Most inexperienced traders make the error of believing they’re late to the sport with Bitcoin. Nope. Unsuitable!

Though Bitcoin is the highest canine, there’s nonetheless loads of room for it to develop and dethrone gold’s market cap (that’s a 10x achieve when that occurs by the way in which).

Let’s talk about two the explanation why you’re nonetheless an early investor in Bitcoin.

Cause #1 Bitcoin is Gold 2.0

Bitcoin is gold 2.0 — its forex redefined — and everybody’s making an attempt to get a chunk of the pie.

Satoshi Nakamoto, the individual or group of builders who created Bitcoin envisioned the asset in the future dethroning treasured metals and different standard fiat currencies:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”. — Satoshi Nakamoto

Whereas it has grown significantly, Bitcoin stays comparatively low-cost, with analysts predicting it’ll attain over $200,000 in 2025.

Cause #2: A generational shift in wealth is occurring now

Throughout the subsequent few a long time, millenials will develop into the wealthiest technology in historical past. Child Boomers are set to cross on an enormous $68 trillion to their kids, the most important generational wealth switch ever.

Everybody’s excited — besides the banks.

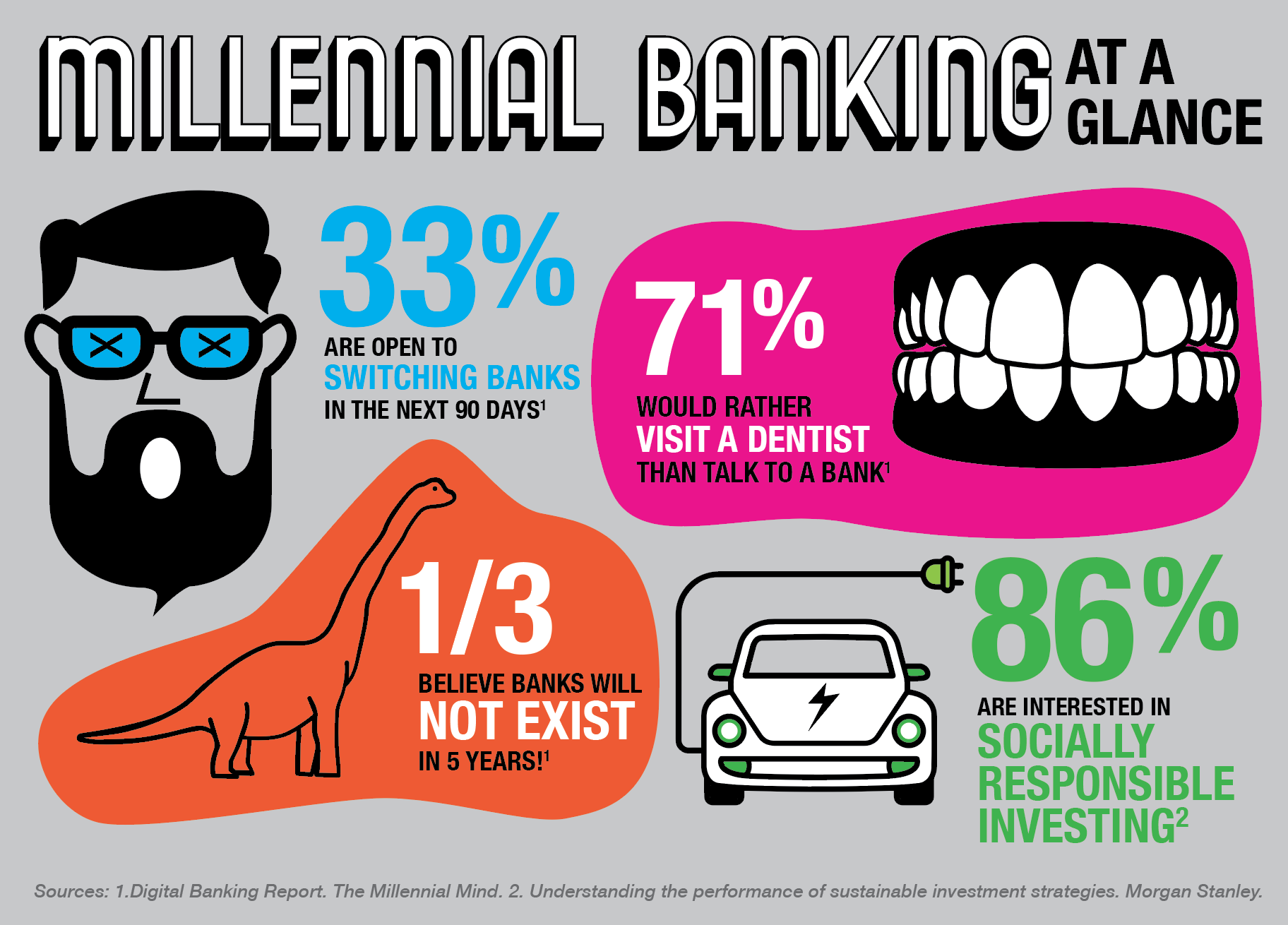

Bitcoin was created after the 2008 monetary disaster as a consequence of a severe distrust in banks. In the meantime, millennials, the technology arguably damage most by the banks, are following swimsuit of their distrust. In accordance with the Millennial Disruption Index — a 3-year examine of 10,000 Millennials, the bulk (71%) of Millennials reported that they’d somewhat go to the dentist than hearken to something banks should say.

As quoted from that examine: “The 2008 financial crisis was the worst financial disaster since the Great Depression, inflicting widespread, devastating costs on millions of American families. All told, more than $13 trillion of household wealth vanished, 11 million individuals were displaced from their homes, and nine million Americans lost their jobs.”

Sorry, isn’t chopping it for millennials or Gen Z. This is the reason 1 / 4 of American Millennials incomes $100,000 in particular person or proudly owning $50,000 in investable property are holding or utilizing cryptocurrencies.

When the generational shift in wealth happens, banks will slowly incorporate cryptocurrency to appease youthful generations or else evaporate. This may occasionally appear preposterous proper now, however the knowledge signifies in any other case.

Listed below are just a few key inquiries to ponder over the way forward for Bitcoin:

- Will extra cryptocurrencies get a verified exchange-traded fund, making it simpler for folks to take a position?

- Can BTC overtake even 1 / 4 of the gold market?

- What if BTC replaces the forex of countries tormented by hyperinflation?

Last Ideas on Bitcoin Adoption

Early Bitcoin traders Tyler and Cameron Winklevoss lately stated this in regards to the crypto: “We think it will be the best-performing asset of the current decade,” Tyler Winklevoss stated in an interview with CNBC.

“Our thesis is that Bitcoin is gold 2.0 and will disrupt gold. If it does that, it must have a market cap of $9 trillion. So we think bitcoin could price one day at $500,000 a bitcoin.”

The marketplace for Bitcoin to develop is very large. We’re nonetheless within the Wild West days of crypto and blockchain.

EXPLORE: XRP Worth Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Most inexperienced traders make the error of believing they’re late to the sport with Bitcoin. Nope. Unsuitable!

- A US Bitcoin Reserve is on its method. Michael Saylor, MicroStrategy’s fierce Bitcoin advocate, needs the U.S. to personal the crypto sport.

- For now, the controversy about cryptocurrency’s place in America’s monetary future is simply starting.

The submit 2 More Reasons Why You’re an Early Bitcoin Investor appeared first on 99Bitcoins.