Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

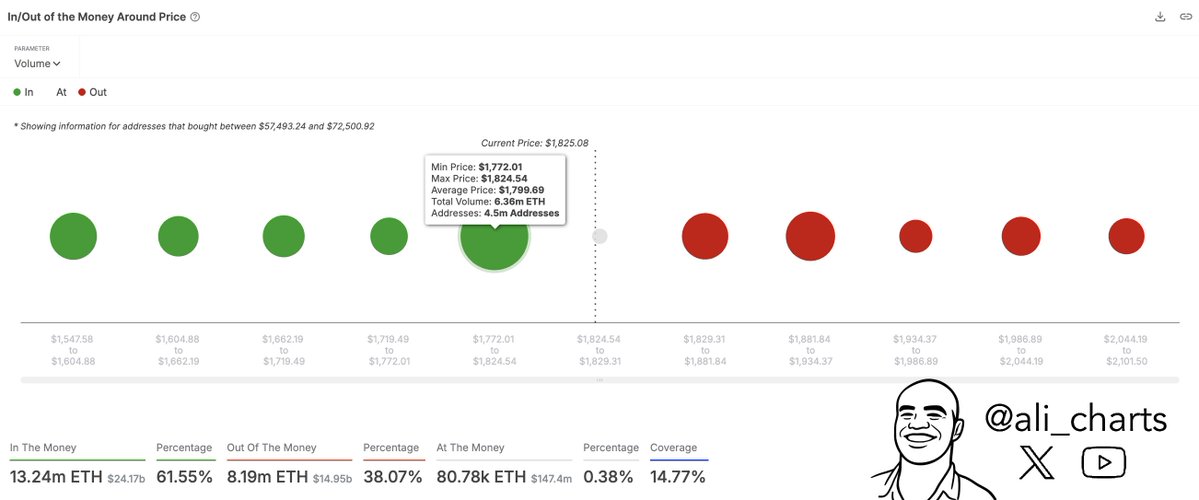

The fast burst of bullish momentum within the crypto market within the closing weeks of April noticed the Ethereum value shut the month above $1,800. Nonetheless, the altcoin failed to finish the month in revenue, making April its fourth consecutive month with a damaging efficiency. In line with the newest on-chain information, the Ethereum value appears to be sitting above an important help degree, which may decide the altcoin’s trajectory over the following few weeks.

ETH Price At Threat Of Falling To $1,772

In a Could 3 put up on the X platform, distinguished crypto analyst Ali Martinez revealed that the worth of Ethereum is likely to be at a important juncture that would resolve its short-term future. Based mostly on the newest on-chain information, the altcoin is prone to falling to round $1,500 ought to it lose this help degree within the coming days.

This on-chain analysis of the Ethereum value revolves across the common price bases of a number of Ethereum buyers. In crypto buying and selling, cost-basis evaluation determines a value degree’s capability to function help or resistance based mostly on the amount of cash final acquired by buyers within the area.

Associated Studying

As proven within the above chart, the dimensions of the dot (inexperienced and purple) represents and immediately corresponds to the variety of Ether tokens purchased inside a value area. The bigger the circle, the upper the quantity of tokens purchased in and across the value zone, and the stronger the resistance or help degree.

In line with information from IntoTheBlock, greater than 6.36 million ETH tokens have been bought by 4.5 million addresses inside the value vary of $1,772 and $1,824 (at a median value of $1,799). As defined earlier, the excessive shopping for exercise inside this value zone has led to the formation of a serious help degree simply beneath the present value.

The Ethereum value is predicted to bounce again when it falls to this degree. The rationale behind this expectation is that when the ETH value returns to round $1,772, buyers with their price bases in and round this degree are prone to defend their positions by shopping for extra tokens, serving to the worth to remain afloat the help area.

Nonetheless, the highlighted chart exhibits that the worth ranges beneath the $1,772 help degree have considerably much less investor exercise. This means that the Ethereum value may fall to round $1,500 with out catching a break if $1,772 is breached. On the flip aspect, the worth of ETH may journey to as excessive as $2,100 if this help degree stays unbreached, as no important resistance lies forward.

Ethereum Price At A Look

As of this writing, the ETH token is valued at round $1,830, reflecting an virtually 1% enhance up to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView