Tether, the issuer of USDT, is stockpiling Bitcoin in 2025. Is this a strategic transfer to guard in opposition to a USDT depeg? In 2021, USDC depegged and couldn’t restore the peg instantly as a result of banks have been closed.

The world’s largest multichain stablecoin by market cap—has been aggressively accumulating Bitcoin over the previous few months.

Tether Stockpiling Bitcoin: Is This A Strategic Transfer?

In line with Arkham information, in Q1 2025, Tether, which has additionally invested in Bitcoin mining operations in Paraguay, purchased 8,888 BTC, bringing its whole holdings to 100,521 BTC.

(Supply)

At this tempo, Tether, a personal agency whose shares are usually not traded on any alternate, is among the many largest BTC holders, trailing Technique (previously MicroStrategy). Nonetheless, it holds extra BTC than Tesla.

This huge accumulation of BTC is why some on X consider the transfer is strategic and will considerably profit the USDT issuer in case of a depeg.

Will Tether Promote Bitcoin If USDT Depegs?

In a publish, an analyst mentioned the choice to stockpile Bitcoin is “something underappreciated.”

One thing underappreciated about Tether is that if USDT ever goes quickly off-peg (like what occurred with USDC), they’ve 7.8bn in BTC to spend immediately to take care of the peg

Whereas circle has all their cash in banks, so repegging might take for much longer (switch delays)

— 0xngmi (@0xngmi) April 2, 2025

If USDT, which at present has a market cap of over $144 billion, depegs, Tether might rapidly promote a few of its BTC at spot charges and restore the peg with out delays.

He cites the USDC depeg of March 2023, through which Circle waited two days for banks to reopen earlier than parity was restored.

In contrast to its competitor, the analyst thinks Tether might promote a part of its Bitcoin holdings to revive a depeg with out inflicting panic within the crypto buying and selling group.

Nonetheless, till a depeg occasion happens—like after the Terra collapse in 2022 when USDT briefly fell to $0.96 or when FTX collapsed, forcing USDT to $0.971—it stays unknown whether or not Tether would promote Bitcoin as its first line of protection.

The Tether Bitcoin Reserve

Tether claims all USDT in circulation is backed by money and different liquid equivalents, similar to U.S. Treasury holdings. Nonetheless, no official audit has confirmed the belongings in its reserve. If something, there isn’t a discounting that they is perhaps holding a number of the finest meme cash to put money into 2025.

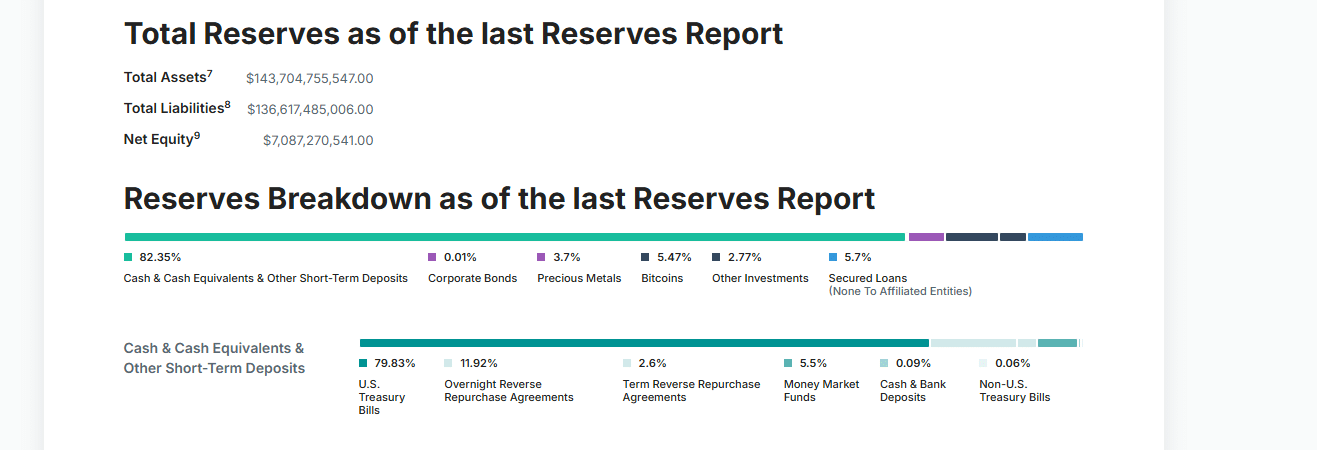

From the Tether Transparency web page, the issuer holds 82.35% in money and money equivalents, together with short-term U.S. Treasuries, as a part of its reserve. Secured loans comprise 5.7% of the full reserve, whereas Bitcoin makes up 5.47%.

(Supply)

For now, if USDT depegs, Tether would possibly liquidate its Treasuries earlier than unloading Bitcoin. This transfer shall be as a result of Treasuries are extra liquid than BTC.

On the identical time, promoting Bitcoin in a disaster would possibly destabilize the market additional, exacerbating the issue and probably inflicting extra liquidity points within the crypto market.

Is Bitcoin The Approach?

Even so, Tether is dedicated to stacking BTC, which is comparatively illiquid and extra risky than Treasuries. They are doubtless holding Bitcoin as a long-term funding quite than an emergency liquidity buffer, cementing its place as among the finest cryptos to purchase.

It’s also strategic. With the US prioritizing the creation of correct stablecoin legal guidelines and establishing a crypto and Bitcoin reserve, Tether is aligning with key developments.

This strategy will proceed regardless of JPMorgan claiming that a few of Tether’s reserves would possibly embrace non-compliant belongings like valuable metals and company debt.

JPM analysts are salty as a result of they do not personal Bitcoin.

— Paolo Ardoino

(@paoloardoino) February 13, 2025

In response, Tether dismissed these considerations, saying JP Morgan is “salty” and doesn’t personal sufficient BTC.

DISCOVER: 9 Excessive-Danger Excessive-Reward Cryptos for 2025

Tether Bitcoin Technique: Will It Promote BTC if USDT Depegs?

- Tether Bitcoin Holdings exceeds 100,000 BTC

- Will Tether promote Bitcoin if USDT depegs?

- USDT issuer reserves primarily include liquid treasuries and money

- BTC is a strategic holding as crypto adoption picks up momentum within the U.S.

The publish Is This The Real Reason Why Tether Is Buying Bitcoin? appeared first on 99Bitcoins.