The Circle IPO, the group behind USDC, is taking its shot on the inventory market. The firm has filed for an IPO on the NYSE below the ticker “CRCL.”

This transfer underscores Circle’s guess on enhancing rules and its drive to form the way forward for digital finance.

(supply)

Robust Income Development For Circle IPO however Declining Revenue

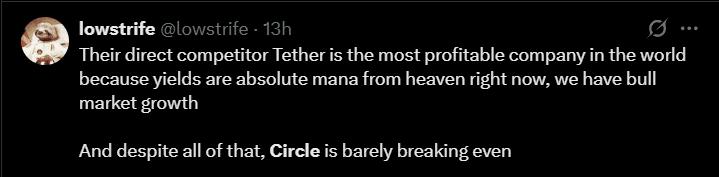

Circle reported $1.67 billion in 2024 income, up 16%, fueled largely by curiosity from USDC reserves saved in Treasury payments and BlackRock funds. But, rising prices weighed heavy, slashing internet revenue by 41.8% to $155.6 million. Out of pocket? $908 million paid to Coinbase to safe USDC’s grip in the marketplace.

Nick van Eck, CEO of Agora, famous the dynamic between the 2 corporations, stating: “Coinbase is making more money on USDC than Circle, which underscores why Circle’s profitability has taken a hit.”

(supply)

Regardless of this decline, Circle stays a frontrunner within the stablecoin market, with over $60 billion value of USDC in circulation.

Circle’s Relationship with Coinbase

One of many standout particulars in Circle’s submitting is its shut monetary relationship with Coinbase. These distribution prices are a double-edged sword for Circle. Whereas they guarantee USDC stays probably the most extensively used stablecoins, additionally they eat into Circle’s backside line.

Matthew Sigel, head of digital asset analysis at VanEck, commented: “The high fees show why revenue is growing, but it also caps net income. Circle has to balance growth with profitability as it prepares to go public.”

(supply)

A Well timed IPO And Crypto Stock Amid Regulatory Optimism

This IPO submitting comes because the crypto business finds itself in a uniquely favorable U.S. regulatory local weather. Since taking workplace, President Donald Trump has set his sights on making america a world chief in digital belongings.

Circle’s 2025 IPO is greater than a company milestone; it’s a bellwether for crypto’s shift into the mainstream. With rumors of Kraken and BitGo eyeing public listings, the transfer underscores a broader business push for legitimacy.

The ripple results may not cease at Wall Road. Circle’s regulatory win in Japan, changing into the primary permitted stablecoin issuer there, indicators a world playbook for crypto adoption and oversight.

DISCOVER: Best Meme Coin ICOs to Put money into April 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- With its Circle USDC Web Group IPO 2025, the corporate is setting the stage to drive transparency and investor confidence within the crypto area.

- With rumors of Kraken and BitGo eyeing public listings, the transfer underscores a broader business push for legitimacy.

- Will Circle’s ambition repay? Solely time will inform, however all eyes are on this historic transfer.

The put up Circle IPO Could Be The Biggest Crypto Stock Launch of 2025: Everything to Know appeared first on 99Bitcoins.