The Bitcoin value has just lately surged $30,000 in only one month, signaling a robust return of the bull market. Nonetheless, as pleasure builds, it’s important to take a step again and assess whether or not this rally is sustainable or if we is likely to be getting forward of ourselves. Let’s break down the present scenario and what it means for buyers.

Key Takeaways

- Bitcoin’s value has jumped from round $75,000 to almost $106,000 in a month.

- Indicators recommend a possible cooling off interval could also be essential.

- Historic information exhibits that speedy value will increase usually result in corrections.

- Monitoring key metrics can assist gauge market sentiment and future value actions.

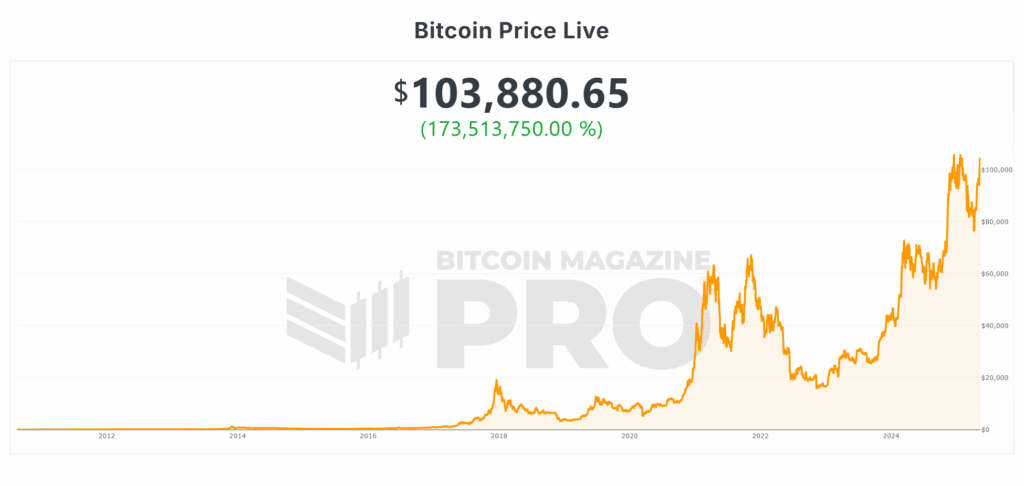

Current Bitcoin Price Motion

Current Bitcoin value motion has been nothing wanting spectacular. In nearly 30 days, it rallied from roughly $75,000 to round $106,000. This sort of motion is thrilling, particularly after a protracted interval of sideways buying and selling and downward tendencies. The market appears to be buzzing with optimism, however we should be cautious.

The Bitcoin Concern and Greed Index

One of many first indicators to take a look at is the Concern and Greed Index, which at present sits at 70. This stage signifies a wholesome quantity of greed available in the market, nevertheless it additionally raises a purple flag. When sentiment is overly optimistic, it could usually result in a pullback.

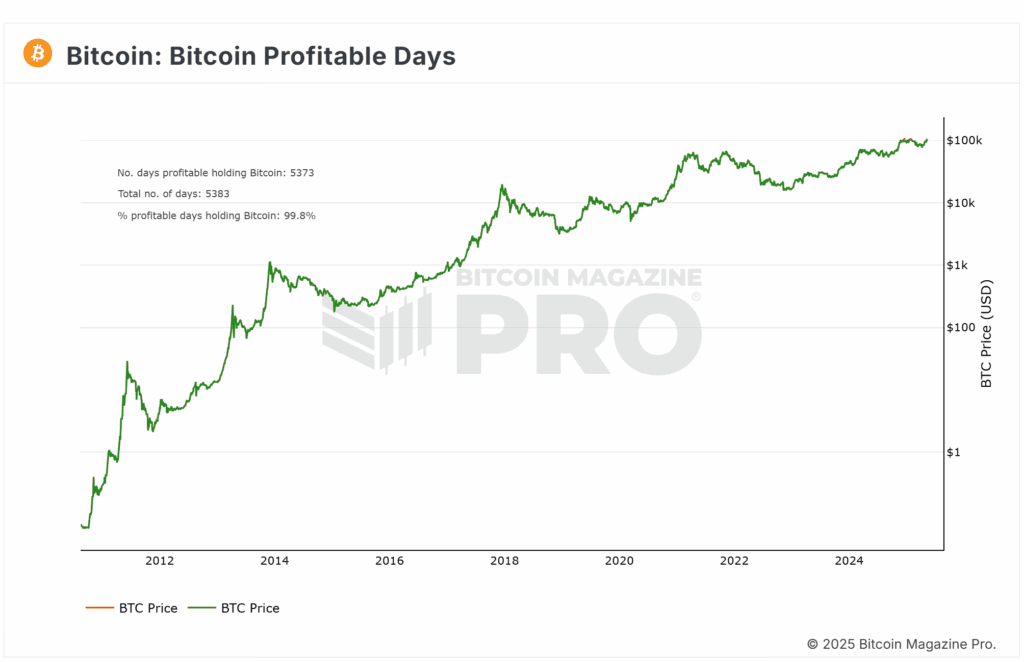

Bitcoin Worthwhile Days Chart

One other encouraging signal is the Bitcoin Worthwhile Days Chart, displaying that 99.7% of days holding Bitcoin are actually worthwhile. It is a sturdy indicator of market well being, nevertheless it additionally means that many buyers are sitting on positive aspects, which might result in profit-taking if costs begin to dip.

Bitcoin Historic Context

To place this rally into perspective, we have to have a look at how lengthy it took the Bitcoin value to first attain $30,000. It took over 11 years to get there, however now we’ve seen an identical value improve in only a month. This speedy rise can usually result in a correction, as markets are inclined to overextend themselves.

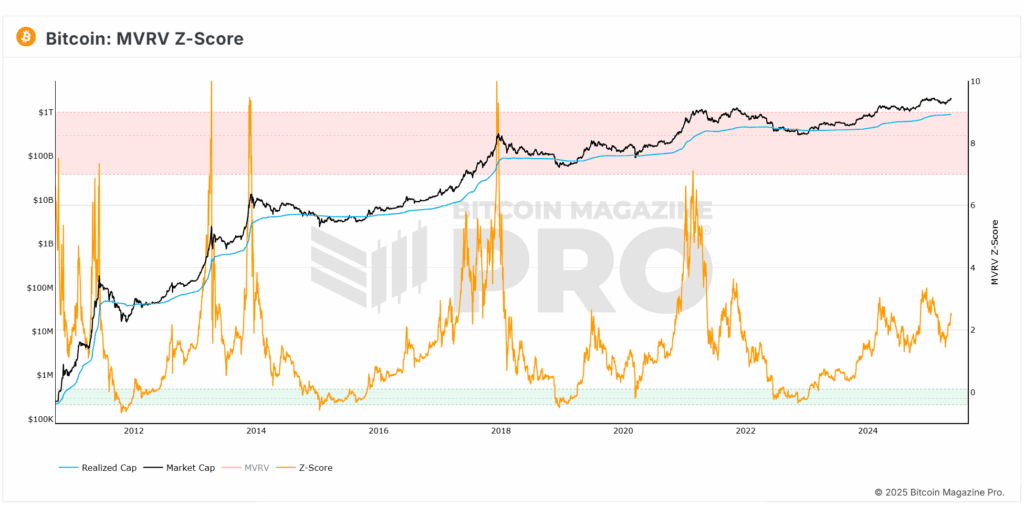

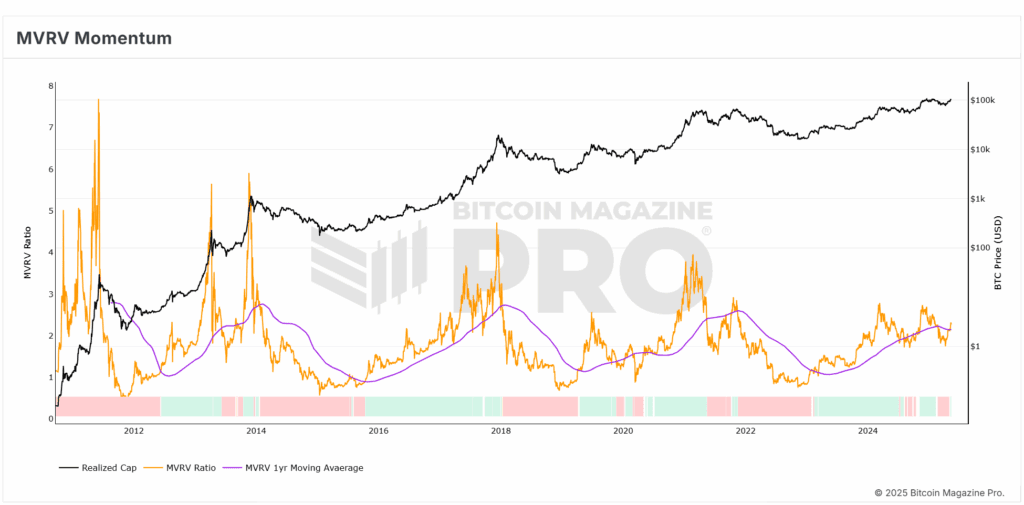

Bitcoin MVRV Z-Rating

The MVRV Z-Rating is one other crucial metric to contemplate. This rating helps us perceive whether or not Bitcoin is overvalued or undervalued based mostly on historic information. Presently, we’re approaching a key stage that has traditionally indicated a possible pullback. If we see a rejection at this stage, it might sign a cooling off interval.

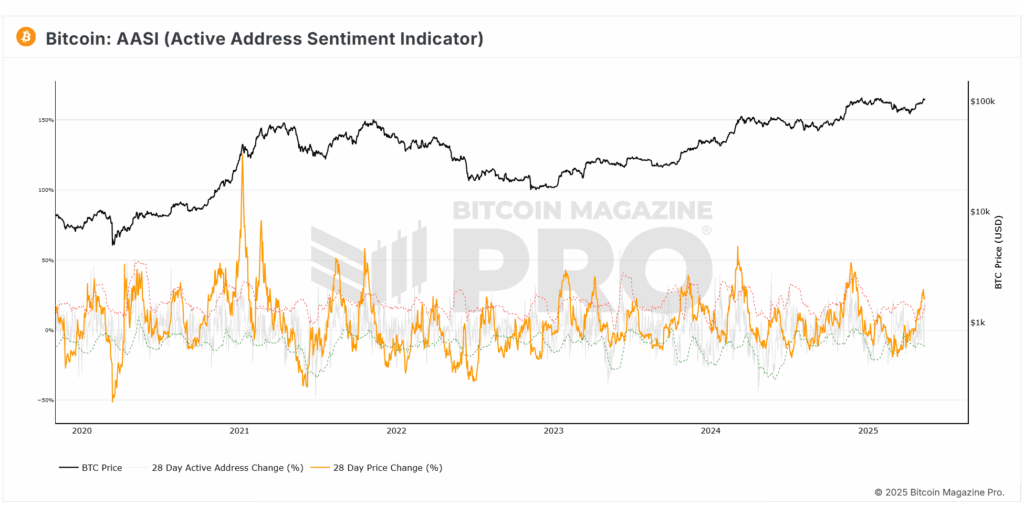

Bitcoin Lively Tackle Sentiment

Wanting on the Lively Tackle Sentiment Indicator, we will see that when Bitcoin’s value rises considerably with no corresponding improve in lively customers, it usually results in unsustainable value ranges. If we see a surge in value however not in lively addresses, it might point out that the rally will not be backed by sturdy fundamentals.

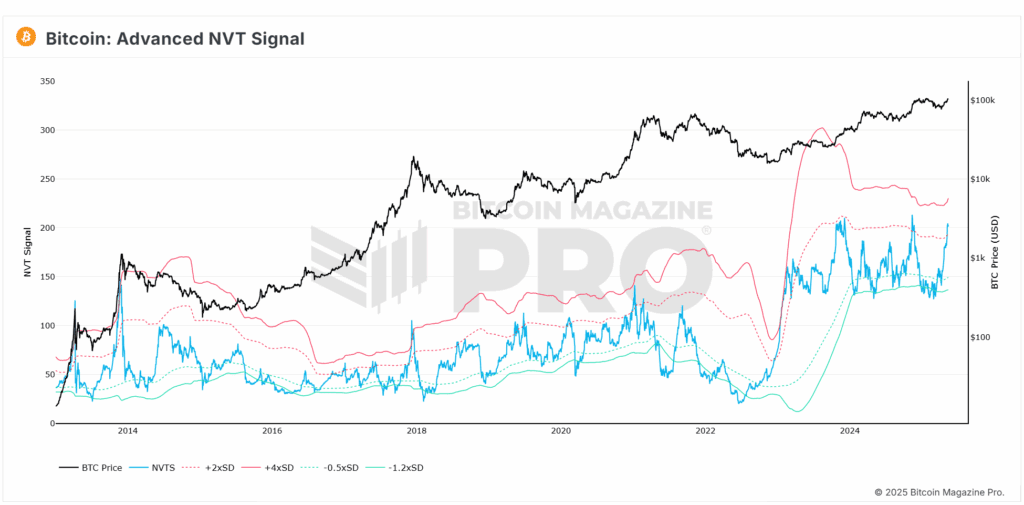

Bitcoin Superior NVT Ratio

The Superior NVT Ratio additionally exhibits related tendencies. When this ratio rises above a sure stage, it means that the market could also be overextended. Traditionally, this has been a sign to be cautious about getting into new positions or making massive investments.

Technical Resistance Ranges

From a technical evaluation standpoint, we have to control key resistance ranges. The current value motion has touched a stage the place sellers have beforehand stepped in, resulting in retracements. If Bitcoin can maintain above $100,000 and switch it into assist, that might be a optimistic signal for future progress.

Whereas the present bullish sentiment is thrilling, it’s important to keep in mind that a slight pullback may very well be wholesome for the market. A cooling off interval permits for a reset in expectations and can assist new capital stream in with out the market changing into too overextended.

Bitcoin Macro Perspective

Regardless of the short-term considerations, the macro outlook for Bitcoin stays sturdy. The MVRV Momentum Indicator exhibits that we’ve got reclaimed a major transferring common, which traditionally signifies the beginning of bullish market circumstances. This means that whereas we may even see some short-term volatility, the long-term development remains to be upward.

Conclusion

In abstract, the current Bitcoin value rally is spectacular, however we should be cautious. The info means that whereas the market is robust, it might be due for a correction. Investors ought to concentrate on the info and keep away from getting swept up within the pleasure. A wholesome pullback might set the stage for even higher positive aspects sooner or later.

As all the time, control the metrics and be ready for regardless of the market throws your manner. Keep knowledgeable, and don’t let feelings drive your funding selections.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.