Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

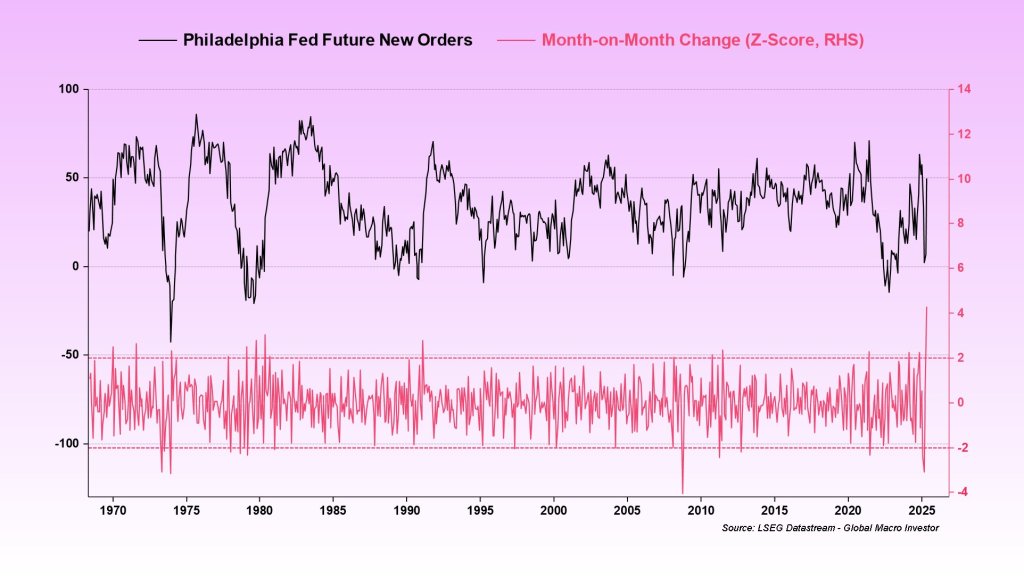

An unprecedented surge within the Philadelphia Federal Reserve’s Could Manufacturing Enterprise Outlook Survey has jolted world danger markets and given crypto asset merchants their clearest macro catalyst of the yr. The Future New Orders diffusion index leapt by forty-plus factors, a transfer that Julien Bittel, head of macro analysis at World Macro Investor (GMI), known as “literally” historic.

Crypto Bulls Can Rejoice

Bittel’s commentary on X framed the print with statistical precision: “Philly Fed data for May dropped yesterday – and the Future New Orders index just made history. Literally. … Expectations for new orders posted the largest monthly spike ever recorded – going all the way back to the index’s inception in May 1968. A staggering +4.3 standard deviation move. He underlined the shock with a comparison few macro watchers will forget: For perspective: that’s an even bigger move up than the downside collapse during the depths of the 2008 Global Financial Crisis (-4.1σ). Let that sink in…”

Bittel then set the surge in a broader narrative that has animated his analysis since late final yr. “Q1 growth was weak. The reason is straightforward – financial conditions tightened sharply in Q4. The dollar ripped, bond yields surged… a classic tightening phase,” he wrote.

Associated Studying

The proximate set off, in his telling, was “businesses panic‑loading inventories ahead of Trump tariffs, and markets front‑running the inflation narrative.” These dynamics, he argued, are a replay of Donald Trump’s first time period: “We’ve highlighted repeatedly: this had all the hallmarks of Q4 2016 during Trump’s first term. Just like early 2017, that tightening spilled over into slower growth momentum in Q1.”

The place 2017 started with doubt and resulted in a synchronous world growth, Bittel believes 2025 is rhyming. “Those Q1 headwinds have flipped into Q2 tailwinds,” he insisted. “Everything flows downstream from changes in financial conditions… Purchasing managers’ expectations are shifting – and shifts in thinking eventually translate into action. Sentiment shifts first. Action follows. It always does. Bullish.”

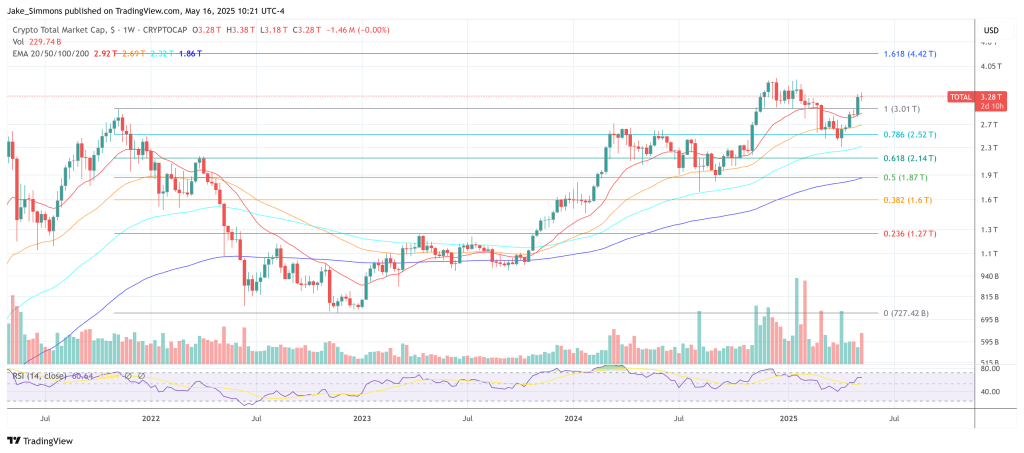

The crypto market responded muted. Bitcoin reclaimed the $104,000 stage in early‑European commerce, however misplaced it afterward. Ether steadied close to $2,600, and excessive‑beta layer‑one tokens resembling Solana and Avalanche moved in tandem.

Associated Studying

Giancarlo Cudrig, head of markets at Immutable, mentioned the size of the shock is much less essential than how underneath‑positioned buyers are for an upside development shock. “An upside economic shock like this – +4.3σ on new orders – is rare. But the bigger story is market positioning. Asset prices are not prepared. The melt‑up is the asymmetric risk. Now it’s being repriced.”

Impartial analyst Market Heretic struck the same notice on X: “When this dropped, markets didn’t even blink. Because the shift’s already in motion. This wasn’t news, it was confirmation. That’s the real tell, when markets shrug off a four‑sigma upside shock. It means the turn is already upon us – and it’s just getting started.”

For crypto buyers, the implications are rapid. A softer greenback and retreating actual‑yield expectations cut back the chance value of holding non‑yielding belongings, whereas the early section of a reflationary flip traditionally favours excessive‑beta exposures. Bittel’s personal playbook is unambiguous: “Sentiment shifts first. Action follows.” So long as that chain response continues, the crypto bulls seem to have each math and momentum on their facet.

At press time, the full crypto market cap stood at $3.28 trillion.

Featured picture created with DALL.E, chart from TradingView.com