The TRUMP meme coin, the official Donald Trump cryptocurrency, took the crypto world by storm upon its launch on Friday. Within hours, it turned the most popular subject available in the market, fascinating traders and fans alike. By Saturday morning, because the U.S. woke as much as the information, the TRUMP coin had skyrocketed to an astonishing $30, marking a jaw-dropping 12,000% enhance from its launch worth.

Associated Studying

The exponential rally that unfolded in a single day now looks as if only the start. The coin’s meteoric rise barely makes a dent in its more and more vertical chart. With a staggering $6 billion market cap and a totally diluted valuation of $30 billion, the TRUMP coin is shortly establishing itself as a phenomenon within the meme coin class.

For early traders, the returns have been life-changing. A modest $10,000 funding at launch is now price an unimaginable $1.2 million, highlighting the huge potential of this viral asset. Because the TRUMP coin continues to dominate headlines, hypothesis is rising about whether or not it is a short-lived hype or the beginning of a brand new development within the crypto house. With such explosive development, all eyes are on this unprecedented meme coin’s subsequent transfer.

TRUMP Turns into The Greatest Meme Coin In Historical past

At 9:44 PM ET on an in any other case quiet Friday evening, President-elect Donald Trump made historical past by launching the $TRUMP meme coin, which has already develop into the largest meme coin phenomenon the market has ever seen. Based on The Kobbeissi Letter, a trusted voice in international capital markets commentary, TRUMP is up a staggering 9,500%, with $2.2 billion in buying and selling quantity inside simply 12 hours of its launch.

Initially met with skepticism, the announcement of $TRUMP’s launch appeared so implausible that many merchants assumed Trump’s account had been hacked. Nonetheless, with no official assertion refuting the coin’s legitimacy, confidence grew—and so did the value.

Associated Studying

By 12:45 AM ET, TRUMP had damaged above $10, accelerating right into a parabolic rally. Within the early hours, merchants witnessed unprecedented returns. One investor reportedly turned $50,000 into almost $1.1 million in simply two hours. Remarkably, TRUMP outperformed the S&P 500’s 30-year cumulative return inside that very same brief window.

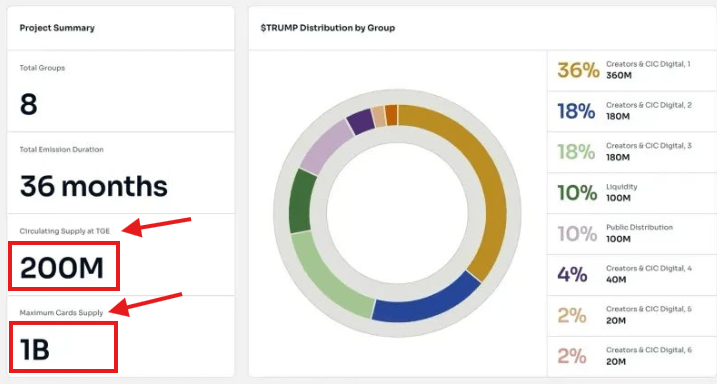

A key issue driving the coin’s explosive worth motion is its restricted circulating provide. Solely 20% of the utmost provide—200 million cash—is presently in the marketplace. Over the following 36 months, the remaining 800 million cash will progressively be launched. Hypothesis is rife that Trump himself holds this undistributed portion, probably giving him substantial management over the asset.

With $TRUMP already establishing itself as a phenomenon, the coin’s trajectory stays a fascinating spectacle. This unprecedented rally and intrigue surrounding its provide mechanics have cemented it as one of the vital extraordinary tales in crypto historical past.

Worth Motion And Market Cap Particulars

The explosive rise of the TRUMP coin has prompted questions on its Market Cap and Fully Diluted Valuation (FDV). With a complete provide of 1 billion cash, the FDV—if all tokens have been circulating—would stand at roughly $21 billion based mostly on present costs. Nonetheless, since solely 200 million cash (20% of the entire provide) are presently in circulation, the market cap is roughly $4.2 billion. This important disparity highlights the influence of circulating provide on valuation metrics.

Associated Studying

Worth motion, for now, offers restricted perception into the coin’s future. There may be little knowledge to conduct significant technical evaluation. The TRUMP chart basically consists of a parabolic inexperienced candle, reflecting its meteoric rise in an hype-dominated surroundings. This leaves the market with one vital query: can demand maintain present ranges because the remaining 80% of the provision progressively enters circulation?

The TRUMP emission schedule outlines how the utmost provide can be reached over the following 36 months. Skeptics argue that this inflow of provide might result in oversaturation, in the end sending the coin’s worth plummeting to $0. Alternatively, bulls imagine the schedule’s gradual nature permits demand to maintain tempo. This might mitigate the chance of great worth dilution. For now, the talk continues.

Featured picture from Dall-E, chart from TradingView