is watching minor liquidity partitions between $114,000 and $118,000 and the $123,000 to $125,000 zone is the place massive choices open curiosity is constructing. These are key areas of curiosity for merchants to observe within the coming weeks of Might 2025.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.