The crypto market is down 5.3% to round $2.99 trillion within the final buying and selling day. Merchants are, nonetheless, bullish about what lies forward. For Ethereum holders, nevertheless, bulls should present their hand extra convincingly earlier than they will totally commit.

EXPLORE: 10 Cash with Excessive Returns: Crypto Forecast 2025

Ethereum Underperforming Regardless of Pectra Deployment On Sepolia Testnet

From the every day chart, ETH is down almost 50% from its 2024 highs, buying and selling at $2,100. This is an enchancment from the near-$2,000 stage seen in late February. Regardless of the present state of value motion, merchants are assured that the eventual activation of Pectra in March 2025 might catalyze demand.

Based on reviews, Pectra was deployed to the Sepolia testnet this week. This is a main step since Pectra first launched on the Holesky testnet after delays attributable to incorrect deposit contract addresses.

Sepolia has efficiently upgraded to Pectra

(Hope I do not jinx it this time) pic.twitter.com/pPtufWbHh2

— terence (@terencechain) March 5, 2025

Whereas presently on Sepolia, builders have recognized minor points, most of them associated to customized deposit contracts, which in flip elevate issues about execution-layer purchasers processing transactions successfully. There are additionally points with empty blocks.

seems to be like sepolia has some subject after pectra

loads of empty blocks pic.twitter.com/0kDTyBUvNn

— Emiliano Bonassi (@emilianobonassi) March 5, 2025

With these lingering issues, builders are working to deal with all points earlier than the All Core Builders name within the coming weeks.

As soon as Pectra goes dwell, a number of enhancements shall be added to the mainnet. A few of these embody enhancements to consumer expertise, particularly for individuals who regularly interact with crypto wallets. Different main upgrades Pectra introduces embody rising the validator staking restrict from 32 ETH to 2,048 ETH and elevating the utmost blob depend to additional increase Layer-2 scalability.

All these upgrades are anticipated to cement Ethereum as a prime sensible contracts platform, probably surpassing rivals like Solana.

Nonetheless, nobody is aware of precisely how ETH costs will react. If historic value motion following key exhausting forks is any indication, ETH holders could should endure much more losses within the coming months.

DISCOVER: Finest Meme Coin ICOs to Spend money on March 2025

Will ETH Tank?

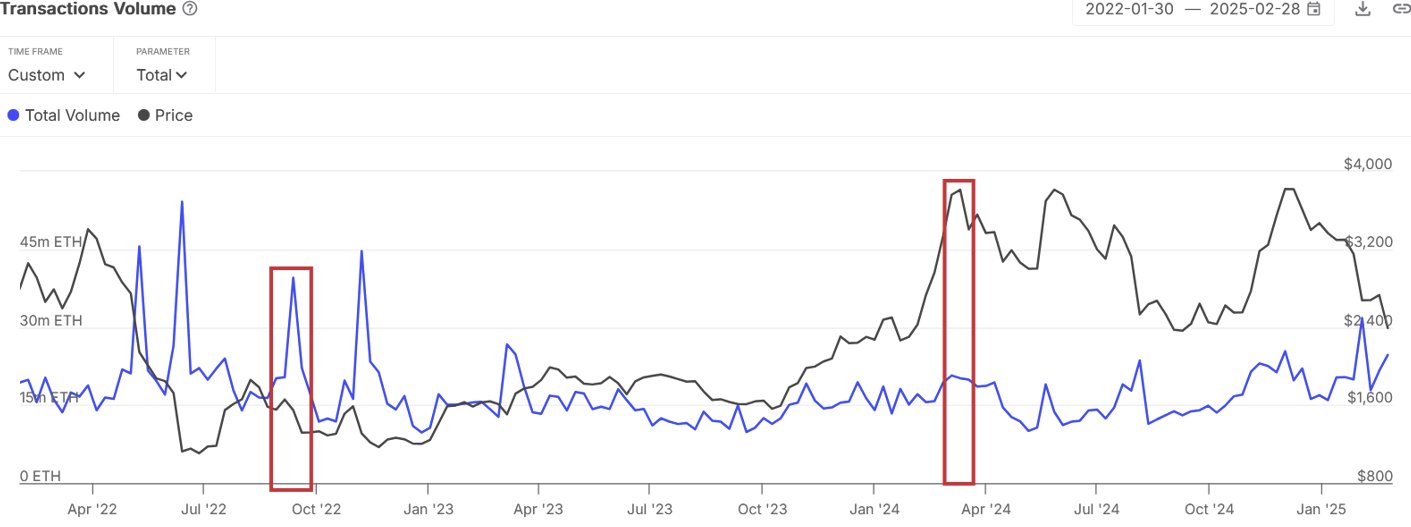

Analysts at IntoTheBlock notice that each time Ethereum prompts key upgrades, ETH costs are likely to drop regardless of the preliminary hype earlier than these modifications are applied.

When Ethereum activated The Merge in 2022, transitioning the chain from a proof-of-work to a proof-of-stake community, ETH costs ended up tanking to under $1,000 by the tip of the 12 months.

Roughly a 12 months later, in early 2024, when Dencun went dwell, ETH costs fell from $4,100 to $2,100 by August 2024. Like The Merge, Dencun was a essential improve that considerably allowed Layer-2 rollup platforms like Base and Arbitrum to scale. By introducing proto-danksharding beneath EIP-4844, the price of rollups dropped by 99%. Even after this profitable deployment, ETH costs bought off earlier than recovering in late 2024.

It stays to be seen whether or not Pectra will change into one other “sell the news” occasion, probably forcing ETH under the essential help stage at $2,000.

Ethereum stays a prime sensible contracts platform, and plenty of analysts contemplate ETH top-of-the-line cash to purchase in 2025. This is regardless of the existence of aggressive platforms like Solana, from which tens of hundreds of meme cash have been launched.

In Peter Brandt’s evaluation, ETH might shake off its present weaknesses and surge above $4,100, probably reaching as excessive as $6,000 within the coming years. Key drivers will embody institutional adoption and a market-wide restoration, particularly if there’s follow-through and a crypto reserve is created in the US in 2025.

- Pectra transitions to Sepolia testnet

- Mainnet set for late Q1 2025 to early April 2025

- Will ETH costs defy historic traits and surge after this improve?

[/key_takeaways]

The put up Pectra Live on Testnet: But Will Ethereum Follow Historical Post-Hard Fork Trends? appeared first on 99Bitcoins.