Strategy has stored up its aggressive Bitcoin shopping for. In line with firm govt Michael Saylor, the agency snapped up a recent 13,390 BTC for about $1.34 billion, paying a median of $99,856 per coin. That pushes the corporate’s complete to 568,840 BTC. It’s an enormous pile—about 2.7% of Bitcoin’s 21 million‐coin cap.

Main Bitcoin Purchase At Almost 100K

Based mostly on stories, Strategy’s newest buy sits just below the $100,000 mark per bitcoin. They spent $1.34 billion this time. That’s not the primary large purchase in 2025. On Could 5 they paid $95,167 for 1,895 BTC, and on April 28 they picked up 15,355 BTC at $92,737 every. It exhibits they’re shopping for at completely different worth ranges. But every purchase is shut sufficient to $100K to seize headlines.

Common Price On The Rise

Strategy’s common worth per coin has climbed from $68,550 to $69,287. That shift issues. A better price foundation means they want even larger worth strikes simply to interrupt even. Peter Schiff, a effectively‐identified gold advocate, warned that their subsequent buy may nudge that common above $70,000. He argues that if Bitcoin falls beneath their weighted price, small paper losses flip into actual losses as soon as they promote.

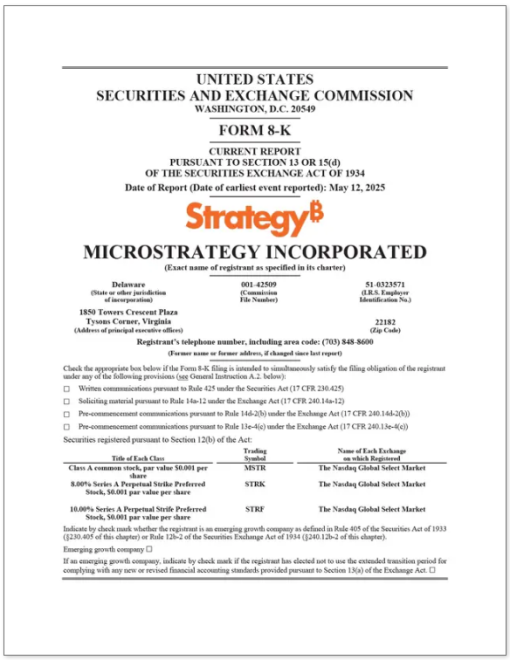

Strategy has acquired 13,390 BTC for ~$1.34 billion at ~$99,856 per bitcoin and has achieved BTC Yield of 15.5% YTD 2025. As of 5/11/2025, we hodl 568,840 $BTC acquired for ~$39.41 billion at ~$69,287 per bitcoin. $MSTR $STRK $STRF

— Michael Saylor (@saylor) Could 12, 2025

Fast Returns On Latest Buys

The corporate highlights a 15.5% Bitcoin yield for the yr up to now. That “yield” is admittedly simply the acquire between immediately’s spot worth and their price foundation. For instance, the Could 5 purchase has already earned about $16.8 million in simply six days—a 9.32% acquire. And the April 28 buy exhibits a revenue of round $177.1 million, or 12.47%. Even the smaller April 14 lot of three,459 BTC at $82,618 has made $74 million, or 25.88%.

Debt Dangers And Market Weight

It’s price noting that Strategy didn’t pay money outright. They used a mixture of debt and fairness. That amps up the stakes if Bitcoin dips. Round $39.41 billion has been spent up to now at a median of $69,287 a coin. At immediately’s worth—hovering close to $104,000—the holding is price about $59.2 billion, or roughly $19.8 billion in unrealized good points. But when costs retreat, these good points may shrink quick.

Strategy’s relentless shopping for additionally takes cash off the open market. With every giant buy, fewer cash are left on exchanges. Some analysts say that may tighten provide and help costs. Others argue the true check will come when markets flip. If demand cools and holders begin promoting, even large gamers like Strategy will really feel the warmth.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.