Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

XRP is buying and selling above essential assist ranges and displaying indicators of energy because the broader crypto market struggles with persistent promoting stress and macroeconomic headwinds. Whereas many digital property have suffered steep corrections in latest weeks, XRP has remained one of the vital resilient performers, holding above key technical zones and attracting rising investor curiosity.

Associated Studying

With market sentiment slowly recovering, many merchants are eyeing XRP as a possible chief within the subsequent wave of features. Analysts imagine that after the market stabilizes, XRP could possibly be among the many first altcoins to rally again towards earlier highs. This optimism is supported by recent on-chain knowledge.

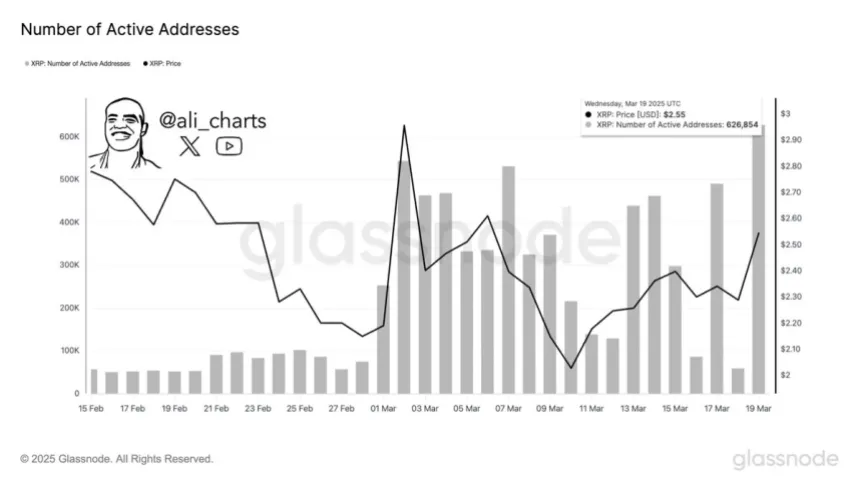

In line with metrics from Glassnode, the XRP community has recorded practically 627,000 lively addresses. This surge in community utilization suggests rising curiosity and adoption, a bullish signal that always precedes worth acceleration. Excessive handle exercise usually signifies extra customers interacting with the community, whether or not by means of transactions, accumulation, or buying and selling.

If the broader market circumstances enhance, this spike in exercise might gas additional upside for XRP. Because it stands, XRP is positioned nicely above its key assist vary and appears primed for a breakout as soon as bullish momentum returns to the market.

XRP Community Exercise Surges Bulls Defend Key Levels

Macroeconomic uncertainty and surging volatility proceed to shake each the crypto and equities markets, fueling widespread worry and triggering panic promoting throughout asset lessons. U.S. commerce conflict issues, inflationary stress, and erratic coverage strikes have stored traders on edge, resulting in deep corrections in most cryptocurrencies. But, amid this uncertainty, XRP stands out with stunning resilience.

Associated Studying

In comparison with main altcoins like Solana and Ethereum, which have each suffered notable losses, XRP stays at a powerful technical stage. Bulls have managed to defend key demand zones, and the present focus is on reclaiming important provide areas to validate a brand new uptrend. The asset’s capability to carry assist regardless of market-wide weak spot has caught the eye of analysts and traders alike.

High analyst Ali Martinez shared on-chain knowledge from Glassnode, revealing that XRP’s community exercise is surging. With practically 627,000 lively addresses—the best since April 2023—XRP exhibits indicators of renewed adoption and utilization. Traditionally, spikes in lively addresses correlate with bullish momentum, as rising participation usually displays investor confidence and transactional demand.

If XRP maintains its assist base and continues to point out energy in community fundamentals, it could possibly be one of many first altcoins to interrupt out as soon as market sentiment recovers. The rise in lively addresses could also be an early indicator {that a} bigger transfer is on the horizon.

Price Holds Robust After Small Rally — Eyes Set on $3 Breakout

XRP is buying and selling at $2.41 after a risky few days of sharp swings between assist and resistance. The token surged over 33% from its latest low at $1.89, displaying robust bullish momentum regardless of market-wide uncertainty. This rebound has positioned XRP among the many top-performing property within the crypto area, attracting renewed consideration from merchants and analysts.

The $2.30 stage now stands as a key short-term assist zone. If XRP holds above this stage, bulls are prone to push towards the psychological $3 mark, which additionally aligns with a historic resistance space. A clear breakout above $3 might open the door for a rally towards vary highs and probably new all-time highs, relying on broader market sentiment.

Nevertheless, if XRP fails to keep up assist at $2.30, a pullback into decrease demand zones across the $2.00 and even $1.89 ranges is feasible. This may possible gradual the tempo of any restoration and improve promoting stress within the quick time period.

Associated Studying

For now, XRP’s worth construction stays bullish, however sustaining momentum will depend upon holding above key ranges because the broader market stabilizes. All eyes are on the subsequent transfer.

Featured picture from Dall-E, chart from TradingView