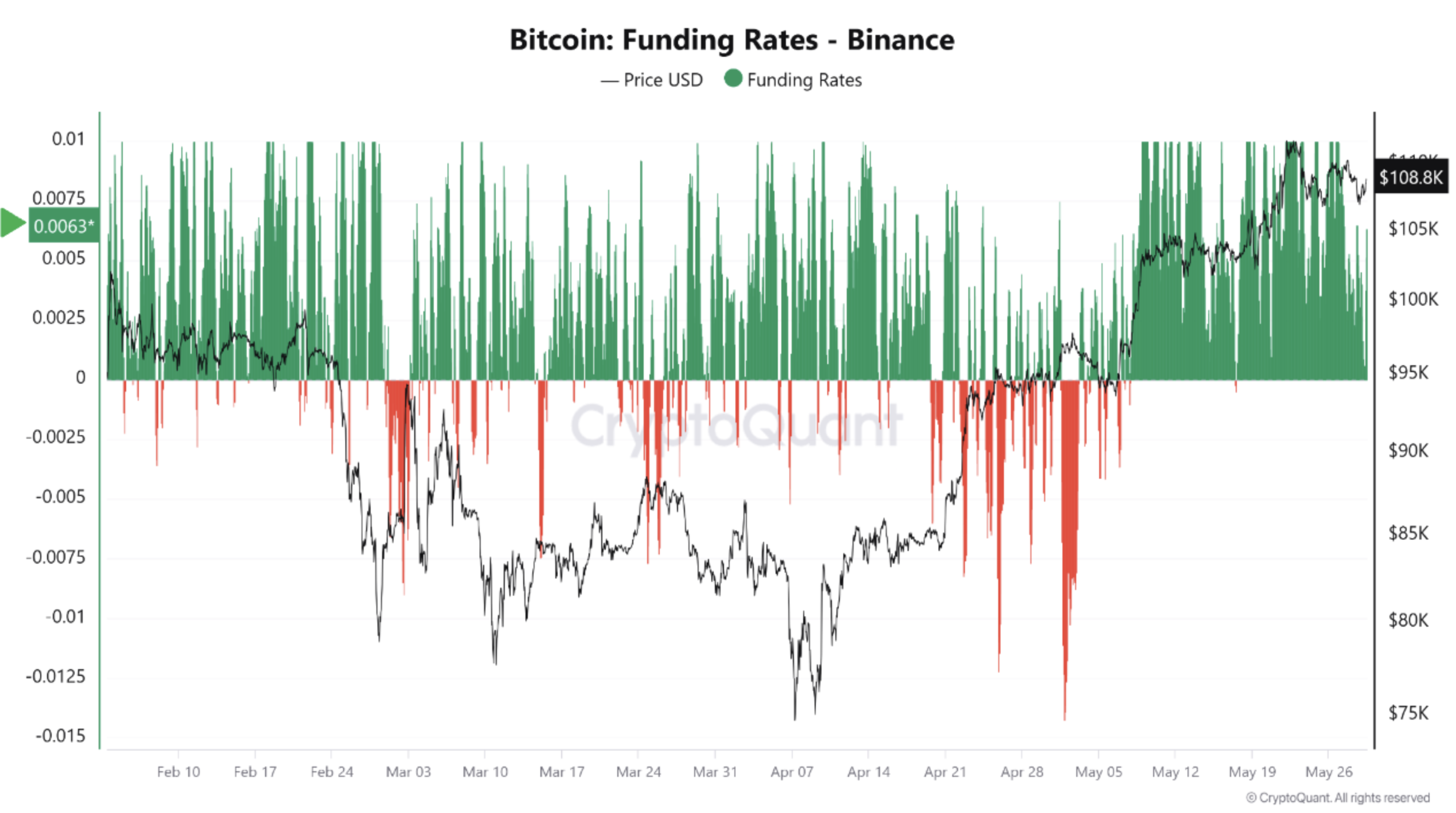

Bitcoin (BTC) has remained range-bound for the higher a part of the final week, hovering just under its newest all-time excessive (ATH) of $111,980 reached on Could 21. Regardless of this milestone, speculative exercise seems to be subdued, as funding charges on Binance – one of many largest crypto exchanges – proceed to be in impartial territory.

Bitcoin Funding Rates Stay Neutral Regardless of New ATH

In keeping with a current CryptoQuant Quicktake submit by contributor Amr Taha, Bitcoin funding charges on Binance have stayed near zero, even within the wake of a brand new ATH. This subdued degree of funding means that extreme leverage amongst retail merchants is presently absent – a optimistic signal for the sustainability of the continuing rally.

For the uninitiated, funding charges are periodic funds exchanged between lengthy and quick merchants in perpetual futures contracts to maintain the contract value aligned with the spot value. When the speed is optimistic, lengthy merchants pay shorts, and when it’s destructive, shorts pay longs – reflecting market sentiment and leverage.

Within the present context, funding charges close to zero point out a balanced sentiment between bulls and bears, with neither aspect aggressively leveraging their positions. This neutrality factors to a extra steady market surroundings, decreasing the chance of sudden liquidations and value crashes.

Including, Taha introduced consideration to current long-side liquidations that occurred when BTC slipped beneath two essential value ranges, $108,500, and $107,500. These occasions have been captured within the beneath Bitcoin Purchase/Promote Strain Delta (90) chart, which additional helps the narrative of cautious market participation.

If funding charges proceed to hover round zero, it might pave the best way for additional sustainable development in BTC’s value. Mixed with the present Purchase/Promote Strain Delta – which stays far beneath earlier peak ranges – there seems to be appreciable upside potential remaining.

Inflows From New Traders Stay Sluggish

Whereas impartial funding charges provide hope for continued value appreciation, on-chain knowledge exhibits some indicators of concern. The Unspent Transaction Output (UTXO) Age Band distribution signifies that inflows from new buyers – these holding BTC for lower than a month – stay sluggish, even after the current ATH.

In a separate Quicktake submit, analyst Avocado_onchain famous that the share of latest buyers has lingered round 30% in the course of the present cycle, in comparison with over 50% in previous bull runs. They cautioned:

In abstract, if previous patterns maintain true, Bitcoin’s upside could also be restricted with out vital inflows from new buyers. For now, monitoring the expansion within the share of latest buyers might be key to assessing future market route.

In the meantime, the Golden Ratio Multiplier suggests that BTC might quickly enter a contemporary value discovery part, with potential targets as excessive as $130,000. At press time, Bitcoin trades at $107,617.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.