Observe Nikolaus On 𝕏 Right here For Each day Posts

One 12 months in the past at present, Gary Gensler and the Securities and Trade Fee (SEC) lastly capitulated and accepted the buying and selling of spot bitcoin alternate traded funds (ETF) to go reside the following day. These ETFs would go on to be the most effective performing ETFs in historical past, with BlackRock’s ETF $IBIT main the cost, taking in over $52 billion inflows alone.

I really feel like lots of people are afraid to confess this, or simply don’t need to, however the ETFs had been probably the most important second in Bitcoin over the course of 2024. Wanting again on the 12 months, it seems like every part that went in Bitcoin’s favor was downstream from these approvals. Let me clarify.

The six large occasions that occurred in 2024 had been as adopted:

- Spot Bitcoin ETF approval by the SEC

- Donald Trump pledging the USA to embrace Bitcoin

- MicroStrategy and different company adoption of Bitcoin

- $100,000 worth milestone

- Gary Gensler resigning from the SEC

- The halving

When BlackRock filed for its ETF in the direction of the tail finish of the bear market in 2023, that marked the start of the brand new bull marketplace for me. We instantly noticed a stampede of different massive asset managers rush to additionally apply for an ETF and the worth of Bitcoin has risen ever since — the worth of bitcoin was $24,900 when BlackRock filed its ETF, then it was $46,000 when it was accepted, and at present we’re sitting at slightly below $100,000.

The primary driver of curiosity and extra adoption of Bitcoin is its worth, not its utility. Giant worth will increase usher in probably the most eye balls, new swimming pools of capital, and generate extra curiosity within the asset total. When bitcoin goes down in worth, all of the vacationers depart and solely the HODLers stay.

Bitcoin ETFs driving up the worth in historic trend helped set the stage for Donald Trump to embrace it. Now not was Bitcoin simply mere magic web cash for a small crowd of individuals on the web, it was now backed by the world’s largest asset managers in BlackRock and Constancy. The large quantities of inflows into these merchandise was like a tsunami, showcasing how a lot demand there actually was for bitcoin and the brand new route our nation was stepping into financially. It confirmed that that is an trade that’s set to develop exponentially, and I consider Trump, like lots of the different politicians together with senators and congressmen, realized they’re higher off combating with us than towards us.

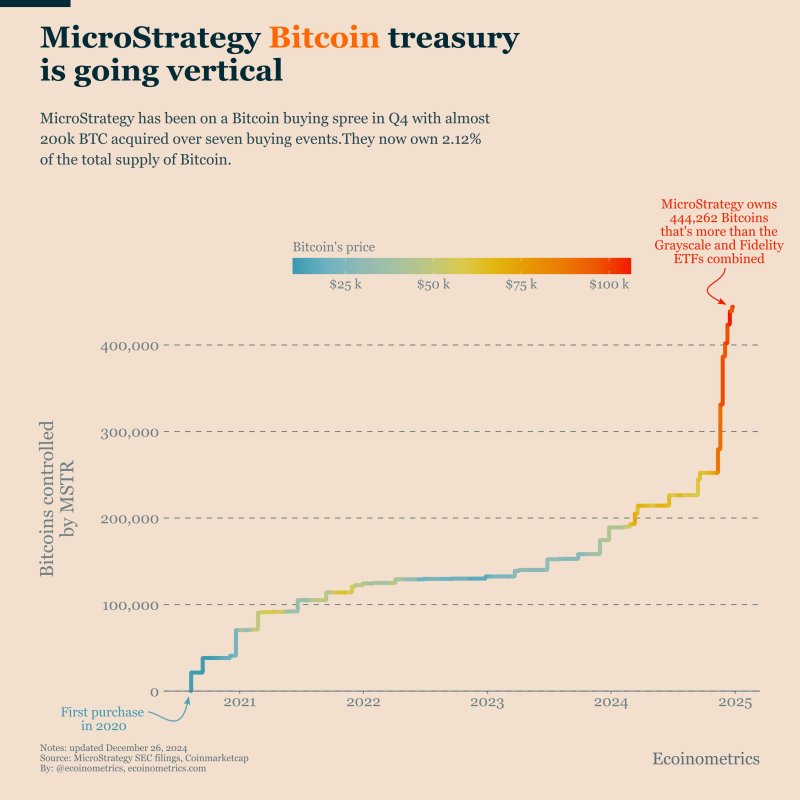

Now with the worth getting pushed up with the backing of the most important asset managers, and a brand new pro-Bitcoin administration coming into the White Home, this gave the inexperienced mild for MicroStrategy and different firms to dive deeper into the asset. And that’s precisely what occurred.

Michael Saylor ramped up MicroStrategy’s bitcoin purchases like by no means earlier than, and has no indicators of slowing down in 2025. Their inventory outperforming bitcoin had caught the eye of numerous different publicly traded firms who copied the ‘Bitcoin For Corporations’ technique, all including extra shopping for stress to bitcoin, additional driving up the asset. MicroStrategy is elevating over $42 billion to purchase extra bitcoin to front-run everybody who doesn’t personal any but — this massive improve in demand and regulatory certainty is sending bitcoin accumulators right into a FOMO frenzy.

All of this mixed, together with the halving occasion the place the manufacturing of recent bitcoin created was minimize in half to solely 3.125 BTC per block, despatched us to a brand new all time excessive over $108,000. The sheer shopping for demand on most days fully off units the quantity of recent cash mined, additional driving up the worth. Simply the opposite day, BlackRock’s ETF alone purchased over 6,078 bitcoin whereas miners solely made 450 new bitcoin. There isn’t sufficient bitcoin to go round for everybody, and they don’t seem to be making any greater than 21 million cash.

NEW: 🇺🇸 BlackRock's spot #Bitcoin ETF purchased 6,078 bitcoin at present, whereas miners solely mined 450 new bitcoin.

Absolute. Shortage. pic.twitter.com/KkHGpP2WAL

— Nikolaus Hoffman (@NikolausHoff) January 8, 2025

The success of those ETFs and alter in presidential administration spelt dangerous information for the SEC and different anti-Bitcoin regulators and politicians. Gary Gensler, who helped maintain up the approval of the spot ETFs for years, is formally leaving the SEC. Each of the democrat commissioners on the SEC who voted towards the approval are additionally leaving the fee. And it seems that Bitcoin is now being set as much as thrive in america over the following 4 with out being attacked by the regulators and politicians who’ve held again this trade for therefore lengthy.

The ETFs had been an enormous second for this trade, and issues would more than likely have turned out very otherwise if that they had not been accepted. The worth of bitcoin would probably be a lot decrease than it’s at present, and we would have even had a special winner within the US presidential election if that they had not been accepted. So many nice issues went in Bitcoin’s favor this previous 12 months, and it was all downstream from the ETF approvals.

This text is a Take. Opinions expressed are totally the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.