Dogecoin has typically demonstrated its capability to defy expectations and go on notable value surges now and again. Essentially the most notable of those rallies was the 2021 rally, which noticed Dogecoin peaking at its present all-time excessive. Nevertheless, the very best is perhaps but to return, as technical evaluation suggests that Dogecoin remains to be on monitor to repeat this transfer and probably even surpass it.

Notably, latest Dogecoin fractal evaluation means that Dogecoin is on monitor to succeed in anyplace between $4 and $23 inside the foreseable future.

Dogecoin’s Price Decline And Historic Fractal Patterns

Dogecoin’s value motion has slowed significantly up to now 4 weeks. The final two weeks of those 4 weeks have been highlighted by a notable decline, which has culminated within the Dogecoin value breaking under the multimonth resistance stage of $0.35 it breached in early November.

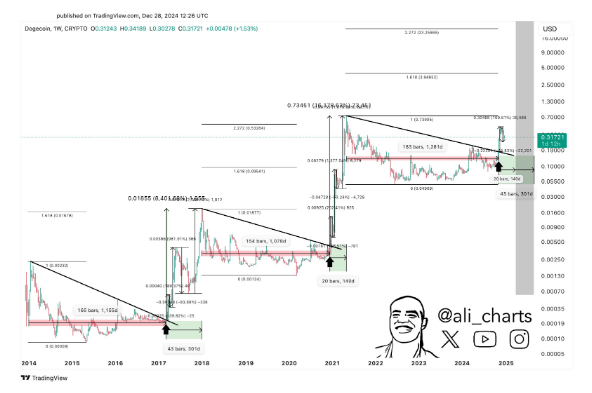

Based on technical evaluation by crypto analyst Ali Martinez, Dogecoin is at present enjoying out a fractal motion on the weekly candlestick timeframe chart. Fractals, in technical evaluation, discuss with recurring patterns that manifest throughout completely different scales and timeframes. For Dogecoin, this fractal motion stretches again to its earliest days as a meme coin in 2013 and supplies a historic lens to foretell its present trajectory.

As proven by the value chart under, the fractal motion is highlighted by a notable correction after a break above a downward sloping trendline drawn from the earlier cycle’s excessive. Within the case of this cycle, the correction has seen Dogecoin falling as little as 45.8% from the latest peak round $0.48. Nevertheless, the corrections up to now two cycles, as proven by the chart under, ended up rebounding to create sturdy multi-month rallies to new all-time highs.

Within the first breakout cycle of 2017, Dogecoin adopted an identical trajectory. After an preliminary breakout and correction, the cryptocurrency launched into a parabolic rally, in the end peaking at $0.01855 in early 2018.

This peak aligned carefully with the 1.618 Fibonacci extension stage measured from the low of the previous bear market. The second breakout cycle occurred in 2021 and led to an much more dramatic value surge. Dogecoin reached an all-time excessive of $0.7316, surpassing the two.72 Fibonacci extension stage from the low of the earlier bear market.

Fractal Factors To One other Parabolic Rally For Dogecoin

Primarily based on the outcomes of earlier value motion, the present fractal sample means that Dogecoin could also be getting ready for the same rebound within the coming months. The extent of this rebound additionally hinges on the extent of the present correction. If the fractal breakout have been to repeat itself, the Dogecoin value may go on one other parabolic rally to the 1.618 or 2.272 Fib extension ranges, or someplace in between.

Based on Martinez, this might put the value targets anyplace between $4 on the 1.618 Fibonacci extension and $23 on the 2.272 Fibonacci extension.

As of now, Dogecoin is buying and selling at $0.326. A rally to $4 would symbolize a 1,126% improve from its present value, whereas a climb to $23 would symbolize a 6,955% improve.

Featured picture from CNET, chart from TradingView