Este artículo también está disponible en español.

Though Bitcoin is having a tough second this week, with costs oscillating between $93k and $96k, not less than one common crypto commentator is predicting an enormous worth run quickly.

Based on Ted Boydston, the market ought to put together for a manic bull run within the coming days, with Bitcoin’s worth focusing on $225k.

Associated Studying

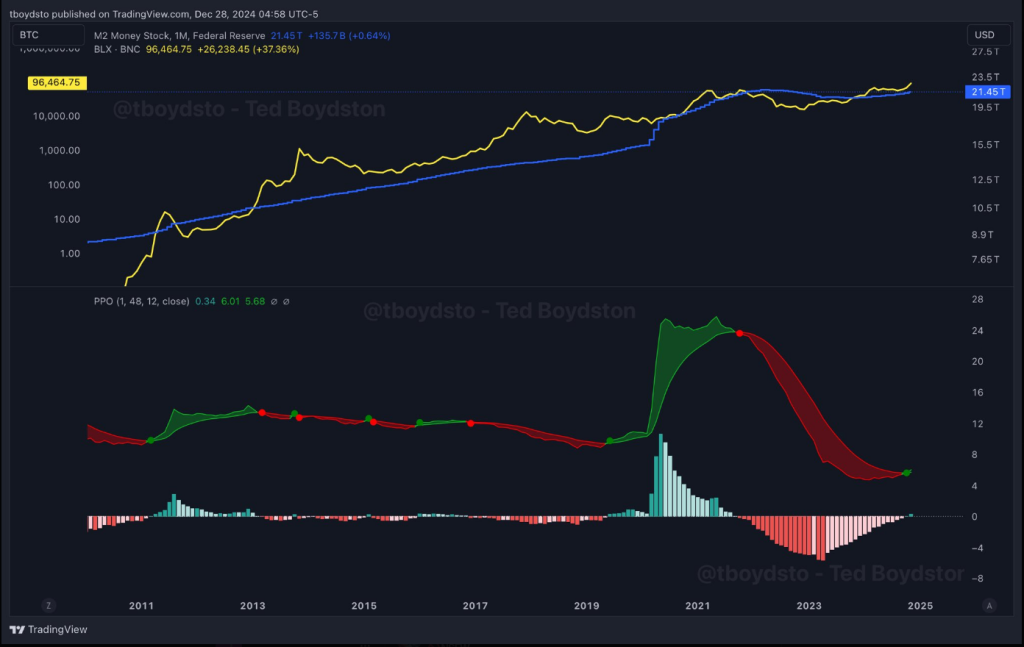

Boydston highlights the worth oscillator on M2, which presents real-time purchase and promote indicators for merchants and buyers. He then defined that the device just lately displayed a purchase sign. And if historical past repeats itself, Boydston expects Bitcoin to start its worth surge, benefitting holders and buyers.

Bitcoin And Its M2 Worth Oscillator Chart

Boydston, a preferred crypto commentator and engineer, presents an interesting perception into Bitcoin’s latest worth motion. Though Bitcoin’s worth has just lately slipped, he sees a possible worth surge quickly.

Apart from the 2016 Bitcoin cycle, a worth oscillator on M2 has supplied properly timed purchase and promote indicators.

The oscillator just lately flashed a purchase. If historical past rhymes, this implies cash printing and Bitcoin’s manic section ought to begin quickly. pic.twitter.com/61RpHYudIw

— Ted Boydston (@tboydsto) December 28, 2024

Boydston posted an M2 worth oscillator graph on Twitter/X, indicating a Purchase sign. For the reason that M2 cash inventory considers liquid money circulation, together with checking deposits, bodily money (M1), cash markets, and financial savings, the chart gives an fascinating perspective on an asset’s attainable course.

As such, this technical chart and indicator provide useful insights into the attainable efficiency of property, together with these within the crypto area of interest.

A Bitcoin Bull Run Soon?

Readers can discover the oscillator taken from the PPO of M2 on the decrease panel utilizing a shared screenshot. The chart displayed purple for 2023 and most of 2024 however flashes a inexperienced or potential purchase sign because the 12 months is about to shut.

Bitcoin’s M2 worth oscillator is flashing a BUY sign!

Aside from the 2016 Bitcoin cycle, this indicator has an insane accuracy.

If historical past repeats, this might sign the beginning of cash printing and one other main BTC pump.

Ignore it at your individual threat! pic.twitter.com/zsepPXjLH0

— BitcoinHyper (@BitcoinHypers) December 28, 2024

Boydston argues {that a} sign like this usually results in the asset’s worth surge and ultimately paves the way in which for a bull run.

Buyers can count on elevated volatility and Bitcoin worth appreciation if this situation performs out. Merchants and buyers have relied on this technical evaluation for years, providing right predictions, besides in 2016. The chart didn’t flash the purchase sign then, however the worth went up after the Bitcoin halving occasion.

Bitcoin’s Future Worth Motion

Crypto analysts focused the $100k mark for Bitcoin a couple of months in the past. Now that this was already achieved in December, many analysts are setting their sights on new targets. Some analysts declare that Bitcoin’s short-term goal is $150k, whereas others speculate that the asset may hit $1 million.

Associated Studying

With loads of estimates, Boydston’s prediction of $225k could appear essentially the most logical and attainable. For Boydston, in a manic section of Bitcoin’s bull run, a high types, aligning with a Fibonacci retracement stage of 0.382.

Featured picture from Getty Photographs, chart from TradingView