Institutional possession of Bitcoin has surged over the previous 12 months, with round 8% of the full provide already within the fingers of main entities, and that quantity continues to be climbing. ETFs, publicly listed corporations, and even nation-states have begun securing substantial positions. This raises vital questions for buyers. Is this rising institutional presence a very good factor for Bitcoin? And as extra BTC turns into locked up in chilly wallets, treasury holdings, and ETFs, is our on-chain information shedding its reliability? On this evaluation, we dig into the numbers, hint the capital flows, and discover whether or not Bitcoin’s decentralized ethos is really in danger or just evolving.

The New Whales

Let’s begin with the Treasury of Public Listed Firms desk. Main corporations, together with Technique, MetaPlanet, and others, have collectively accrued greater than 700,000 BTC. Contemplating that Bitcoin’s complete hard-capped provide is 21 million, this represents roughly 3.33% of all BTC that can ever exist. Whereas that offer ceiling received’t be reached in our lifetimes, the implications are clear: the establishments are making long-term bets.

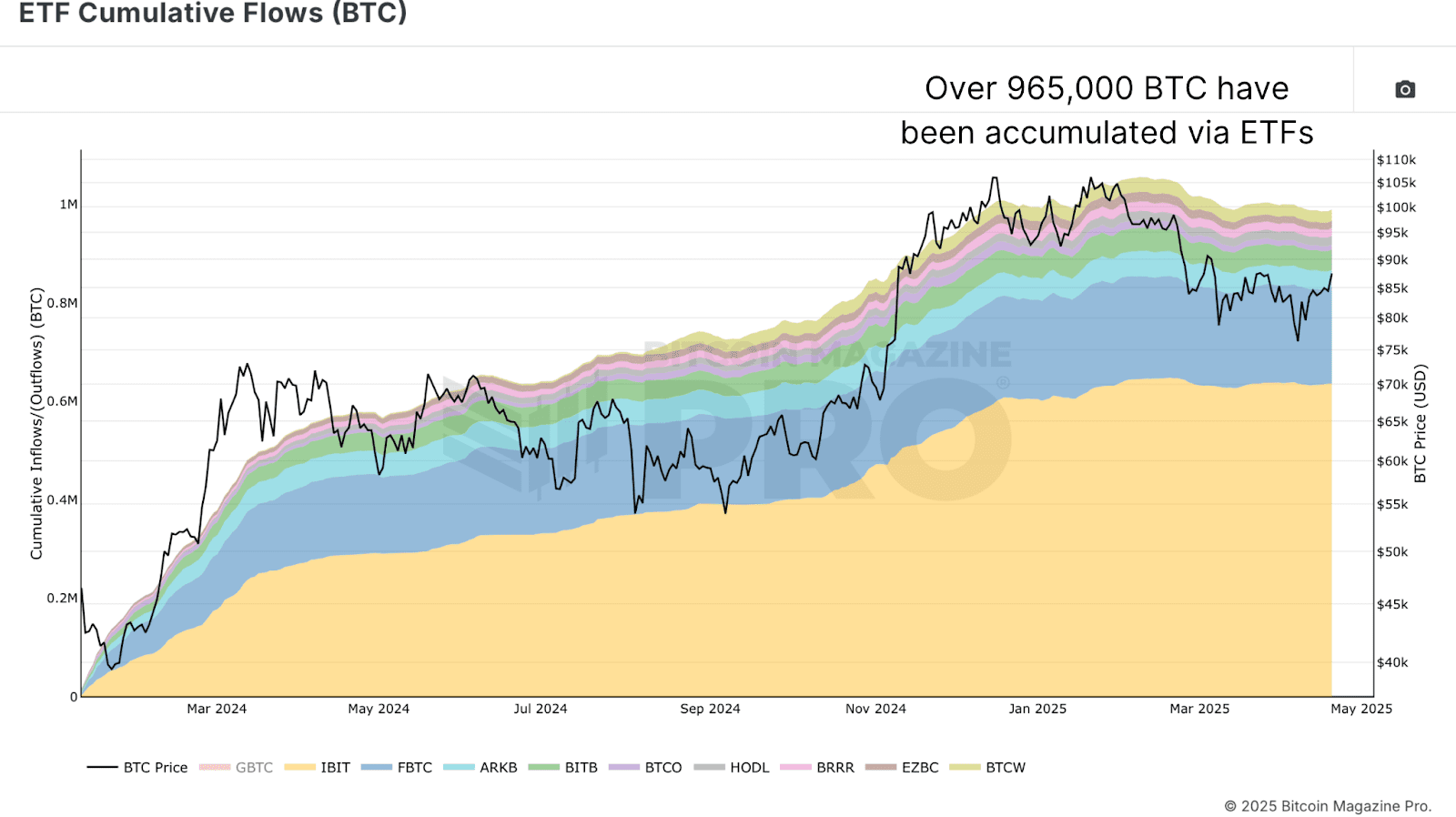

Along with direct company holdings, we will see from the EFT Cumulative Flows (BTC) chart that ETFs now management a major slice of the market as properly. On the time of writing, spot Bitcoin ETFs maintain roughly 965,000 BTC, just below 5% of the full provide. That determine fluctuates barely however stays a serious drive in every day market dynamics. After we mix company treasuries and ETF holdings, the quantity climbs to over 1.67 million BTC, or roughly 8% of the full theoretical provide. However the story doesn’t cease there.

Past Wall Avenue and Silicon Valley, some governments at the moment are lively gamers within the Bitcoin area. Via sovereign purchases and reserves underneath initiatives just like the Strategic Bitcoin Reserve, nation-states collectively maintain roughly 542,000 BTC. Add that to the earlier institutional holdings, and we arrive at over 2.2 million BTC within the fingers of establishments, ETFs, and governments. On the floor, that’s about 10.14% of the full 21 million BTC provide.

Forgotten Satoshis and Misplaced Provide

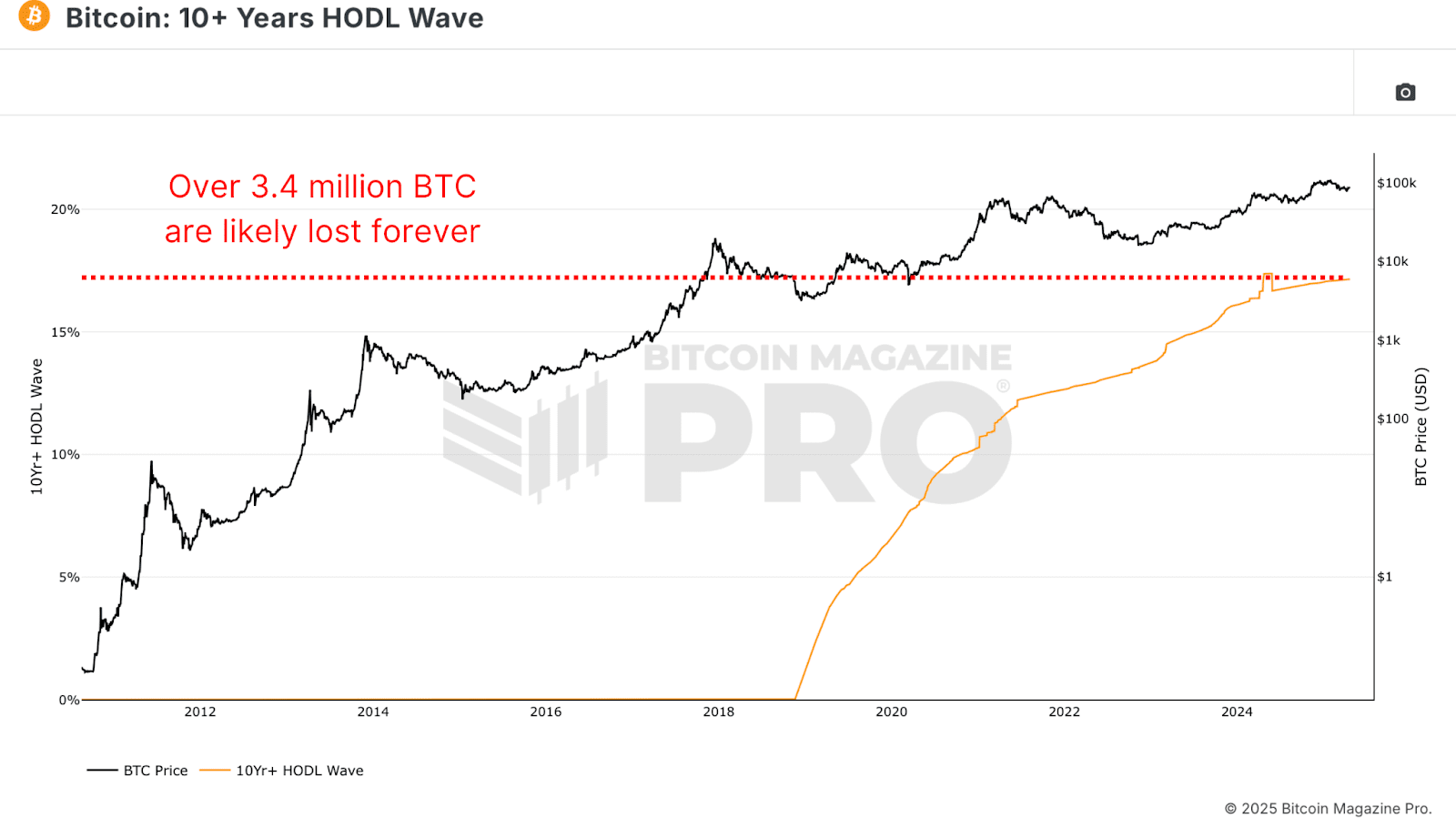

Not all 21 million BTC are literally accessible. Estimates primarily based on 10+ Years HODL Wave information, a measurement of cash that haven’t moved in a decade, recommend that over 3.4 million BTC are possible misplaced ceaselessly. This consists of Satoshi’s wallets, early mining-era cash, forgotten phrases, and sure, even USBs in landfills.

With roughly 19.8 million BTC at present in circulation and roughly 17.15% presumed to be misplaced, the efficient provide is nearer to 16.45 million BTC. That radically modifications the equation. When measured in opposition to this extra life like provide, the share of BTC held by establishments rises to roughly 13.44%. Which means roughly one in each 7.4 BTC accessible to the market is already locked up by establishments, ETFs, or sovereigns.

Are Institutions Controlling Bitcoin?

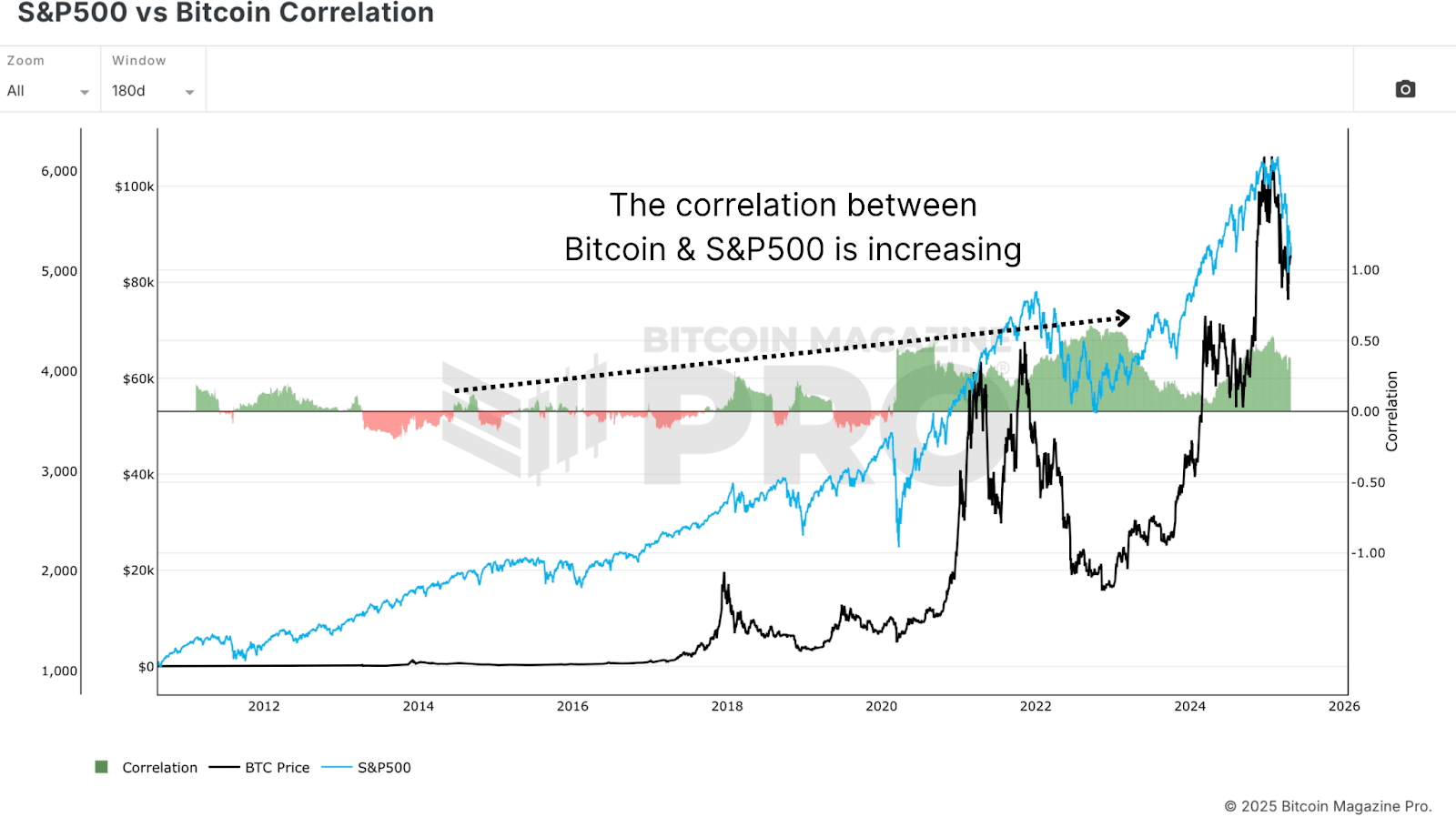

Does this imply Bitcoin is being managed by firms? Not but. However it does sign a rising affect, particularly in value habits. From the S&P 500 vs Bitcoin Correlation chart, it’s evident that the correlation between Bitcoin and conventional fairness indexes just like the S&P 500 or Nasdaq has tightened considerably. As these massive entities enter the market, BTC is more and more seen as a “risk-on” asset, which means its value tends to rise and fall with broader investor sentiment in conventional markets.

This may be helpful in bull markets. When world liquidity expands and threat property carry out properly, Bitcoin now stands to draw bigger inflows than ever earlier than, particularly as pensions, hedge funds, and sovereign wealth funds start allocating even a small share of their portfolios. However there’s a trade-off. As institutional adoption deepens, Bitcoin turns into extra delicate to macroeconomic situations. Central financial institution coverage, bond yields, and fairness volatility all begin to matter greater than they as soon as did.

Regardless of these shifts, greater than 85% of Bitcoin stays exterior institutional fingers. Retail buyers nonetheless maintain the overwhelming majority of the provision. And whereas ETFs and firm treasuries could hoard massive quantities in chilly storage, the market stays broadly decentralized. Critics argue that on-chain information is turning into much less helpful. In spite of everything, if a lot BTC is locked up in ETFs or dormant wallets, can we nonetheless draw correct conclusions from pockets exercise? This concern is legitimate, however not new.

Must Adapt

Traditionally, a lot of Bitcoin’s buying and selling exercise has occurred off-chain, notably on centralized exchanges like Coinbase, Binance, and (as soon as upon a time) FTX. These trades not often appeared on-chain in significant methods however nonetheless influenced value and market construction. Today, we face an analogous scenario, solely with higher instruments. ETF flows, company filings, and even nation-state purchases are topic to disclosure laws. In contrast to opaque exchanges, these institutional gamers usually should disclose their holdings, offering analysts with a wealth of information to trace.

Furthermore, on-chain analytics isn’t static. Tools just like the MVRV-Z rating are evolving. By narrowing the main focus, say, to an MVRV Z-Rating 2YR Rolling common as a substitute of full historic information, we will higher seize present market dynamics with out the distortion of long-lost cash or inactive provide.

Conclusion

To wrap it up, institutional curiosity in Bitcoin has by no means been larger. Between ETFs, company treasuries, and sovereign entities, over 2.2 million BTC are already spoken for, and that quantity is rising. This flood of capital has undoubtedly had a stabilizing impact on value in periods of market weak point. Nonetheless, with that stability comes entanglement. Bitcoin is turning into extra tied to conventional monetary programs, rising its correlation to equities and broader financial sentiment.

But this doesn’t spell doom for Bitcoin’s decentralization or the relevance of on-chain analytics. The truth is, as extra BTC is held by identifiable establishments, the power to trace flows turns into much more exact. The retail footprint stays dominant, and our instruments have gotten smarter and extra attentive to market evolution. Bitcoin’s ethos of decentralization isn’t in danger; it’s simply maturing. And so long as our analytical frameworks evolve alongside the asset, we’ll be well-equipped to navigate no matter comes subsequent.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising group of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.