Patrick Witt, the White House’s deputy director for digital-asset coverage and interim chief of the Pentagon’s Workplace of Strategic Capital, yesterday eliminated the ultimate doubt about Washington’s intentions for its newly created Strategic Bitcoin Reserve (SBR). In a fireplace chat on the Bitcoin Coverage Summit, Witt confirmed that “there will be the forthcoming report on the interagency activities,” including that the administration has “already taken some steps with the SBR. […] how do we follow that up with the accumulation plan.”

Bitcoin Accumulation In Movement

Witt defined why such a programme has migrated from white-paper idea to presidential coverage. “Bitcoin and the digital-assets ecosystem is an engine for economic growth,” he mentioned. “A strong economy enables everything else. We want to be the crypto capital of the world, and that includes both innovation on-chain and domestic mining.”

He then framed the asset as “a tool of modern statecraft,” arguing that the nation that shapes the following financial structure will wield affect corresponding to the USA’ post-1945 greenback hegemony. “If we’re not actively shaping and influencing what that new construct looks like,” he warned, “we’re going to be at a disadvantage.”

His third rationale was geopolitical: bitcoin’s borderless rails, he contended, lengthen monetary inclusion to “the billions who are unbanked or live under wildly irresponsible regimes,” thereby opening recent markets for US capital and reinforcing the attraction of dollar-denominated property.

Though Witt wore a digital-asset hat on stage, his different job—overseeing the Pentagon’s Workplace of Strategic Capital—hovered within the background. He reminded the viewers that OSC, a automobile initially seeded with $984 million in lending authority, now stands at 5 billion {dollars} and will attain $200 billion if Congress grants fairness powers.

Witt hinted that a few of that war-chest might move into bitcoin-adjacent power and compute infrastructure. “We want compute and energy to be domestic, secure, and abundant,” he mentioned, inviting miners and grid-modernisation corporations to view OSC as a possible lender of first resort relatively than final. “We’re open for business.”

Egan steered the dialog towards the sensible obstacles of embedding bitcoin in nationwide technique. Witt acknowledged the legislative gauntlet—“getting a seemingly innocuous bill across the finish line requires horse-trading and compromise”—however argued that trade itself can shorten the trail by appearing as a “trusted partner and objective resource” relatively than merely “selling their own book.” He famous that White House employees engaged on digital property is “thin,” making exterior analysis indispensable when drafting statutes or rule-makings that may survive contact with political actuality.

The deputy additionally painted a uncommon image of the day-to-day contained in the Government Workplace. The inter-agency report that may formalise the buildup plan—on account of land on the President’s desk in early July—has already absorbed enter from the Treasury, the Council of Financial Advisers, the Nationwide Safety Council and, crucially, OSC’s finance technologists. Witt described the doc as “the best policy product we can fashion within the realm of the possible,” language that implies its drafters imagine the plan can proceed with out recent appropriations.

Whereas yesterday’s remarks topped a collection of hints by Bo Hines—who has argued since March that Washington ought to “acquire as much bitcoin as we can responsibly get”—Witt’s place contained in the chain of command provides his phrases a pressure earlier signalling lacked. In analyst shorthand, Hines implied the need to build up; Witt confirmed the institutional equipment is clicking into gear.

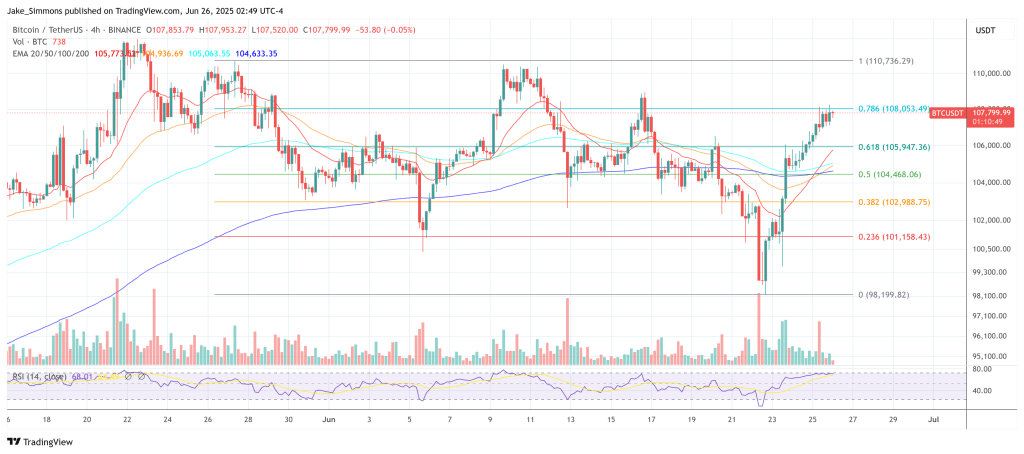

At press time, BTC traded at $107,799.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.