The BNB value has exhibited a comparatively sturdy degree of volatility over the previous few months — even when the crypto market has generally been sluggish. The altcoin began the yr’s second quarter preventing to carry above the necessary $500 degree, however has since regained a great quantity of bullish momentum.

The BNB value broke out of the uneven zone across the $600 mark in early Could, mirroring the more and more optimistic market sentiment in latest weeks. Nonetheless, the altcoin appears to be struggling to breach the $700 degree in its try to reclaim its all-time excessive value.

BNB Gearing Up For An Aggressive Wave Of Volatility

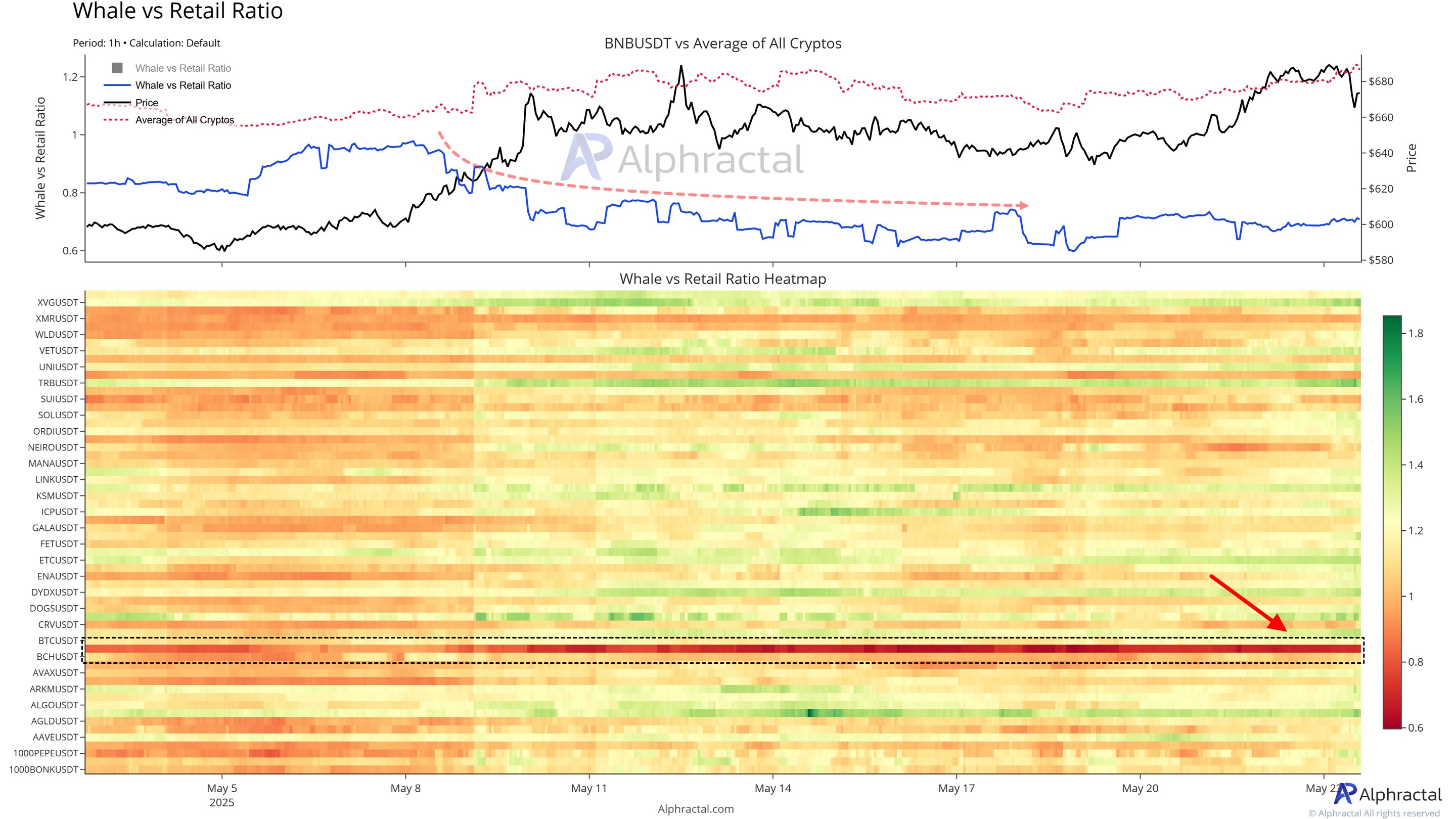

In a Could 23 submit on the X platform, funding knowledge agency Alpractal defined the potential components behind the latest sluggishness within the BNB value over the previous week. The on-chain analytics platform pinpointed a related class of traders as the main drivers behind BNB’s newest bearishness.

Within the BNB value situation, Alphractal regarded on the “Whale vs Retail Ratio,” an on-chain metric that measures the extent of publicity of whales to an asset in comparison with the retail traders. In accordance with knowledge from the market intelligence platform, the BNB whales, much more than different massive altcoin traders, have gotten more and more bearish than retail merchants.

Supply: @Alphractal on X

Moreover, Alphractal highlighted that the purchase stress for the BNB token has declined to decrease ranges in comparison with final week. Furthermore, contemplating the bullish impulse skilled by Bitcoin, the response of the BNB value prior to now week has been fairly tame relative to the remainder of the market.

In accordance with the on-chain analytics platform, the dwindling purchase stress may indicate aggressive short-term volatility for the BNB value. Along with whales’ propensity to quick the altcoin, this implies the worth of BNB is extra more likely to transfer within the downward path over the subsequent couple of days.

BNB Price At A Look

As of this writing, the worth of BNB stands at round $670, reflecting a 2% decline within the final 24 hours. The altcoin began Friday on an ascent, having fun with a fast rise towards the $690 mark within the early hours of the day.

The efficiency of the BNB chain’s native token on Friday is particularly worrisome, contemplating that the crypto market has lagged on most weekends in 2025. Nonetheless, the BNB value continues to be up by almost 3% prior to now seven days.

The value of BNB on the every day timeframe | Supply: BNBUSDT chart on TradingView

Featured picture from Shutterstock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.