Worldcoin and Hyperliquid rank among the many high two cryptocurrencies by weekly positive factors. CoinGecko information exhibits that WLD and HYPE gained almost 35% prior to now week. The 2 tokens might prolong their worth rally subsequent week.

Worldcoin (WLD) has rallied for seven consecutive weeks, seen within the WLD/USDT weekly worth chart. Within the final 24 hours, WLD gained almost 2% and almost 35% within the final seven days. Worldcoin’s rally is probably going pushed by a collection of bulletins from the Sam Altman-led AI agency relating to the mission’s enlargement plans.

Hyperliquid (HYPE) added 7% to its worth on the day, up almost 35% within the final seven days. The mission’s current positive factors are attributed to HYPE accumulation and demand from crypto elites like Arthur Hayes, former BitMEX CEO and co-founder of Maelstrom.

Worldcoin and Hyperliquid worth forecast

Worldcoin posted seven consecutive weeks of positive factors, and the rally continued this week. WLD worth might prolong its rally based on technical indicators on the weekly timeframe. A 32% enhance might push WLD to check psychologically vital resistance at $2.

RSI reads 51, crossing above the impartial degree at 50 and MACD flashes consecutively inexperienced histogram bars, signaling a constructive underlying momentum in WLD worth pattern.

Within the occasion of a flashcrash or market-wide correction, WLD might slip to help at $0.914.

The each day worth chart helps the same thesis with WLD focusing on resistance at $1.641, the decrease boundary of an FVG. This marks almost 8% climb for WLD from the present worth degree of $1.538.

The $0.835 help is vital to WLD because the AI token continues its upward pattern. RSI has crossed above 70, into the “overbought” zone and MACD alerts constructive underlying momentum in WLD worth pattern.

WLD faces resistance at $2, marked as R2 on the WLD/USDT each day worth chart.

HYPE is 13% away from its closest resistance, at R1, marked by $40 on the each day timeframe. HYPE began its upward pattern on April 7, 2025. The token might discover help at $32 within the occasion of a correction.

Momentum indicators on the each day timeframe help additional positive factors in HYPE, RSI climbed in direction of 83 and is sloping upwards. MACD is flashing inexperienced histogram bars above the impartial line, signaling the underlying constructive momentum in HYPE worth pattern.

The 2024 peak of $42.252 is a key goal for HYPE, it comes into play as soon as the token flips resistance at $40 into help.

WLD and HYPE on-chain evaluation

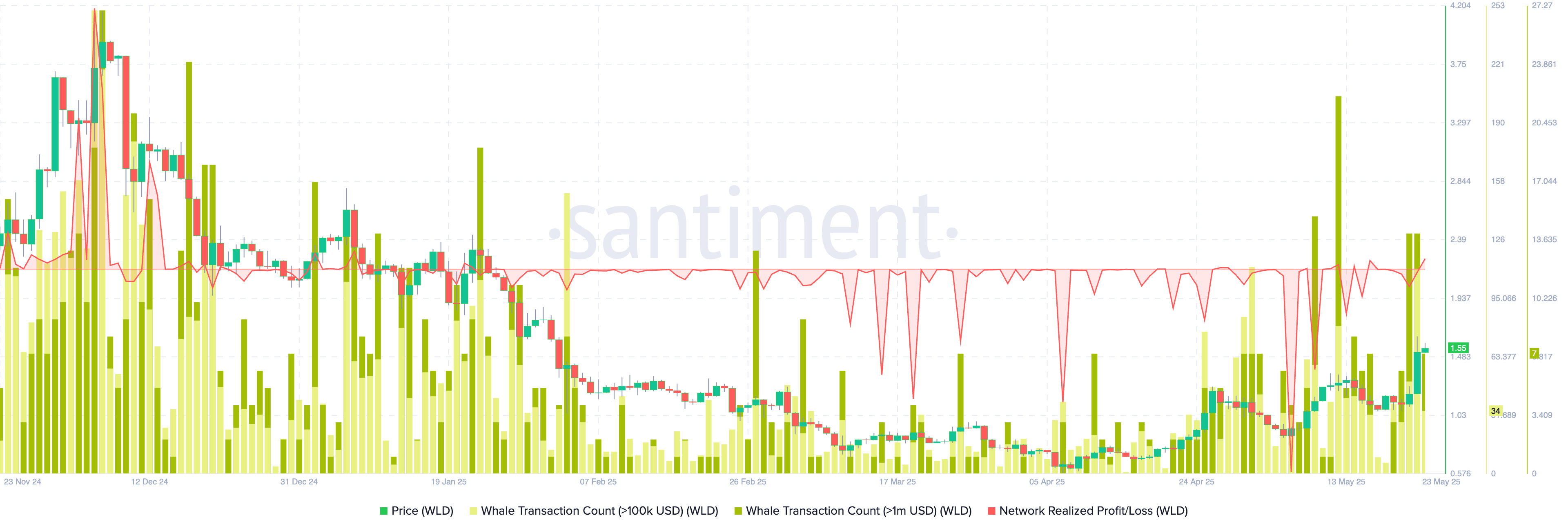

Worldcoin’s on-chain indicators help a bullish thesis for WLD within the coming weeks. Community realized revenue and loss, a metric that identifies the web revenue/lack of all tokens moved on a given day exhibits constant loss realization from merchants all through the primary a part of 2025.

NPL exhibits possible capitulation in WLD, sometimes adopted by a rise in a token’s worth. The whale transaction depend in two segments, valued at $100,000 and $1 million and better exhibits spikes this week.

Giant pockets traders moved their WLD tokens realizing positive factors on their holdings, in a comparatively small quantity in comparison with the depend of merchants taking losses prior to now few weeks. This exhibits promoting stress on WLD is comparatively low and there may be scope for worth achieve subsequent week.

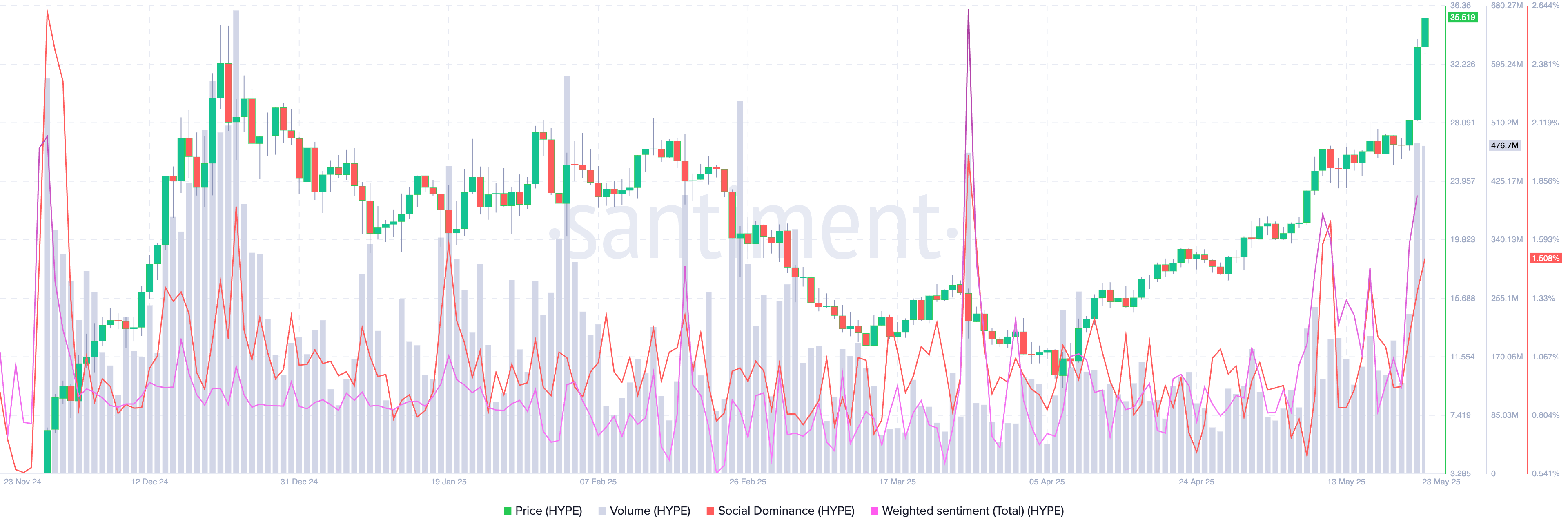

Hyperliquid’s on-chain metrics present a spike in commerce quantity, weighted sentiment and social dominance alongside the rally. HYPE worth rallied this week, driving up the share of HYPE’s mentions throughout social media platforms and weighted sentiment turned more and more constructive.

Whereas a spike is famous in social dominance and weighted sentiment, it stays comparatively low when in comparison with the massive constructive spike noticed in March 2025. This was adopted by a correction in HYPE and the token began its upward pattern within the second week of April 2025.

Derivatives merchants bullish on HYPE rally, WLD hype fades

Derivatives information from Coinglass exhibits that lengthy/brief ratio exceeds 1 for HYPE. This suggests merchants are bullish on achieve in HYPE worth, and brief positions dominate liquidations within the 24 hour timeframe.

The overall liquidations for the final 24 hours are $940,000, a majority of brief positions paid for longs, based on Coinglass information.

The futures open curiosity chart for HYPE exhibits that OI is at its highest degree since December 2024. OI has climbed to $1.16 billion, in the course of the ongoing worth rally and this marks the overall worth of open derivatives contracts in HYPE.

Worldcoin derivatives information evaluation exhibits almost 50% enhance in OI within the final 24 hours. Much like HYPE, brief liquidations exceed lengthy and the overall quantity of liquidations stands above $7 million.

The lengthy/brief ratio is beneath 1 and exhibits derivatives merchants is probably not as bullish on WLD worth achieve and sidelined patrons ought to train warning when opening a commerce within the AI token.

Catalysts driving positive factors in WLD and HYPE

For WLD, one of many largest catalysts is the announcement of Worldcoin’s enlargement and the direct token sale to a16z and Bain Capital Crypto. Information of a direct buy of $135 million in WLD has fueled a bullish sentiment amongst merchants.

By means of its official account, the Worldcoin workforce mentioned that the funding was a direct buy of non-discounted tokens, by two of the “earliest backers” of the mission.

Hyperliquid has made a number of bulletins about bridges constructed to switch tokens to the HYPE ecosystem, new listings and partnerships. Nonetheless, a current tweet from Maelstrom co-founder Arthur Hayes has supported the social media mentions of HYPE.

Early on Friday, Messari Crypto reported {that a} Hyperliquid short-seller acquired liquidated for $23 million because the token posted almost 90% positive factors.

Tether and its associate Plasma Basis energy zero-fee stablecoin transfers and the initiative was prolonged to the Hyperliquid trade, including to the checklist of catalysts.

The on-chain perpetual trade’s new listings, partnerships and the arrival of zero-fee stablecoin transfers in its ecosystem are at the moment the biggest catalysts driving positive factors in HYPE token.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.