Why is crypto down right this moment? Effectively, not right this moment, precisely. Nevertheless it has been over the previous couple of days. Santa Clause rally be damned!

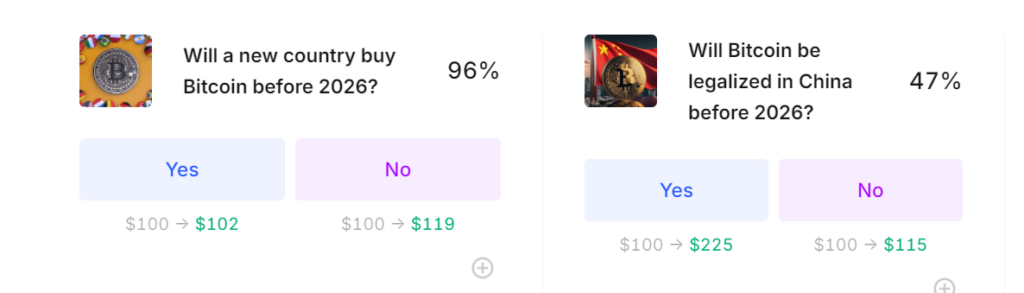

Crypto markets are bracing for a seismic shift, with platforms like Polymarket and Kalshi hinting that 2025 would possibly redefine every thing. Bitcoin (BTC)

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

and Ethereum (ETH)

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

are tipped to shatter information.

On the similar time, anticipated regulatory overhauls may redraw the U.S. crypto panorama, shaking up how these property are traded and secured.

Betting market Kalshi places Bitcoin’s probabilities of hovering previous $125,000 in 2025 at a stable 60%, with Ether trailing however nonetheless more likely to clear $5,000. Polymarket gamers maintain the road barely decrease however stay bullish, giving Bitcoin 50/50 odds of breaking $120,000 by March 2025.

With all-time highs of $108,300 for Bitcoin and $4,720 for Ether, these projected milestones may cement their roles as heavyweight contenders within the world monetary enviornment.

Why is Crypto Down Today? Bitcoin and Ether Goal New Data

The push for cryptocurrency-based ETFs is fueling bullish momentum. Polymarket odds present a robust probability that U.S. regulators will approve ETFs for XRP (75%), Solana (69%), and Litecoin (51%) by mid-2025, whereas Dogecoin lags behind with a modest 22% shot. These ETFs may lure conventional traders with regulatory security nets, injecting contemporary liquidity and dashing up adoption throughout the market.

One of many extra intriguing developments is the hypothesis round a strategic Bitcoin reserve. Kalshi signifies a 59% chance that the incoming Trump administration may set up such a reserve throughout his presidency—although Polymarket locations the chances at a extra modest 29% for this occurring inside his first 100 days in workplace.

2025 will probably be generally known as the "Bitcoin Trump Pump"

.

Get pleasure from your week off earlier than blasting off. pic.twitter.com/69NRpe7DEf

— Bitcoin Munger (@bitcoinmunger) December 26, 2024

Ought to this occur, Bitcoin’s function may evolve into one thing far larger, pushing nations to acknowledge it as a strategic reserve. It might mark a turning level, making digital property a legit a part of official monetary frameworks globally.

EXPLORE: Largest Meme Coin Of 2024! The Yr’s Largest Winners In Overview

A Totally different Absorb Futures Markets

Whereas prediction markets paint a largely optimistic image, extra conventional monetary devices like futures markets are cautious.

Merchants on the Chicago Mercantile Trade (CME) predict Bitcoin’s spot value at $98,000 and Ether’s at $3,500 by March 2025—under the formidable targets set by Kalshi and Polymarket however nonetheless reflecting substantial development.

Futures markets, constructed on hypothesis and hedging, have a tendency to chop via the noise, providing a tempered view that balances hype with market realities.

EXPLORE: 11 Greatest AI Crypto Cash to Put money into 2024

What’s Subsequent for Crypto in 2025?

Skeptics apart, the 2025 crypto forecast stays sanguine, if not essentially the most hyped yr ever for Bitcoin. 2025 may usher in mainstream adoption, cutting-edge monetary merchandise, and heightened authorities engagement with digital currencies. For traders, the play is evident—keep knowledgeable and educated.

With Bitcoin aiming for mid-six figures and new ETFs dominating the narrative, the scene is something however banal. 2025 would possibly simply rewrite the script for digital property in world finance.

EXPLORE: Ukraine deems Bitcoin unlawful, Coinbase fights for brand new $50 million founding spherical and extra

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Will Crypto Explode in January: Why is Crypto Down Today and Will it Recover in 2025? appeared first on 99Bitcoins.