Bitcoin holds $87K however crypto dips 2.7% at this time. Tariffs, Bitcoin ETF outflows hit costs—will BTC/USD keep above $86K?

The Bitcoin worth is steady at press time, rejecting bear makes an attempt over the previous two buying and selling days. BTCUSD is buying and selling above $87,000; consumers have the higher hand, although the broader crypto market is down.

Bitcoin Worth Agency however Flat: Every part To Know About BTC USD This Week

In line with Coingecko, the overall crypto market cap is $2.9 trillion, down 2.7% within the final 24 hours.

Nevertheless, Bitcoin is impressively absorbing any try and push costs decrease. If this continues, it could anchor the subsequent wave of upper highs for BTC USD.

Technically, Bitcoin worth has help at round $86,000 and resistance at $89,000 and $90,000.

(BTCUSD)

Bulls should convincingly shut above the liquidation zone for the uptrend from This autumn 2024 to proceed. This might set the ball rolling, maybe even lifting costs to $100,000 and all-time highs.

Nonetheless, bullish as merchants could also be, some elements are slowing momentum and miserable crypto costs, as clear within the occasions up to now 24 hours.

Why Is Crypto Down Today? Will it Get well?

After beneficial properties in This autumn 2024, costs are depressed, with most altcoins—together with among the greatest cryptos to purchase—posting double-digit losses and even reversing beneficial properties from late 2024.

Ethereum, Solana, Cardano, and even EOS are beneath strain, sliding sharply from 2025 highs.

A mix of things would possibly heap extra strain on costs. Although the Federal Reserve plans to ultimately decrease charges, topic to how macroeconomic elements evolve, tariffs beneath the Donald Trump administration proceed to intensify market nerves.

If new tariffs are introduced, they might disrupt the economic system, forcing traders to tighten their purse strings and channel funds to bonds as an alternative of dangerous property, primarily cryptos. This present state of risk-off sentiment explains why the Bitcoin uptrend is labored and why crypto costs are usually depressed.

So long as Bitcoin stays beneath $90,000 and bulls fail to observe by way of, weak arms would possibly select to money out and exit their positions.

This preview could possibly be the case from on-chain information as a result of short-term holders are already within the purple and will not wait longer.

Brief-term holders are deep within the purple, at the moment sitting on -12% of combination losses—ranges not seen up to now two years, besides on the backside of the 2024 correction.

Only in the near past, on the ATH, they have been sitting on 28% of earnings.

Whole decimation. pic.twitter.com/xqakwD8Uyb

— Sina

twenty first Capital (@Sina_21st) March 10, 2025

Any worth drop may set off a panic sell-off, accelerating the decline and growing strain on altcoins.

Will BTC USD Keep Above $86,000?

The massive gamers have to be concerned if Bitcoin is to shut above $90,000 and race to $100,000.

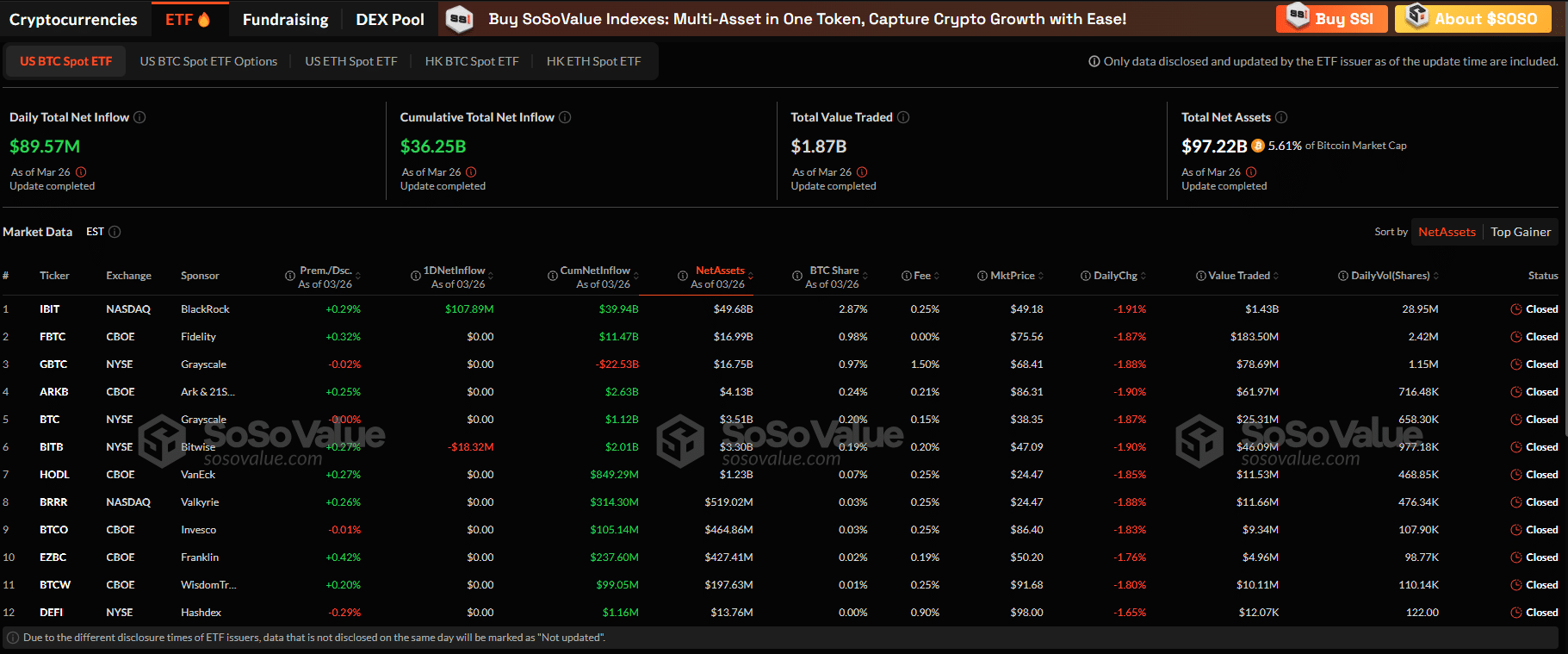

In line with Soso Worth, there’s institutional curiosity, and extra spot Bitcoin ETF shares are being purchased.

Yesterday, over $89 million in BTC-backed shares have been bought by establishments and high-net-worth people in the US. Notably, Bitcoin ETF inflows have been encouraging this week, a web optimistic for bulls.

(Supply)

Moreover, extra Bitcoin whales are engaged. On-chain information reveals that the variety of whales holding between 100 and 10,000 BTC has elevated since Bitcoin fell beneath $80,000. This factors to potential accumulation, with savvy merchants shopping for the dip and even contemplating among the hottest presales to purchase proper now.

Regardless of short-term holders within the purple zone, on-chain information doesn’t trace that they’re dashing to promote.

Since January 1st, 2025, Brief-Time period Holders (STH) have elevated their provide by 201,743 BTC. The cohort at the moment holds 5,750,076 BTC.

On the peaks of earlier cycles, STH held 8.4M and 7M BTC, respectively.

In essence, round 200K BTC are at the moment sitting at an unrealized… pic.twitter.com/i65zLLoz0Z

— Axel

Adler Jr (@AxelAdlerJr) March 25, 2025

Since early January 2025, they’ve amassed and at the moment maintain over 200,000 BTC.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Bitcoin Worth Today: Why Crypto Is Down and Will BTC Hold $86K in 2025?

- Bitcoin Worth Today: BTC steady above $87,000 regardless of crypto costs falling

- Why Crypto Is Down: commerce wars and Tariffs Might Power Capital Away from cryptos

- Will BTC/USD maintain above $86,000? Bitcoin ETF outflows decelerate as establishments double down

The put up Will BTC USD Hold $86K? Why Is Crypto Down Today? appeared first on 99Bitcoins.